Surge Copper released final drill results from the 2021 Berg exploration program, highlighting several holes that intersected broad zones of high-grade material and ended in mineralization.

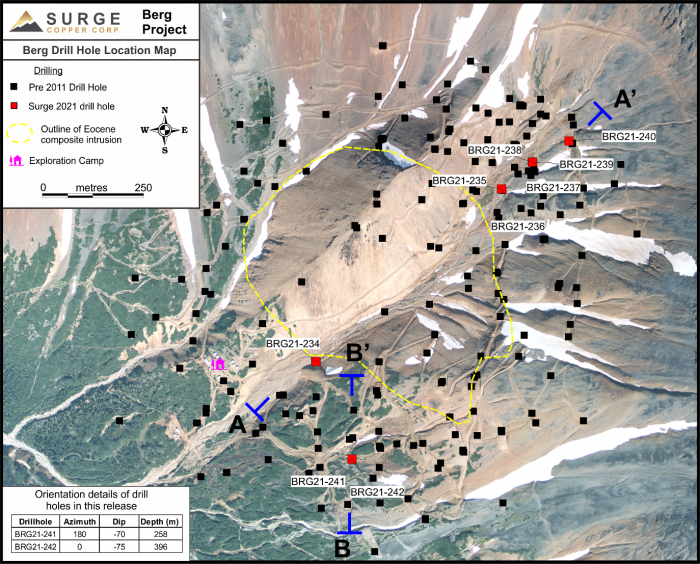

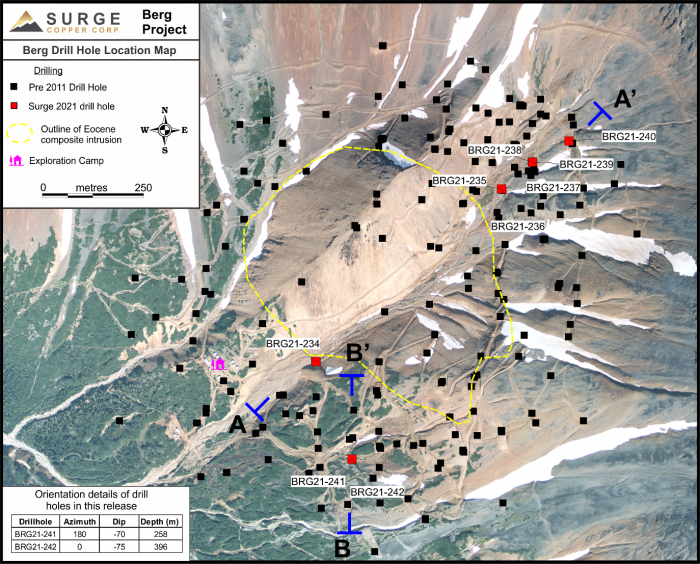

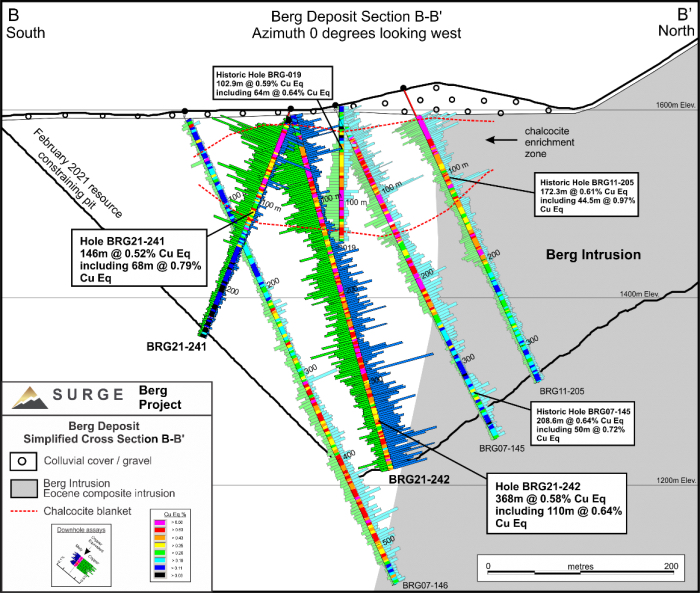

The final two holes from the 2021 campaign, BRG21-241 and 242, were drilled in the southern portion of the Berg Deposit to test the expansion potential of chalcocite-blanket-style mineralization between widely spaced historic drill holes (see Exhibit 1).

NorthWest reported on March 21 that the holes successfully intersected high-grade, near-surface mineralization and have extended the known high-grade further south than previously modelled.

Exhibit 1. Berg Drill Hole Location Map.

Source: Surge Copper Corp.

