Marathon Gold recently announced more encouraging infill drilling results from the Berry Zone at the Valentine Project in central Newfoundland, showing potential for further resource growth.

The latest batch of fire assay results from fifteen diamond drill holes shows the potential for Marathon to add weight to the 1.5km-long Berry Deposit (see Exhibit 1).

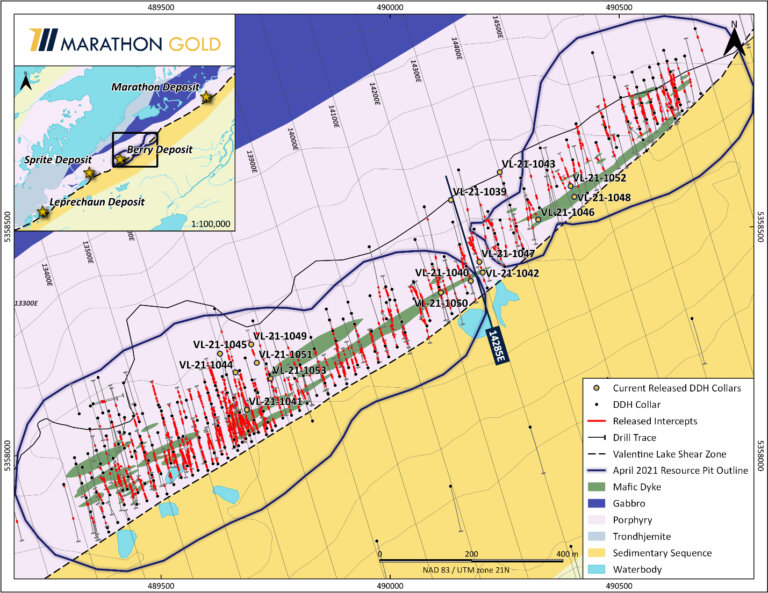

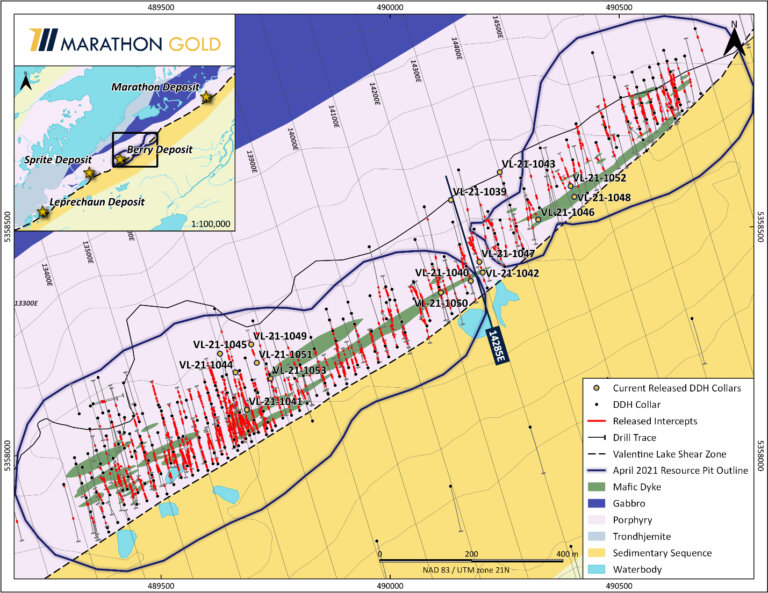

Exhibit 1. Location Map of Valentine Gold Project, Central Newfoundland.

Source: Marathon Gold Corp.

Highlight intercepts include:

- 86 g/t gold over 2m, 9.33 g/t gold over 2m (inclg 12.33 g/t gold over 1m), 7.67 g/t gold over 2m (inclg 13.29 g/t gold over 1m) and 7.18 g/t gold over 2m (inclg 12.92 g/t gold over 1m) in Hole VL-21-10140

- 16 g/t gold over 11m inclg 20.93 g/t gold over 1m and also inclg 19.07 g/t gold over 1m in Hole VL-21-1042

- 51 g/t gold over 13m inclg 25.33 g/t gold over 1m plus 1.03 g/t gold over 12m in Hole VL-21-1052

