Westhaven continues to explore and grow the size of the mineralization footprint at the 100%-owned Shovelnose Precious Metals Project in southwestern British Colombia. The company currently has two diamond drill rigs on site and is focussed on the FMN and Alpine Zones.

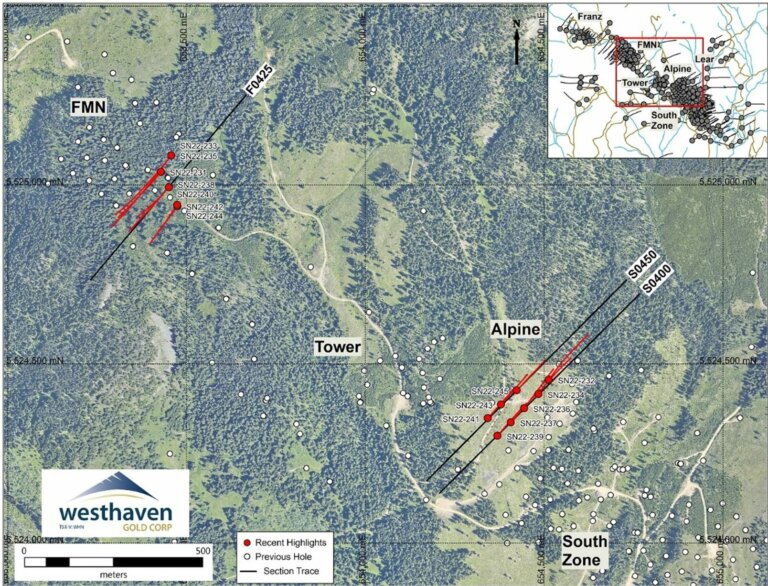

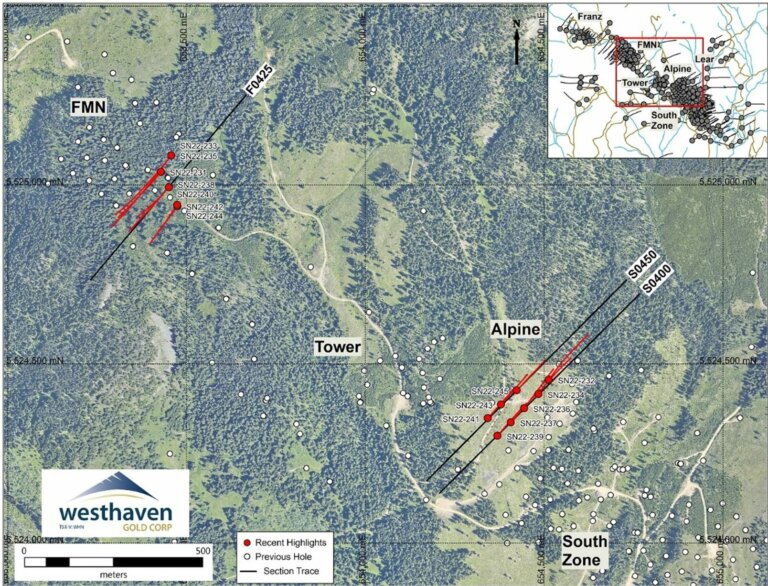

The drill results support the continuity of high-grade and bulk tonnage-style gold mineralization over a wide area which remains open in all directions. The large, wholly-owned, 17,623-hectare Shovelnose property is conveniently located in the Spenses Bridge Gold Belt adjacent to the Coquihalla Highway only 30 km south of Merritt BC. Figure 1.

Recent Drill Intercept Highlights include:

Sn22-238: FMN Zone – 1.51 g/t gold and 8.47 g/t silver over 76.98m starting at only 24m below surface.

SN22-236: Alpine Zone – 1.08 g/t gold and 4.44 g/t silver over 40.00m

SN22-240: FMN Zone – 3.47 g/t gold and 5.04 g/t silver over 24.89m

SN22-229: FMN Zone – 5.69 g/t gold and 343.57 g/t silver over 14.96m

SN22-213: FMN Zone – 3.36 g/t gold and 11.48 g/t silver over 38.22m

SN22-214: FMN Zone – 1.19 g/t gold and 3.85 g/t silver over 22.28m

Exhibit 1. Location of Westhaven’s Properties within the Spences Bridge Gold Belt

Source: Westhaven Gold Corp.

What Does It Mean?

The emerging FMN Zone is 2km northwest of the South Zone resource area. Given the robust nature of this system, and the low drill density in this area, Westhaven management believes there will be more high-grade shoots and broad intervals of potentially bulk tonnage gold mineralization discovered along this 4km trend (see Exhibit 2).

Exhibit 2. A Plan Map of Shovelnose Showing Mineralized Zones.

Source: Westhaven Gold Corp.

