Northwest has hit more wide zones of consistent, strong copper-gold grades at Kwanika, British Columbia. Assays from the final two holes of the 2021 “grade-enhancement” drilling on the Kwanika Deposit returned 280.00m grading 1.08% copper-equivalent (CuEq) in Hole K-21-220 and 227.60m grading 0.83% CuEq in Hole K-21-222. Both of these wide intervals hosted higher-grade intervals of 13.85m grading 4.16% CuEq in Hole K-21-220 and 4.0m grading 5.05% CuEq in Hole K-21-222. CuEq was calculated by Northwest assuming 100% metal recoveries and copper, gold and silver prices of $3.25/lb, $1,600/oz and $20/oz, respectively.

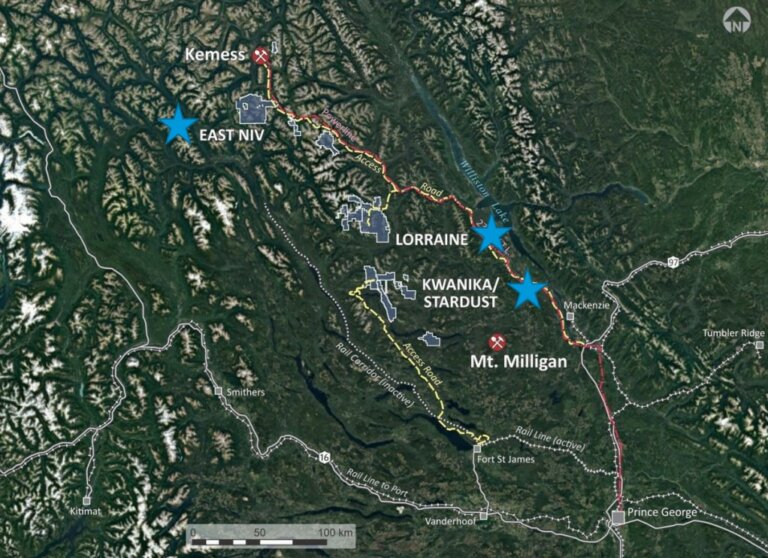

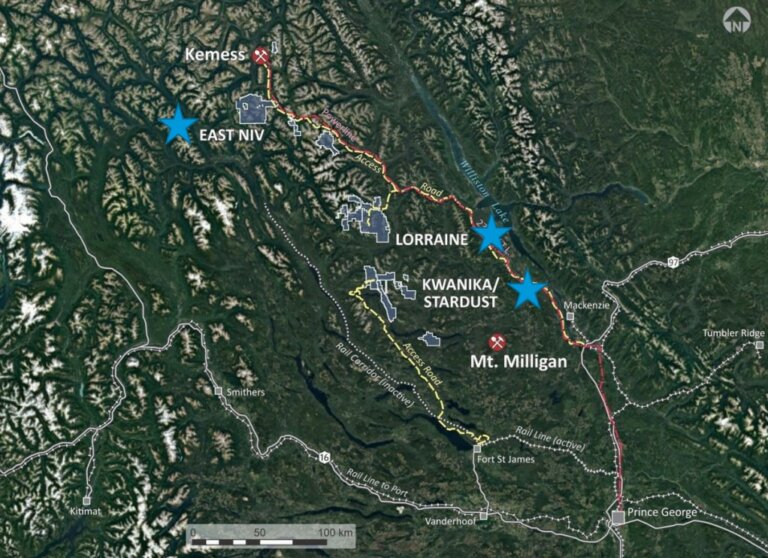

Northwest holds 100% ownership in over 150,000 hectares of prime real estate in British Columbia. The company’s flagship Kwanika/Stardust Project, the Lorraine Project and East Niv are sandwiched between the historical Kemess Mine to the North and the active Mt. Milligan Mine to the south (Exhibit 1), both currently held by Centerra Gold (CG-TSX).

Exhibit 1. Northwest’s Strategically Located Land Position near Infrastructure, British Columbia

Source. Northwest Copper Corp.

Kwanika’s High-Grade Core in the Central Zone is Showing Consistency

Northwest’s Kwanika “grade-enhancement” program focused on maximizing the potential of Kwanika’s high-grade core. With that in mind, “grade-enhancement” drilling is expected to help de-risk the resource model ahead of a planned Preliminary Economic Assessment (PEA) (expected in 2022) that envisions potential ore from the Kwanika Deposit and potential ore from the Stardust Deposit feeding a central processing facility. Outlining more high-grade mineralization (in both deposits) could sweeten the PEA economics.

As part of the “grade-enhancement” program at Kwanika, Holes K-21-220 and -222 were drilled up-dip and down-dip of previously-reported Hole K-21-217, respectively (Exhibit 2). Hole K-21-217, highlighted by 235m of 2.92% CuEq (including 9.40m of 33.60% CuEq), was previously released in an October 2021 press release.

As seen in Exhibit 2, the drill hole assay results, plotted perpendicular to the drill hole trace, show areas within the Central Zone of the modelled Resource where estimated block values may under-represent the high-grade mineralization present.

