Galway Metals has reported another discovery at the Clarence Stream Gold Project in New Brunswick, lending further credence that this may be a new emerging gold district in North America.

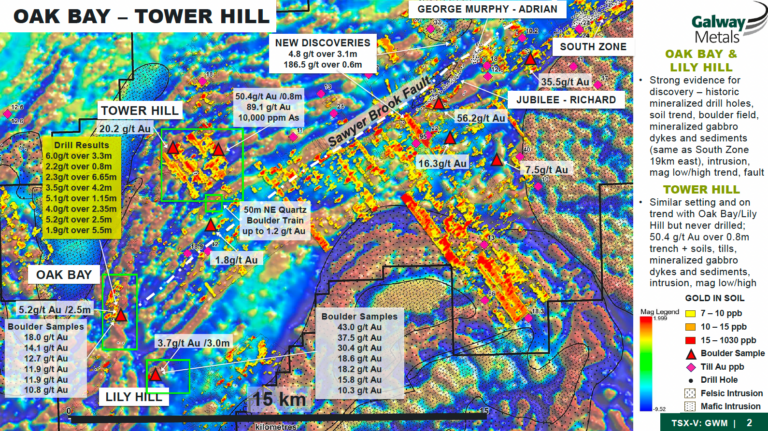

First-pass drilling at the Oak Bay property, which the company optioned in July 2020, has revealed a similar geological setting to the existing South Zone at Clarence Stream, which hosts the bulk of the current resource, located some 19km to the east (see Exhibit 1).

Among the highlight intercepts reported are:

- 6.0 grams per tonne (g/t) gold over 3.30m, including 9.3 g/t gold over 1.1m, from a vertical depth of 13.8m in hole GWM21OB-01

- 2.2 g/t gold over 0.80m from 18.2m vertical depth in hole GWM21OB-02

- 2.33 g/t gold over 6.65m, including 6.7 g/t over 0.60m from 5.4m vertical depth in hole GWM21OB-03 and

- 3.5 g/t gold over 4.20m, including 8.6 g/t gold over 0.60m from 31.8m vertical depth in hole GWM21OB-09.

The mineralization at Oak Bay and the neighbouring Lily Hill property comprises arsenopyrite-rich quartz veining in altered, silicified gabbro dykes in contact with sediments, both of which are mineralized.

The zone is open in all directions.