Surge Copper completed nine drill holes at Berg in 2021, where it is pursuing an option to earn a 70% interest from Centerra Gold (CG-TSX). Among the drill hole highlights:

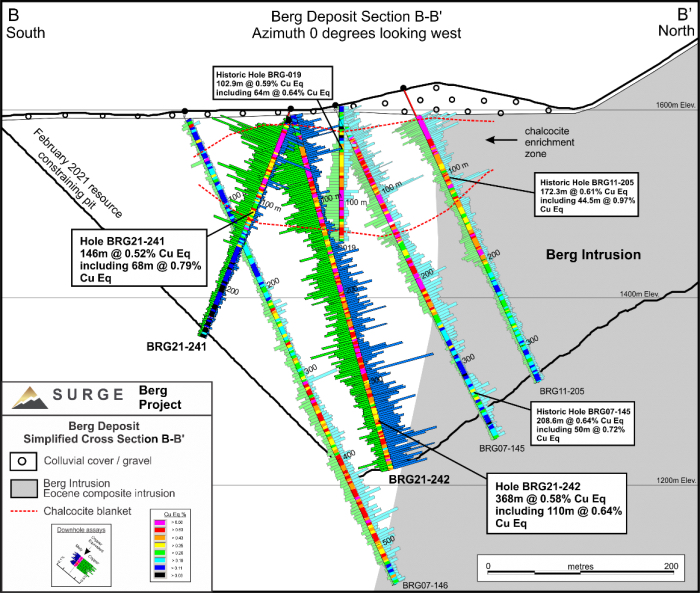

- Hole BRG21-241 intersected 146m grading 0.52% copper equivalent (CuEq) from 20m downhole, including 22m grading 1.04% CuEq within a larger zone of 68m grading 0.79% CuEq within the main chalcocite blanket

- Hole BRG21-242 intersected 368m grading 0.58% CuEq from 28m downhole with the hole terminating in mineralization

- Hole BRG21-242 intersected higher-grade mineralization returning 110m grading 0.64% CuEq, including 44m grading 0.76% CuEq, within the chalcocite blanket

Exhibit 2. Berg Deposit Cross-Section ‘B-B’ Showing Results for Holes BRG21-241 and 242.

Source: Surge Copper Corp.

The results dovetail nicely with the March 17 release (https://surgecopper.com/news-releases/surge-copper-intersects-high-grade-at-berg-including-132-metres-of-0.83-cueq-followed-by-71-metres-of-0.65-cueq-with-the-hole/) of holes BRG21-237 through 240 which were all drilled in the north-eastern portion of the Berg Deposit. Highlights include:

- BRG21-237 intersected 132m grading 0.83% CuEq from 34m downhole within the main chalcocite blanket, followed by 71m grading 0.65% CuEq from 184m downhole, with the hole ending in mineralization

- Hole BRG21-238 intersected 144m grading 0.60% CuEq from 24m downhole, including 100m grading 0.74% CuEq associated with chalcocite blanket

- Hole BRG21-239 intersected 223m grading 0.58% CuEq from 20m downhole including 38m grading 0.89% CuEq also associated with the chalcocite blanket, with the hole again ending in mineralization

Again, the results followed the tenor of the initial release of results from three holes on March 8 (https://surgecopper.com/news-releases/surge-copper-intersects-357-metres-of-0.59-cueq-including-92-metres-of-0.84-cueq-at-the-berg-deposit), which include:

- Hole BRG21-234 intersected 1m grading 0.42% CuEq from 15m downhole with the hole ending in mineralization

- Hole BRG21-235 intersected 162m grading 0.69% CuEq from 20m downhole

- Hole BRG21-236 intersected 357m grading 0.59% CuEq from 24m downhole with the hole ending in mineralization

- All three holes intersected high-grade, near-surface mineralization within a well-developed chalcocite blanket

The Significance

The 2021 drill program at Berg focused on two of the known areas within the sizeable Berg Deposit that host substantial zones of higher-grade material both within the closer-to-surface secondary enrichment zone and the deeper primary mineralization.

According to Surge, the drill holes were planned to test areas with sparse historical data and attempted to extend some of these high-grade zones laterally.

The results clearly demonstrate the program was successful, with all nine holes intersecting long intervals of mineralization, including broad zones of high-grade with many holes ending in mineralization.

Surge singled out hole BRG21-242, drilled into a 150m-wide circular gap in historical drilling, as one of the most robust results of the program and combined with hole BRG21-241, Surge believes the holes represent a significant extension of high-grade mineralization along this section.

Surge also reported consistent silver grades across most holes.