- 64 g/t gold over 4m inclg 27.59 g/t gold over 1m and also 1.25 g/t gold over 24m in Hole VL-21-1050

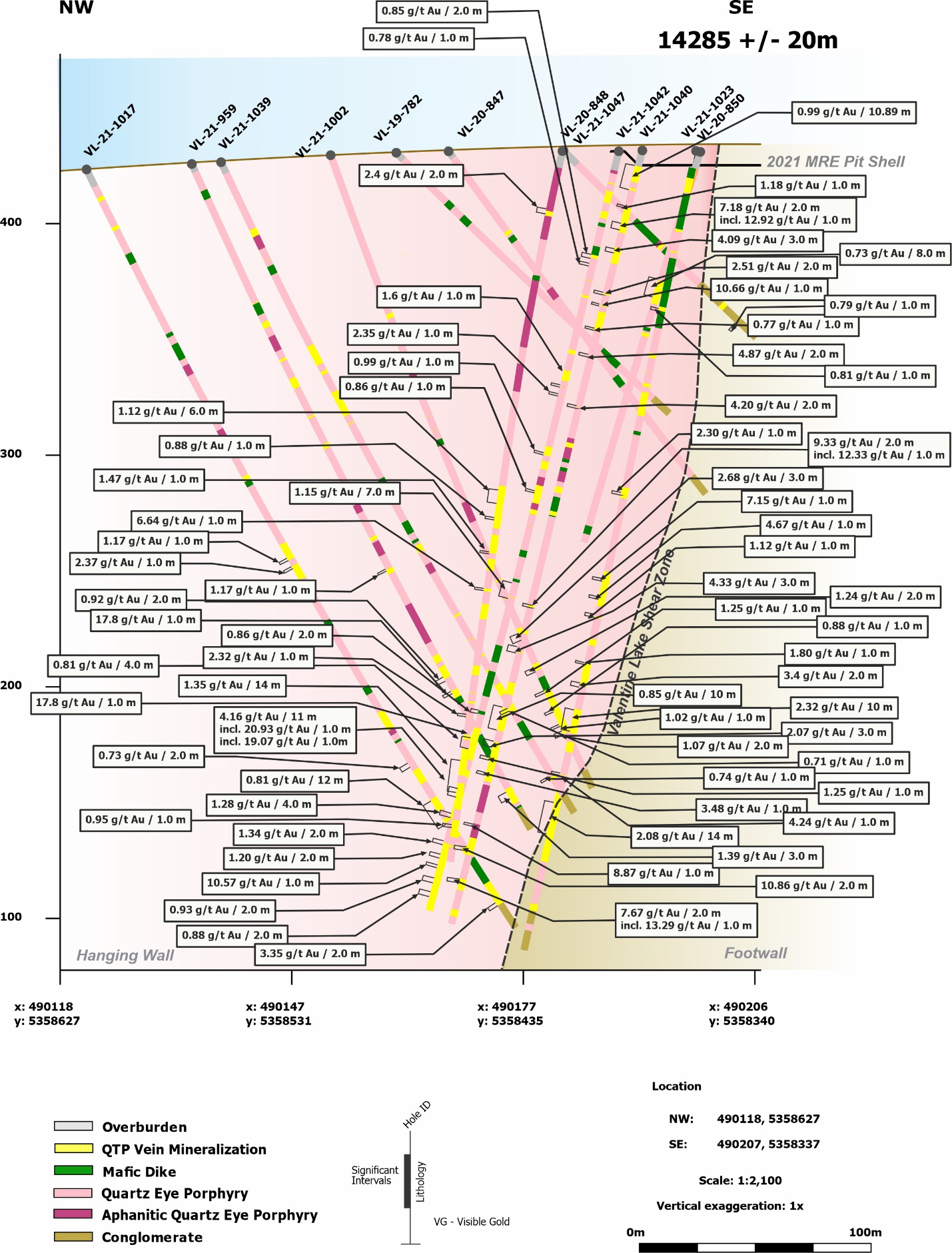

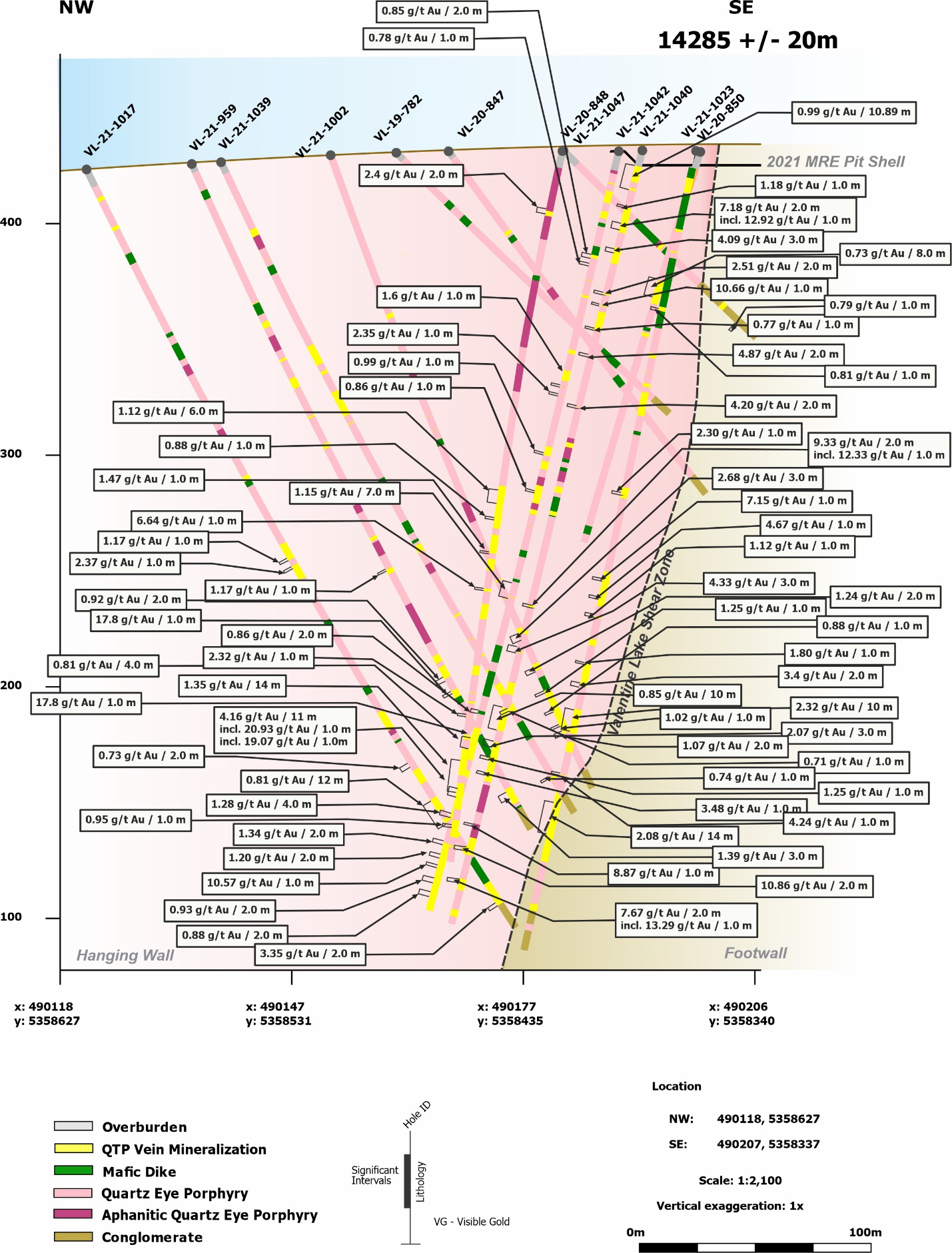

The company is enjoying exploration success in two areas where positive results are expected to offer the company the potential to expand the overall scope of the deposit. These are the hanging-wall area in the western portion of the Berry Deposit and the ‘saddle area’ (see Exhibit 2) between the two conceptual pit shells used in the April 2021 Mineral Resource Estimate (MRE). According to the company, the western hanging-wall area is growing with resource-grade intercepts, while the saddle area is yielding mineralization at depth (see Exhibits 2, 3 and 4).

Exhibit 2. Berry Deposit Drill Plan

Source: Marathon Gold Corp.