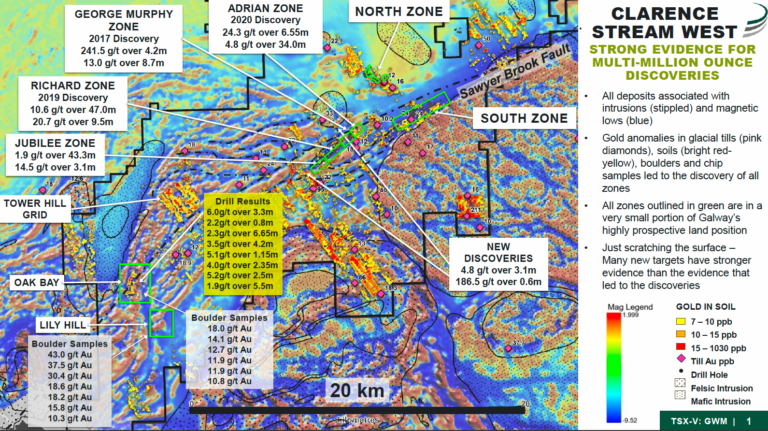

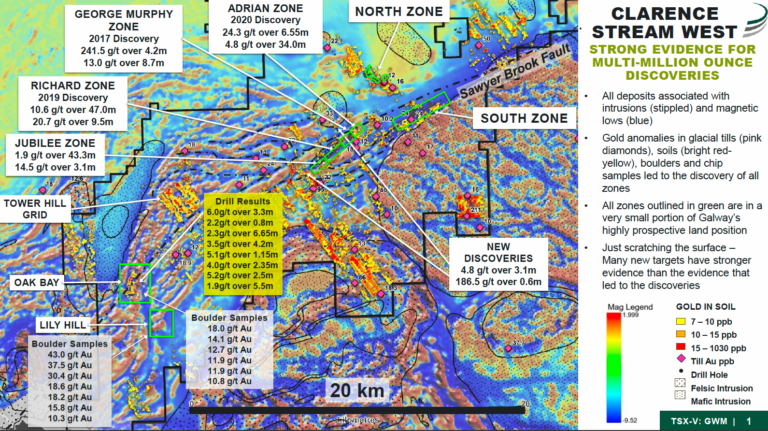

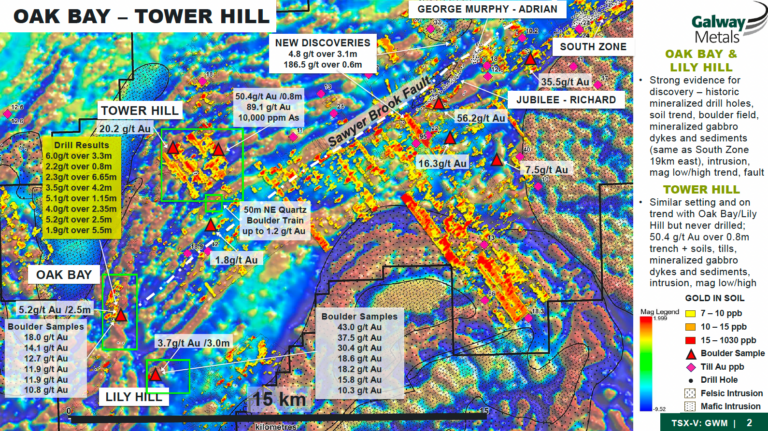

Exhibit 1. Galway’s Discovery Zones at Clarence Stream, New Brunswick

Source: Galway Metals Inc.

The Significance

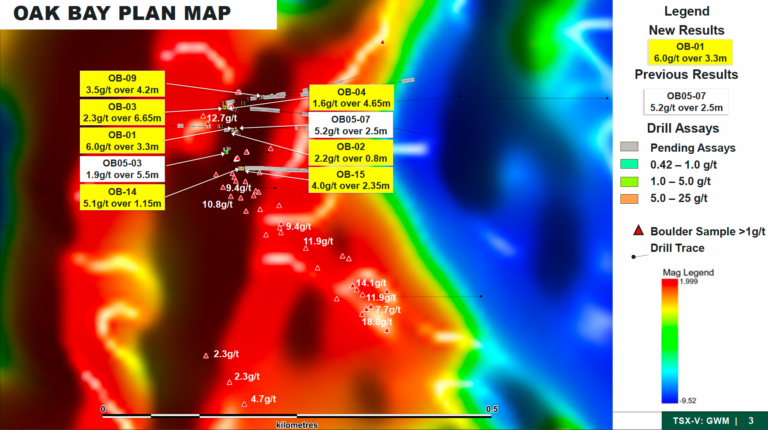

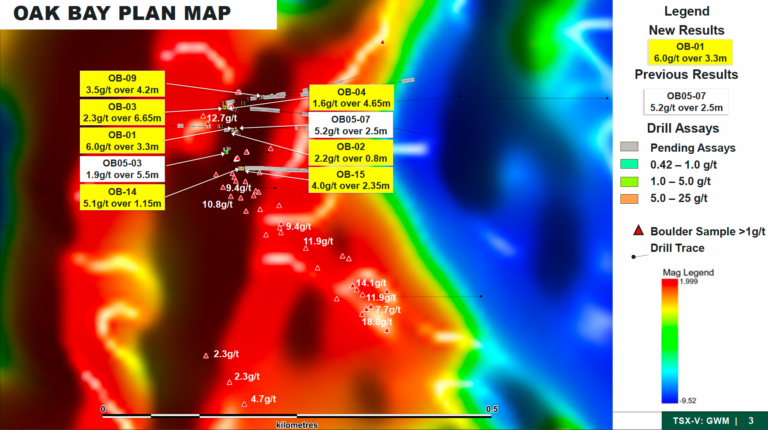

The Oak Bay Zone has been drill-delineated with strong, consistent intersections over 110m of strike length (see Exhibit 2).

The zone is open in every direction. Assay results are slow returning from the labs and those from further down each hole are pending, as are results from holes 5 through 8 and 10 through 13.

Exhibit 2. Oak Bay Plan Map with Results Superimposed on Magnetic Contours

Source: Galway Metals Inc.

The 19km Between Oak Bay and the South Zone is highly prospective. Galway interprets the ground between Oak Bay and the South Zone as a sizeable multi-phase Gabbro Complex.

The mineralized gabbro dykes at Oak Bay and the South Zone are thought to have originated from this complex.

Galway has not yet drilled the gabbro complex or the 19km between Oak Bay and the South Zone, except for the 3km trend further north that hosts the Adrian, George Murphy, Richard and Jubilee Zones (see Exhibit 3).

The gabbro complex and the area north between Oak Bay and the South Zone host two of the three highest-grade glacial till anomalies (95 and 86 ppb gold) at Clarence Stream. The extensively anomalous gold-in-soil anomalies extend several kilometres in both northeast and northwest directions, and Galway has reported boulder and chip samples of up to 35.5 and 16.3 g/t gold.

The Oak Bay claims host widespread boulders with grades up to 18 g/t gold, while Lily Hill has chip samples up to 43 g/t gold.

Lily Hill is another optioned property just southeast of Oak Bay, containing similar geology. Hole LH07-01 (drilled in 2007 by previous operators) intersected 3.7 g/t gold over 3.0m in a contact breccia zone of 23.6m Gabbro dyke which is reportedly entirely mineralized. This intersection has not been follow-up by subsequent drilling.

Exhibit 3. Clarence Stream’s Regional Exploration Prospects

Source: Galway Metals Inc.

Strong linear gold soil anomalies at Oak Bay are present grading up to 882 ppb gold, which is in the top 10 of the approximately 50,000 soil samples taken at Clarence Stream, while Lily Hill has soil values to 190 ppb Au. Cordierite alteration is present in the sediments that consist of siltstones and slate.