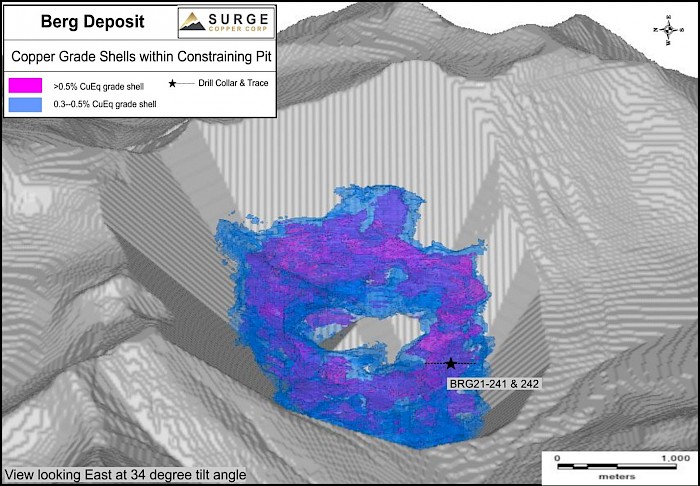

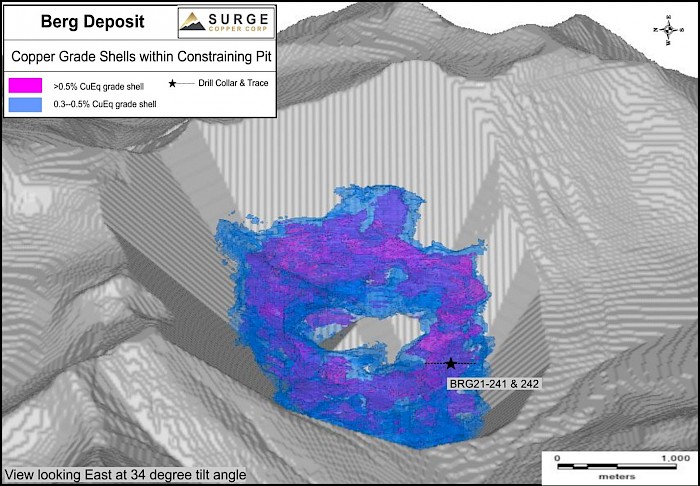

In the context of a drill-hole database that spans as far back as the 1960s, that was inconsistently sampled for precious metals, these results provide excellent validation of the size and tenor of the Berg Deposit (see Exhibit 3).

Exhibit 3. Current Berg Resource Block Model Showing Constrained Pit and Grade Shells.

Source: Surge Copper Corp.

Next Steps

The company plans to incorporate the results from the 2021 drilling into the Berg geological model, which will assist in planning additional exploration holes.

Given the strong results from the 2021 drill program, additional holes may be planned that seek to optimize and improve the drill hole database and resource block model in targeted areas.

We expect Surge Copper to have regular news flow through 2022. The property is only 28km northwest of the flagship, 100%-owned Ootsa Project containing the East Seel, West Seel, and Ox porphyry deposits located next to the open-pit Huckleberry Copper Mine, owned by Imperial Metals (III.TSX).

In the coming months, Surge is working toward releasing a resource update for the Ootsa Project, publishing inversion and targeting results from regional airborne geophysics, updating the regional exploration pipeline and releasing the results from the West Seel metallurgical test work program.

Company Profile

- Established mining district

- Located adjacent to the idled Huckleberry Mine in Central BC

- Excellent regional infrastructure including roads, grid power, water and multiple deep-water ports

- Significant resource base

- Ootsa: 224Mt grading 0.44% CuEq1 containing 2.2 B lbs CuEq in M&I2

- Berg: 610Mt grading 0.41% CuEq containing 5.5 B lbs CuEq in M&I3

- Discovery potential

- Target-rich environment near existing resources

- Large, 122,372 ha largely unexplored land package

- New geophysical surveys and target drilling in 2022

- Experienced management

- Highly experienced team with technical and financial backgrounds

- Track record of success in discovery, capital raising and M&A

- Combined, the adjacent Ootsa and Berg Properties provide Surge a dominant land position in the Ootsa-Huckleberry-Berg District and control over four advanced porphyry deposits

Notes

Except where specified, all occurrences of copper equivalent (CuEq) are calculated on a gross in-situ basis, with no adjustments made for recovery, using the following pricing assumptions for copper equivalency: $3.00/lb Cu, $1,700/oz Au, $10/lb Mo, $22/oz Ag.

The Mineral Resource Estimate was conducted by P&E Mining Consultants Inc. and has an Effective date of January 1, 2016. Eugene Puritch and Brian Ray are the Qualified Persons responsible for the estimate. Open pit optimization was done using a Lerches Grossman algorithm to define the mineral resource using metal prices of $3.25/lb Cu, $1350/oz Au, $12/lb Mo, and $22/oz Ag. CuEq have been calculated using base case prices of $3/lb Cu, $1,250/oz Au, $10/lb Mo, $18/oz Ag and recovery assumptions of 90 to 92% for Cu, 65 to 70% for Au, 70% for Mo, 60 to 65% for Ag and take into account smelter payable rates and refining costs.

The Berg Resource statement has an effective date of March 9, 2021. The technical report is available under the company’s profile at www.sedar.com. A cut-off value of 0.2% CuEq was used as the base case for reporting mineral resources which have been constrained by a conceptual open pit shell. CuEq was calculated using metal prices of $3.10/lb Cu, $10/lb Mo, and $20/oz Ag with the following recoveries applied: supergene zone Cu = 73%, Mo = 61%, and Ag = 52%; hypogene zo ne Cu = 81%, Mo = 71%, and Ag = 67%; leachate zone Cu = 0%, Mo = 61%, and Ag = 52%. Smelter and refining costs were not applied.