The Significance

Thirteen of the fifteen drill holes returned ‘significant’ drill intercepts of greater than 0.7 g/t, and all but one of the fifteen returned additional intercepts with gold grades above the 0.3 g/t gold cut-off used in the April 2021 Berry MRE.

Exhibit 3. Cross Section 14285E (View NE) with Significant (>0.7 g/t Au) Intercepts, Berry Deposit.

Source: Marathon Gold Corp.

Gold mineralization at the Valentine project is mainly in shallowly southwest dipping, en-echelon stacked quartz-tourmaline-pyrite-gold veins (QTP-Au).

At the Leprechaun, Marathon and Berry Deposits, these QTP-Au veins form densely stacked and northwest plunging Main Zone-style envelopes within intrusive host rocks on the hanging wall (northwest) side of the Valentine Lake Shear Zone (see Exhibit 1).

According to Marathon’s assessment, the extent of mineralization appears related to the size and frequency of sheared mafic dykes, which extend northeast-southwest within the hanging wall parallel to the shear zone.

Next Steps

Marathon Gold currently has four diamond drill rigs operating at Valentine as part of the 2021 exploration program.

One rig targets the Berry Deposit, two rigs at the Victory Deposit, and one at the Sprite Deposit.

Of note, drilling at Victory has revealed vital areas of mineralization in previously untested areas next to the Valentine Lake Shear Zone, with visible gold.

We expect Marathon to continue releasing regular news flow through to the end of the year.

Exhibit 4. Long Section of the Berry Deposit (view NW) incorporating 84,448 meters of drilling

Source: Marathon Gold Corp.

For complete information about Marathon Gold and the Valentine project, visit their website at marathon-gold.com.

Company Highlights:

- Maiden Berry Zone MRE – the 1.5km-long Berry Zone is emerging as an important new area of concentrated gold mineralization.

- Inferred Resource: 11.33Mt averaging 1.75 g/t gold for 638,700oz contained gold

- Largest undeveloped gold resource in Canada* (effective Nov 20, 2020 and inclusive of Reserves)

- Measured Resources: 32.59Mt averaging 1.83g/t gold for 1.92mln contained ounces gold

- Indicated Resources: 24.07Mt averaging 1.57g/t gold for 1.22mln contained ounces gold

- Inferred Resources: 29.59Mt averaging 1.72g/t gold for 1.64mln ounces gold

- Reserve Estimate* – included in the above Measured and Indicated Resources (effective Nov 20, 2020)

- Proven Reserves: 29.68Mt averaging 1.46g/t gold for 1.4mln contained ounces of gold

- Probable Reserves: 17.38Mt averaging 1.17g/t gold for 0.65mln contained ounces of gold

- Positive Feasibility Study (FS) (March 2021) – Contemplates open-pit mining from the Marathon and Leprechaun Deposits only

- Base Case Highlights Include:

- After-tax IRR = 31.5%; After-tax NPV(5%) = C$600 mln (using a US$1,500/oz gold price)

- After-tax Payback Period = 1.8 years

- Initial Capex = C$305mln

- 13 Year Mine Life; 173,000oz/yr in yrs 1 to 9 (from high-grade mill feed), 56,000oz/yr in yrs 10-13 (from low-grade stockpile)

- LOM Total AISC estimated at US$833/oz

- Mill Expansion Strategy

- In yrs 1-3, 6,800tpd (Gravity-Leach)

- In yrs 4-13, 11,000tpd (Gravity-Flotation-Leach)

- Controls 20km-long system hosting the four Valentine Lake Gold Camp Deposits – room for expansion and discoveries in a top-tier jurisdiction

- Accessible by year-round roads and proximal to provincial electrical infrastructure – Hydro substation at Star Lake, only 30km from the property

- Metallurgical tests have demonstrated an average recovery of 94.2%

- Franco-Nevada Corp (FNV-TSX) holds a 2% NSR on the Valentine Project

- Strong treasury

- Reported C$107mln in the treasury as of July 2021.

- Announced $8.66mln financing with Pierre Lassonde on Nov 25, 2020.

*Assumptions include US$1,500 per gold oz and CAD/USD= $1.33. For further assumptions, please refer to the relevant technical report found here (https://marathon-gold.com/valentine-gold-project/technical-reports/).