Marathon clears a major hurdle on the path to development as provincial regulators give key Project approvals while drill results continue to trickle in expanding the potential of the Valentine Gold Project. The Newfoundland and Labrador Minister of Environment and Climate Change recently advised Marathon that the Environmental Assessment Committee (EAC) completed its review of Marathon’s Environmental Impact Statement (EIS) and the Cabinet of the Government of Newfoundland and Labrador (NL) has approved the Project. This coincides with federal completion of the technical review required for the Environmental Impact Statement (EIS). A 30-day public review on the federal side is ongoing required prior to final federal approval. The Provincial approval allows Marathon to proceed with site-specific permitting, including the acquisition of the Project’s Mining Lease. In addition, Marathon continues to receive assay results from the 2021 drill program. The recent results were from 18 in-fill holes drilled along the 1.5 km Berry Deposit.

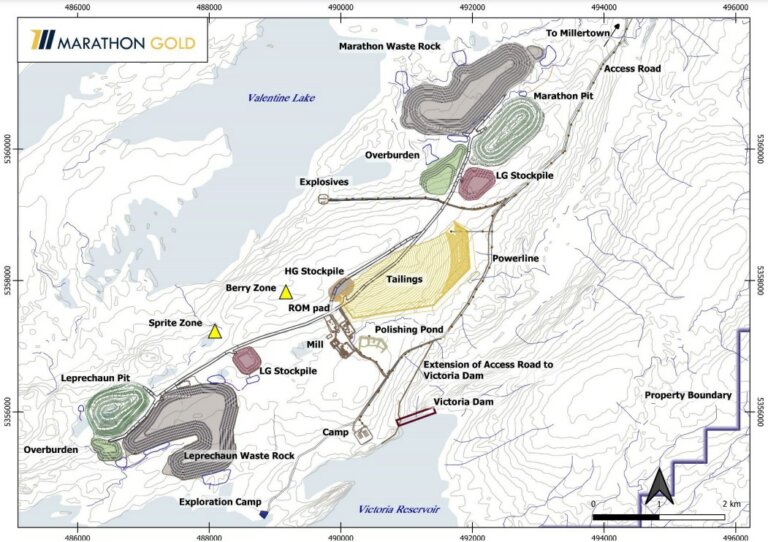

Marathon is advancing its 100%-owned Valentine Gold Project located in the central region of Newfoundland and Labrador. The Valentine Project hosts a 20km-long mineralized system with five known Deposits (Marathon, Leprechaun, Sprite, Victory and the Berry Zone), at present. The two deposits, Marathon and Leprechaun, currently in the mine plan host estimated Proven Mineral Reserves of 1.40mln gold ounces (29.68Mt averaging 1.46g/t gold) and Probable Mineral Reserves of 0.65mln ounces gold (17.38Mt averaging 1.17g/t gold). For complete details on the Valentine Gold Project’s Reserves and Resources, see the ‘Company Highlights’ section below.

Exhibit 1. Marathon’s Valentine Gold Project Showing Project Resources

Source. Marathon Gold Corp.

The Economic Assessment Proceeded Rather Routinely

Marathon’s Environmental Impact review timeline:

- April 5, 2019 – Project description filed at the provincial and federal levels in parallel

- Marathon files a project description with both the Impact Assessment Agency of Canada (IAAC) and the NL Department of Environment and Climate Change.

- April 16, 2019 – The project description is accepted into the formal Environment Assessment process

- July 3, 2019 – An NL Environment Assessment Committee is established

- September 29, 2020 – The EIS is filed

- November 3, 2020 – The EIS is accepted as conforming to guidelines allowing the formal review process to begin

- February 2021 – Federal Information Requirements and provincial review comments issued

- The Federal Information Requirements and provincial review comments reflect feedback from regulators, Indigenous groups, the public and other Project stakeholders.

- May 3, 2021 – Marathon responds to 76 first-round federal Information Requirements

- August 3, 2021 – Marathon responds to 362 first-round provincial review comments

- Provincial responses take the form of an amended EIS

- October 18, 2021 – Marathon submits responses to 23 second-round Federal Information Requests

- Following this, four additional Information Requests were responded to by Marathon.

- January 7, 2022 – Marathon files a second amendment to the Valentine EIS in response to 33 second-round provincial review comments

- The second EIS amendment begins a new round of provincial EIS review

- March 16, 2022 – Marathon receives formal notification from the IAAC that the technical review is complete and no new Information Requests would be forthcoming

The Significance

Now that Marathon has been released from the provincial portion of the Environmental Assessment, earlier than expected, the permitting process for potential eventual construction may proceed in earnest. Though the federal review is not fully complete, the province’s decision is seen as a key support. The completion of the overall Economic Assessment Process is in sight.