Exhibit 2. Cross section Parallel to K-21-220 and -222 (Looking approximately West-Southwest)

Source. Northwest Copper Corp.

New significant drill results from the two holes included:

- Hole K-21-220: 280.00m grading 1.08% CuEq (0.59% copper (Cu), 0.66g/t gold (Au) and 2.00g/t silver (Ag)) from 257.10m to 537.10m down-hole.

- Reported high-grade sub-intervals included:

- 141.55m grading 1.49% CuEq (0.75% Cu, 1.00g/t Au and 2.70g/t Ag) from 353.45m to 495.00m down-hole, including

- 13.85m grading 4.16% CuEq (1.03% Cu, 4.29g/t Au and 4.90g/t Ag) from 481.15m to 495.00m down-hole.

- Hole K-21-222: 227.60m grading 0.83%CuEq (0.39% Cu, 0.60g/t Au and 1.30g/t Ag) from 200.40m to 428.00m down-hole.

- Reported high-grade sub-intervals included:

- 115.80m grading 1.32% CuEq (0.52% Cu, 1.09g/t Au and 1.80g/t Ag) from 312.20m to 428.00m down-hole, including

- 48.00m grading 2.33% CuEq (0.70% Cu, 2.23g/t Au and 2.50g/t Ag) from 345.00m to 393.00m down-hole, including

- 4.00m grading 5.05% CuEq (1.52% Cu, 4.85g/t Au, 5.10g/t Ag) from 359.00m to 363.00m down-hole and including

- 4.00m grading 3.72% CuEq (1.12% Cu, 3.57g/t Au and 4.30g/t Ag) from 379.00m to 383.00m down-hole.

The Significance

Northwest is trying a new approach to unlock the value of the Kwanika and Stardust Deposits. By focussing on the high-grade cores of Kwanika and Stardust (see ‘Company Highlights below) and combining them into one operation, Northwest hopes to make the economic case in a PEA expected this year.

The highest-grade mineralization of the Kwanika Deposit is depicted in the block model cross section (Exhibit 1) as the dark purple and light purple blocks. Holes K-21-220 and K-22-222 both support the current block model up-dip and down-dip from Hole K-21-217, a key objective of the “grade-enhancement” drilling. Additionally, these new assay results indicate additional potential areas where the block model may under-represent the higher-grade mineralization, which we expect would factor into the upcoming PEA.

The remaining results from the 2021 drill program were also recently released. Highlights of the step-out drilling include 137m grading 0.52% CuEq including 1.30% CuEq over 34m in hole K-21-223. Hole K-21-223, along with hole K-21-224 were drilled at the South Zone and hole K-21-221 was drilled north of the Central Zone (see Exhibit 3).

Exhibit 3. Drill Hole Location Map Illustrating Recent Holes Released and Conceptual Pit Shape

Source. Northwest Copper Corp.

Next Steps

As previously mentioned, Northwest is undertaking a PEA that combines the Kwanika and Stardust Deposits under one operation. Northwest is expected to keep advancing this goal and Northwest’s President and CEO, Peter Bell, stated that testing for additional high-grade mineralization at Kwanika, including offsets to Hole K-21-217 are a planned focus for 2022.

At the time of the press release, Northwest indicated we can expect a summary of their 2022 programs in the coming weeks.

Company Highlights

- Relatively new company focused on unlocking value through the combination of the Stardust underground and Kwanika open-pit and underground operations to form the Kwanika/Stardust flagship project

- Stardust1 has an existing Mineral Resource comprising:

- Indicated: 1.96 million tonnes grading 2.59% CuEq, for 112.1 million pounds of CuEq

- Inferred: 5.84 million tonnes grading 1.88% CuEq for 242.2 million pounds CuEq

- Kwanika’s1 large scale complements Stardust’s high grades with a historical Mineral Resource comprising:

- Measured: 42.9 million tonnes grading 0.54% CuEq, for contained metal of 330 million pounds of copper, 493,000 ounces of gold and 1,525,000 ounces of silver

- Indicated: 180.6 million tonnes grading 0.38% CuEq, for contained metal of 994 million pounds of copper, 1,338,000 ounces of gold and 4,748,000 ounces of silver

- Inferred: 90.4 million tonnes grading 0.26% CuEq, for contained metal of 339 million pounds of copper, 504,000 ounces of gold and 1,753,000 ounces of silver

- Favourable metallurgy for Stardust-Kwanika project

- Pipeline of earlier-stage projects:

- Potential new discovery at East Niv

- Lorraine – large land package, existing high-grade trends, potential synergy with Kwanika-Stardust

- Well-financed – $25mln in cash as of January 25, 2022 (February corporate presentation)

- Part of the Oxygen Capital Group of Companies

- Substantial ownership by insiders and associates (over 20%)

- Strong institutional investment following (10% ownership)

1 – See relevant technical reports for key assumptions and complete details.

For more information on the grade-enhancement results, find the press release here.

For more information on the last assay results from the 2021 step-out drilling program, find the press release here.