Cassiar Gold’s efforts to revitalize the historical namesake district in northern British Columbia, received another shot in the arm. Following the wide, good gold grade intercepts released last week, the company released a further batch of results from four diamond drill holes from the Taurus Deposit on the Cassiar North property, further demonstrating the deposit’s bulk-tonnage potential (see Exhibits 1 and 2).

The company interprets the results from holes aimed at the central portion of the Taurus Deposit, known as the 88 Hill and Gap Zones, as confirmation of continuous zones of higher-grade, near-surface gold mineralization occurring at less than 100m vertical depth.

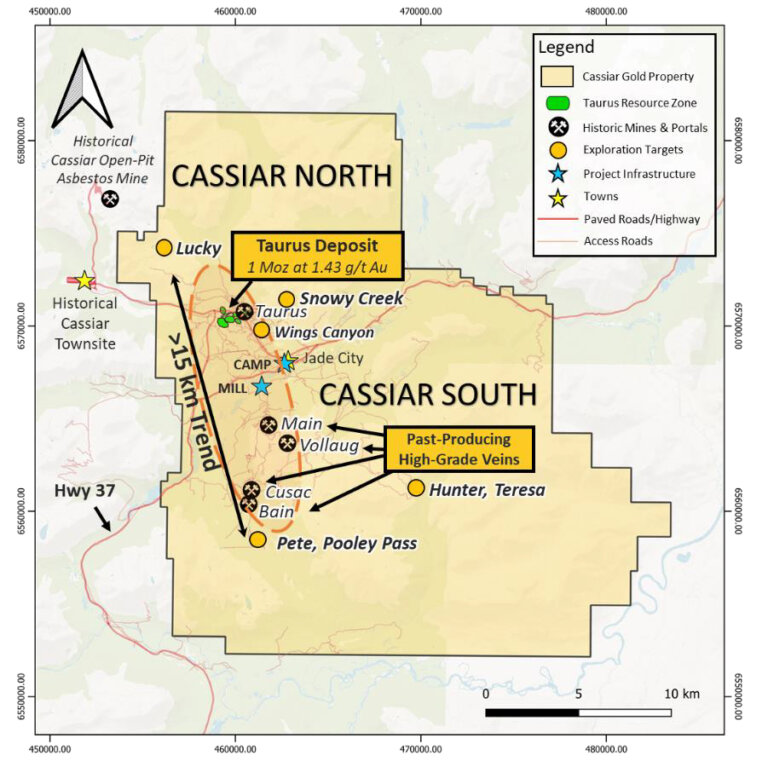

Recall, the Taurus Deposit hosts an existing near-surface, bulk-tonnage Inferred Gold Resource of one-million ounces grading 1.43 grams per tonne (g/t) gold, and it is likely to growth on the back of the 2021 exploration program.

Exhibit 1. Location Map of the Cassiar Gold Property in British Columbia, Canada

Source: Cassiar Gold Corp.

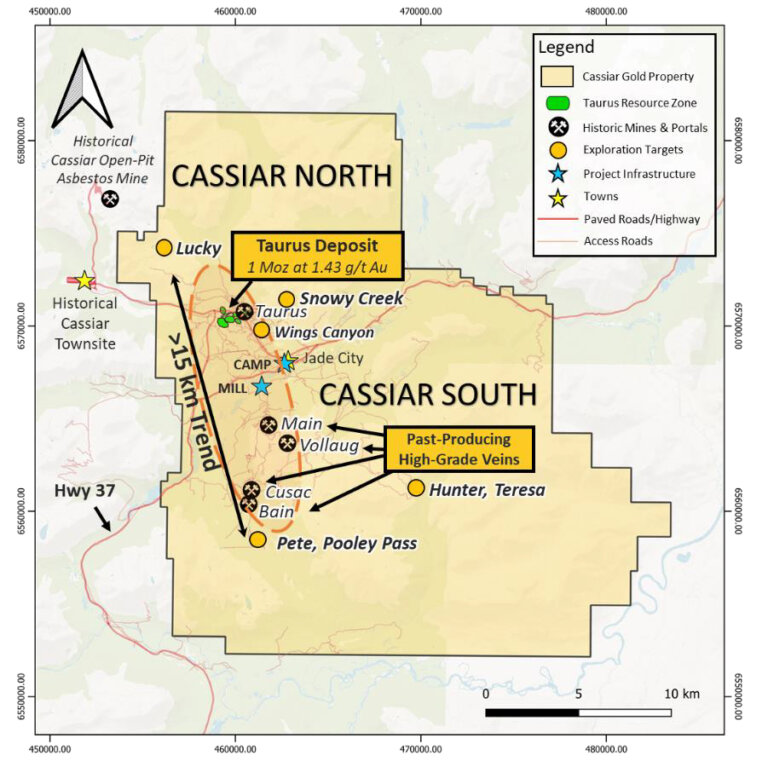

Exhibit 2. Plan Map of the Cassiar Gold Property Illustrating Priority Exploration Targets

Source: Cassiar Gold Corp.

Highlight intercepts recently reported include (see Exhibits 3 and 4):

- Drillhole 21TA-129 intersected 23.2m grading 3.56 g/t gold from 16.9 to 40.1m downhole;

- Drillhole 21TA-125 intersected multiple intervals, including:

- 1m grading 3.53 g/t gold from 123.4 to 136.4m downhole, including 51.7 g/t gold over 0.50m,

- 8m grading 1.80 g/t gold from 70.2 to 108m downhole, including 23.4 g/t gold over 1.1m, and

- 3m grading 1.16 g/t gold from only 9.9 to 62.2m downhole, including 8.11 g/t gold over 1.7m

- Drillhole 21TA-126 intersected 3.5m grading 3.38 g/t gold from 51.5 to 55m downhole and 22.9m grading 0.91 g/t gold from 102 to 124.9m downhole, including 48 g/t gold over 11.7m.