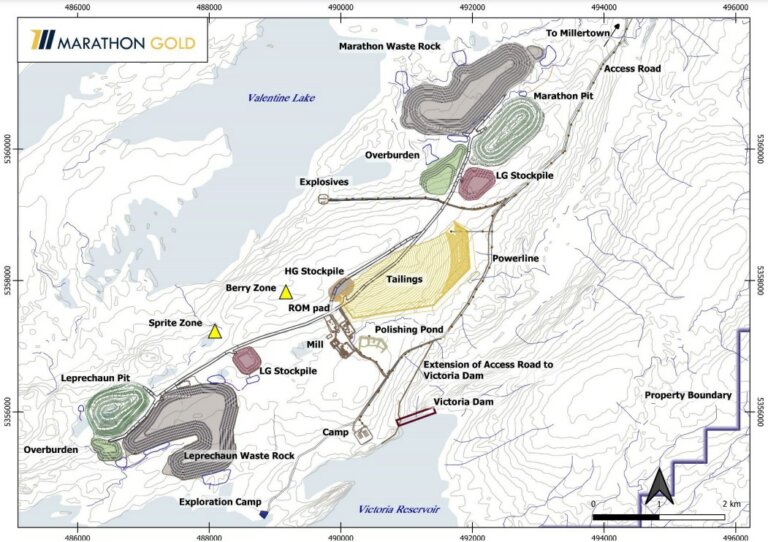

Exhibit 2. Proposed Site Layout

Source. Marathon Gold Corp.

Next Steps

The mine approval process is ongoing at the federal level. Marathon was notified on March 16th, 2022 that the federal EIS review process is completed. The next step is the issuance of the Federal Economic Assessment Report for public review. Following the 30-day public review, the Minister of Environment and Climate Change Canada could be in the position to make the decision on the Valentine Gold Project’s acceptability.

In addition to getting started on site-specific permitting, Marathon has planned the release of a new Berry Zone Mineral Resource Estimate forecasted for completion in Q2/2022 (assays dependent). The Berry Zone is Marathon’s newest Deposit and is not included in the March 2021 Feasibility Study.

Results from 18 drill holes were released on March 15 (see link below). Highlights from the drilling included 5.06 g/t gold over 25m including 9.13 g/t gold over 11m from hole VL-21-1119 and thick intersections of 1.80 g/t gold over 48m including 14.27 g/t gold over 2m and 24.48 g/t gold over 2m in hole VL-21-1139 plus 2.19g/t gold over 37m in hole VL-21-1123. Mineralization is described as typical Quartz-Tourmaline-Pyrite-Gold (QTP-Au) mineralization as noted at the Leprechaun and Marathon Deposits. We believe the continuation of the same style of mineralization in a similar structural setting bodes well for continued discoveries and additions to the Mineral Resource Estimate.

Continuing on the exploration front, Marathon anticipates drilling 50,000m in 2022 spread between the Berry Deposit, Victory Deposit and grassroots drilling targets.

Company Highlights

- Maiden Berry Zone MRE – the 1.5km-long Berry Zone is emerging as an important new area of concentrated gold mineralization.

- Inferred Resource: 11.33Mt averaging 1.75g/t gold for 638,700 contained ounces gold

- Largest undeveloped gold resource in Canada* (effective Nov 20, 2020 and inclusive of Reserves)

- Measured Resources: 32.59Mt averaging 1.83g/t gold for 1.92mln contained ounces gold

- Indicated Resources: 24.07Mt averaging 1.57g/t gold for 1.22mln contained ounces gold

- Inferred Resources: 29.59Mt averaging 1.72g/t gold for 1.64mln contained ounces gold

- Reserve Estimate* – included in the above Measured and Indicated Resources (effective Nov 20, 2020)

- Proven Reserves: 29.68Mt averaging 1.46g/t gold for 1.4mln contained ounces of gold

- Probable Reserves: 17.38Mt averaging 1.17g/t gold for 0.65mln contained ounces of gold

- Positive Feasibility Study (FS) (March 2021) – Contemplates open-pit mining from the Marathon and Leprechaun Deposits only

- Base Case Highlights Include:

- After-tax IRR = 31.5%; After-tax NPV(5%) = C$600 mln (using a US$1,500/oz gold price)

- After-tax Payback Period = 1.8 years

- Initial Capex = C$305mln

- 13 Year Mine Life; 173,000oz/yr in years 1 to 9 (from high-grade mill feed), 56,000oz/yr in years 10-13 (from low-grade stockpile)

- LOM Total AISC estimated at US$833/oz

- Mill Expansion Strategy

- In years 1-3, 6,800tpd (Gravity-Leach)

- In years 4-13, 11,000tpd (Gravity-Flotation-Leach)

- Controls 20km-long system hosting the four Valentine Gold Camp Deposits – room for expansion and discoveries in a top-tier jurisdiction

- Accessible by year-round roads and proximal to provincial electrical infrastructure – Hydro substation at Star Lake, only 30km from the property

- Metallurgical tests have demonstrated an average recovery of 94.2%

- Franco-Nevada Corp (FNV-TSX) holds a 2% NSR on the Valentine Gold Project

- Strong treasury

- Reported C$87mln in the treasury (March corporate presentation).

- Announced $8.66mln financing with Pierre Lassonde on Nov 25, 2020.

- Community Cooperation Agreements with the six surrounding communities signed in December 2020

*Assumptions include US$1,500 per gold oz and CAD/USD= $1.33. For further assumptions, please refer to the relevant technical report found here (https://marathon-gold.com/valentine-gold-project/technical-reports/).

For more information on the latest press releases, click here.

For more information on Marathon Gold and the Valentine Gold Project, visit the company website here.