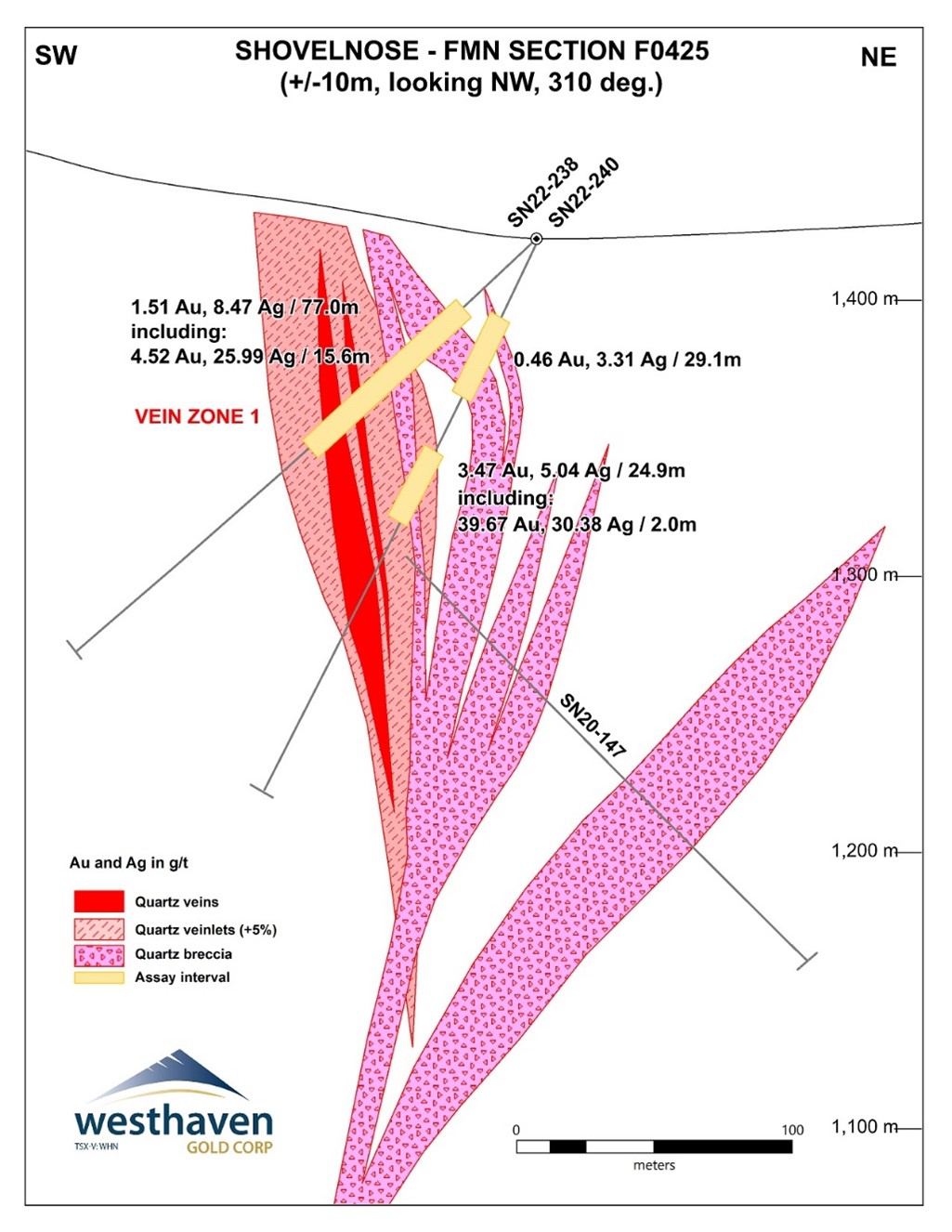

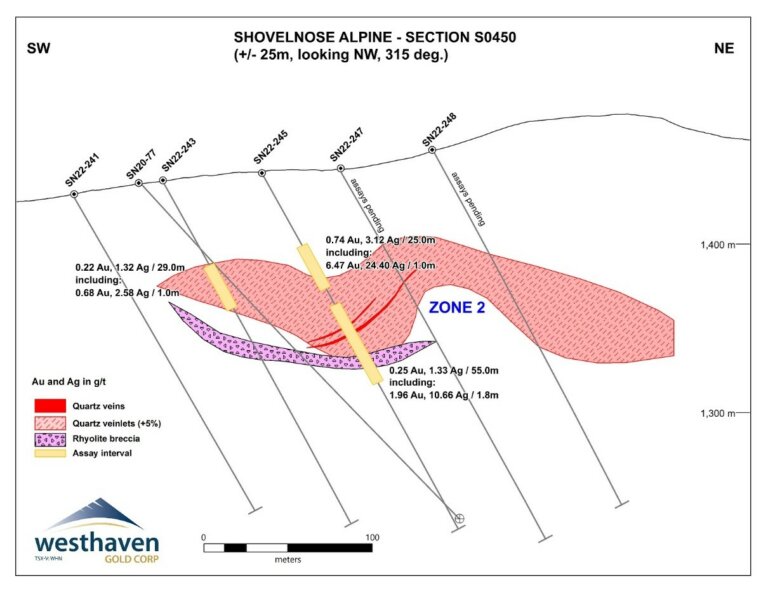

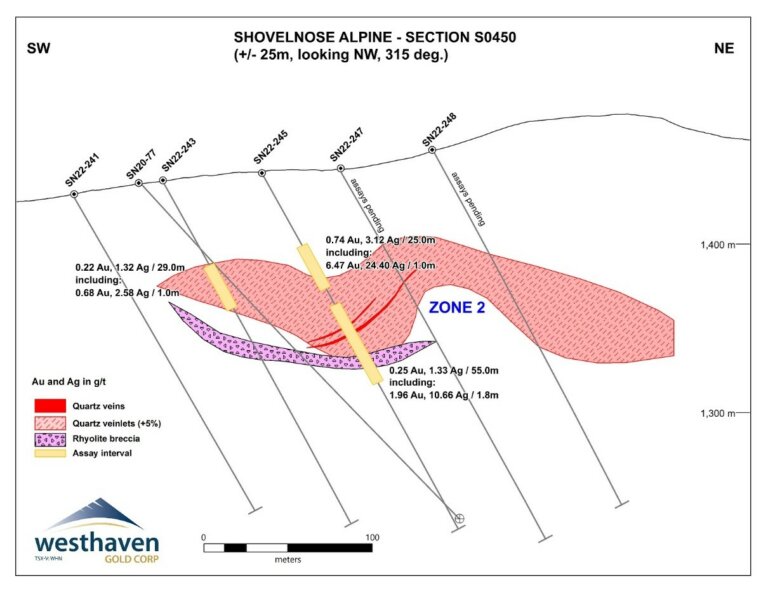

Drilling at Shovelnose continues at the FMN and Alpine targets. According to the company, tighter-spaced drilling over Vein Zone 2 at the Alpine target, intersected significant widths of gold-silver mineralization greater than the cut-off grade of the open pit maiden resource released earlier this year for the adjacent South Zone target area, immediately southeast of Alpine. Due to the interpreted shallow and gently dipping nature of Vein Zone 2 in this locale, the company expects to add to the open-pit potential of the Alpine target area (see Exhibits 3 and 4).