The Sawyer Brook Fault, the main conduit for gold-bearing fluids at Clarence Stream, is located close to the drilling at Oak Bay and Lily Hill.

Next Steps

Galway plans to follow up on the initial drill program at Oak Bay and drill several of the targets in this highly anomalous 19km gap and the gabbro complex in 2022.

Now that drilling for the upcoming resource has been completed, Galway plans to accelerate its drilling of the many gold anomalies to demonstrate Clarence Stream’s district scale.

Galway plans to release the Clarence Stream resource update before year-end.

Company Highlights

- Forthcoming MRE update incorporating new mineralized zones at Clarence Stream, New Brunswick.

- Expanded, fully funded exploration drill programme at Clarence Stream from 75,000m to 100,000m utilizing seven drill rigs

- Clarence Stream Deposit Resource1 – (North and South Zones only)

- Measured: 236,000 tonnes grading 1.81g/t gold for 14,000 contained ounces gold

- Indicated: 5.942 mln tonnes grading 1.97g/t gold for 376,000 contained ounces gold

- Inferred: 3.409 mln tonnes grading 2.53g/t gold for 277,000 contained ounces gold

- Clarence Stream Project Highlights

- 65km (non-contiguous) of prospective strike and discoveries as indicated by gold-in-till, soil, boulder and chip samples along magnetic lows (aligning with the Sawyer Brook Fault); the belt is under-explored and proximal to excellent infrastructure

- Resource Expansion Potential – Only 2 of 7 Clarence Stream Deposits are in the Resource Estimate – George Murphy, Jubilee and Richard Zones are not yet included but are expected in the next Resource Estimate update – Adrian and GMZ North provide additional potential growth

- Excellent Access and Infrastructure – well located only 70km south-southwest of Fredericton in southwestern New Brunswick. Excellent road access cutting through the property, readily accessible power and a local workforce. Proximal to the border with Maine

- Estrades Deposit Resource2, Quebec – former producing, high-grade Volcanogenic Massive Sulphide (VMS) Mine

- Indicated: 1.497 mln tonnes grading 3.55 g/t gold, 122.9 g/t silver, 7.2% zinc, 1.06% copper and 0.6% lead for contained metal of 170,863 oz gold, 5.9 mln oz silver, 237.6 mln lbs zinc, 35.0 mln lbs copper and 19.8 mln lbs lead

- Inferred: 2.199 mln tonnes grading 1.93 g/t gold, 72.9 g/t silver, 4.72% zinc, 1.01% copper and 0.29% lead for contained metal of 136,452 oz gold, 5.2 mln oz silver, 228.8 mln lbs zinc, 49.0 mln lbs copper and 14.1 mln lbs lead

- Estrades Highlights

- September 10, 2018 Resource Estimate increased the Indicated Resource by 15% and the Inferred Resource by 80% over the August 2016 estimate

- An expanded 25,000m drill programme using three rigs targeting the three main mineralized horizons at the Estrades property is underway

- Well-financed – Approximately$20 mln in cash (reported in the June 30, 2021) with no debt

- Management and Shareholder’s interest are aligned – ~21% ownership by Management, Friends and Family

- Institutional Ownership 52%

- Seasoned management team – the same key management team that sold Galway Resources for US$340 mln in 2012

Notes (from relevant technical reports):

1 – Pit constrained resources as stated are contained within a potentially economically minable pit; pit optimization was based on an assumed gold price of US$1,350/oz, gold recovery of 90%, a mining cost of CAD$3.00/t, an ore processing and G&A cost of CAD$20.00/t, and pit slopes of 45 degrees; Pit constrained resources are reported using a gold cut-off grade of 0.42 ppm, which incorporates a 3% royalty and gold sales costs of CAD$5.00/oz beyond the costs used for pit constrained optimization; Underground resources as stated are contained within modelled underground stope shapes using a nominal 1.5m minimum thickness, above a gold cut-off grade of 2.55 ppm, and below the reported pit constrained Resource; The underground cut-off is based on an assumed gold price of US$1,350/oz, Gold Recovery of 90%, mining cost of CAD$100/t, an ore processing and G&A cost of US$20.00/t, a 3% royalty, and gold sales costs of CAD$5.00/oz;

2 – Mineral Resources are estimated at long-term metal prices (USD) as follows: gold $1,450/oz, Ag $21.00/oz, Zn $1.15/lb, Cu $3.50/lb and Pb $1.00/lb; Mineral Resources are estimated using an average long-term foreign exchange rate of US$0.80 per CDN$1.00; Mineral Resources are estimated at a cut-off grade of CDN$140/tonne NSR, which included provisions for metallurgical recoveries, freight, mining, milling, refining and G&A costs, smelter payables for each metal and applicable royalty payments; Metallurgical recoveries for resource estimation are: Zn 92%, Cu 90%, Pb 85%, Gold 80% and Ag 70%.

*For a complete description of Resource assumptions, please review the relevant technical reports