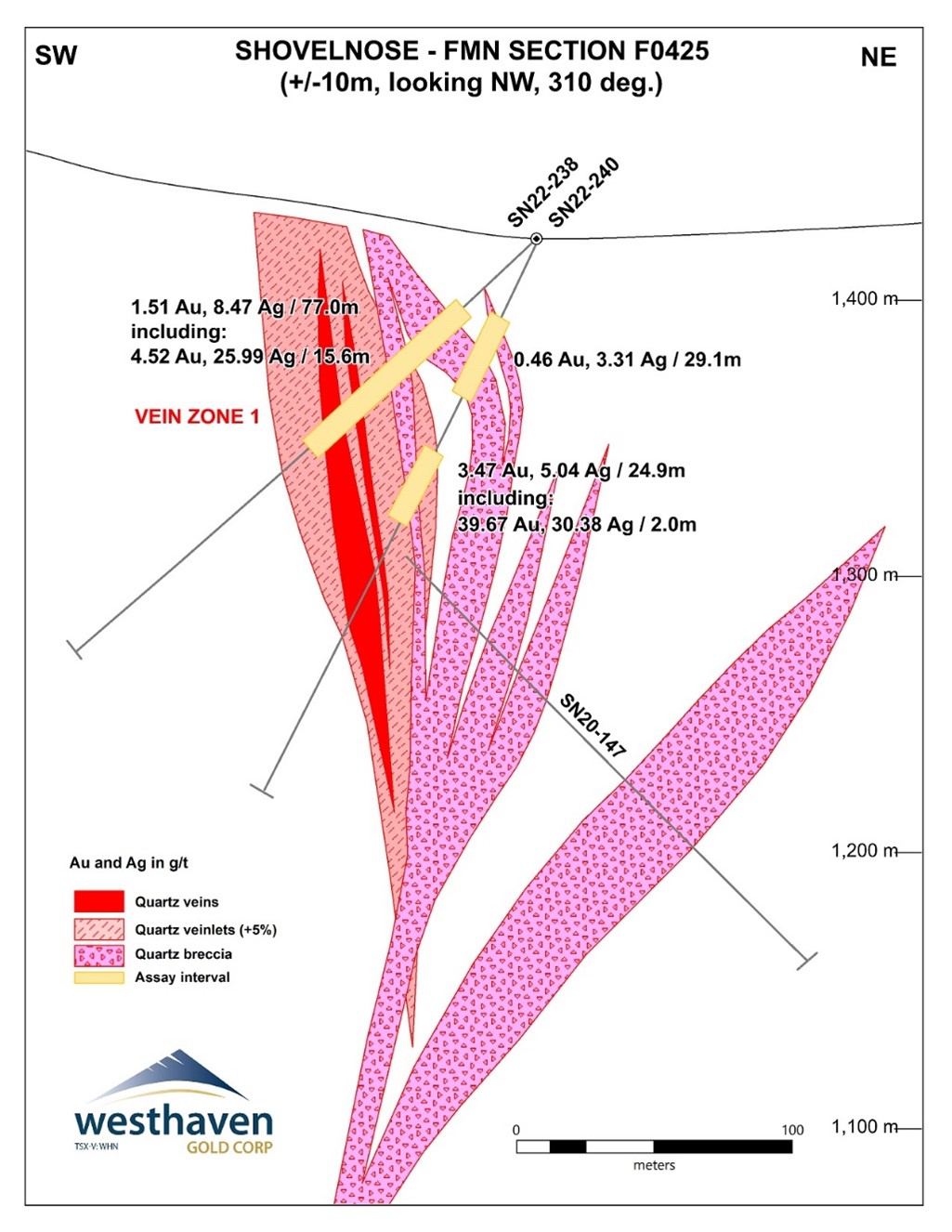

Exhibit 3. Cross-section of the FMN Zone at Shovelnose.

Source: Westhaven Gold Corp.

The company reports that infill and step-out drilling at FMN continue to yield significant gold intersections in Vein Zone 1 and also in post-mineral heterolithic breccias that cut Vein Zone 1. The late-stage breccias have returned 0.46 g/t gold over 29.08m in SN22-240 and 1.16 g/t gold over 42.17m in SN22-211.

Given the robust nature of this system and low drill density in this area, we believe Westhaven has a district-scale opportunity to discover more high-grade chutes along about 4km of highly prospective trend.

What’s Next?

Westhaven reports it has drilled about 21,000m in 70 holes at Shovelnose in 2022. The company is on pace to drill ~40,000m by year-end and aims to provide an updated resource estimate, including the FMN and Alpine Zones, by March 2023.

Westhaven plans to target Vein Zones 1 and 2 for further drilling over the 1km distance between FMN and Alpine, where drilling is limited to shallow historic holes and more recent, broadly spaced step-outs.

Drilling at FMN will continue on 50m spaced sections along strike toward the southeast to follow-up on additional mineralization uncovered during 2020 drilling.

The company plans to undertake a geophysical program for FMN to assist in targeting Vein Zone 1 between FMN and Franz to the northwest.

Additional results remain pending from the FMN, Alpine and South Zone expansion holes, providing an expected steady news flow.

Exhibit 4. Cross-section of the Alpine Zone at Shovelnose

Source: Westhaven Gold Corp.

Company Highlights

- High-grade gold discovery at Shovelnose (discovery hole intersected 17.7 metres of 24.50 g/t gold and 107.92 g/t silver at the South Zone in October 2018).

- Maiden Mineral Resource Estimate1 on Shovelnose South Zone in January 2022:

- 841,000 Indicated ounces at 2.47 g/t gold-equivalent.

- 277,000 Inferred ounces at 0.94 g/t gold equivalent.

- 95% gold and 96% silver recoveries in preliminary metallurgical test results

- Mineralization is reportedly non-refractory and amenable to recovery by a standard industry process flowsheet.

- The Shovelnose property is situated off a major highway, near power, rail, large producing mines, and within commuting distance from the City of Merritt, which translates into low-cost exploration.

- District-scale discovery potential in the emerging Spences Bridge Gold Belt where the company’s four projects, Shovelnose, Prospect Valley, Skoonka Creek and Skoonka North, cover 17,623 hectares.

- Shareholder alignment – insiders own 25% and have a track record of successful mine development.

Notes (from relevant technical reports):

1 – The Shovelnose MRE is estimated using metal price assumptions of US$1,675 per ounce for gold and $21.50per ounce for silver, with a USD:CD FX of 0.77. C$ operating costs used were $3 per tonne mineralized material mining, $2.50 per tonne waste mining, $2.00 per tonne overburden mining, $18 per tonne processing and $5 per tonne G&A.

The pit slopes used were 50º in rock and 30º in the overburden.

Please click the following for the 2019 to 2022 drill hole tables of assay results: https://www.westhavengold.com/projects/shovelnose-gold/maps/