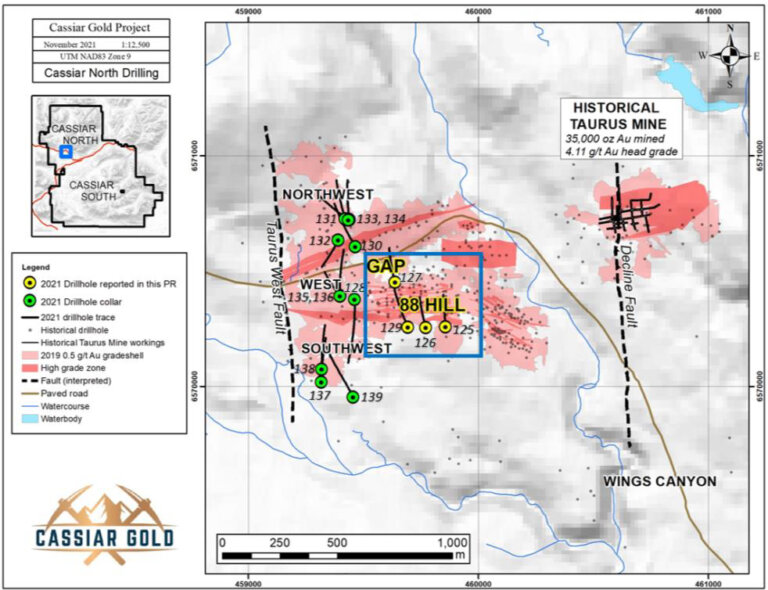

Exhibit 3. Cassiar North 2021 Drill Campaign Drillhole Locations Map

Source: Cassiar Gold Corp.

The Significance

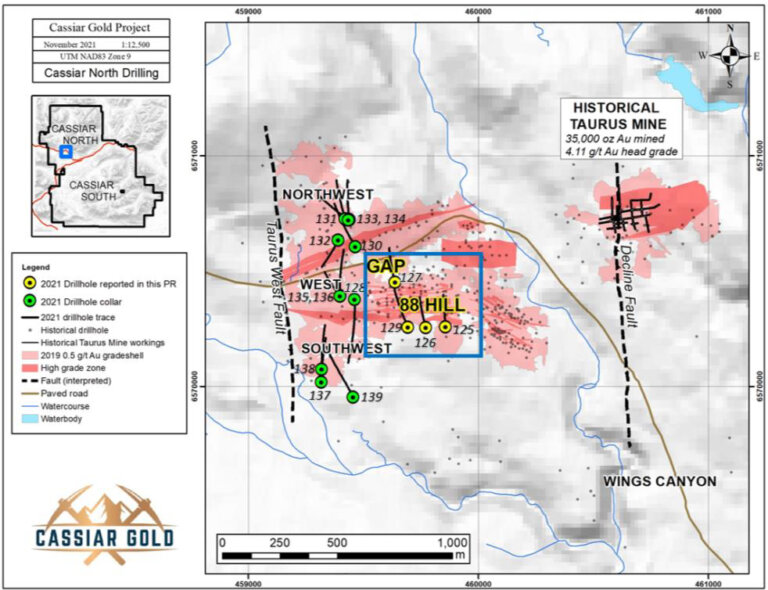

The 2021 Cassiar North exploration campaign, completed between June and August, focused on the Taurus Deposit, and comprised 15 drill holes totalling 4,098m. The priority drill targets entailed the 88 Hill, Gap, West, Southwest and Northwest zones of the deposit (see Exhibit 3).

At the 88 Hill Zone, confirmation drill hole 21TA-125 was directed northwards, spaced 35m from two historical parallel holes. It crossed several south-directed drill holes that were also on-section.

Cassiar interprets the hole as intersecting several broad intervals of gold mineralization over a drill length of about 125m, including notable intercepts of 52.3m of 1.16 g/t gold, 37.8m of 1.8 g/t and 13.1m of 3.53 g/t. The hole also included significant narrow, high-grade veins that returned up to 51.7 g/t Au over 0.5m. We view the results from this hole as further validating data from the company’s 2019 NI43-101 Resource Estimate and expect it to contribute to the ongoing efforts to upgrade the resource.

Meanwhile, hole 21TA-126 was an infill drill hole located within a 75m gap between historical drill holes along the southern margin of the 2019 NI43-101 resource 0.5 g/t gold grade shell. The results are said to be consistent with the resource estimate model and suggest a higher potential for southward extension of the deposit to the west and east.

Further, hole 21TA-129 was another north-directed drill hole located 40m from parallel historical drill holes to test an undrilled area up-dip from the previous drilling. It crossed several historical on-section drill holes.

The hole indicates that near-surface mineralization remains open laterally and is expected to provide the basis for updated modelling in this area.

Exhibit 4. Distribution of 2021 Drill Holes at the Taurus Deposit, Cassiar North

Source: Cassiar Gold Corp.

Over at the Gap Zone, where only sparse historical drilling had been completed, the company followed up from gold mineralization identified in the 2020 field campaign.

Drillhole 21TA-127 was drilled to infill a 100m east-west and 200m north-south gap between historical holes. According to the company, the grades returned appear to be consistent with historic Taurus Deposit grades and suggest that future infill drilling in this area could expand the resource.

Next Steps

Cassiar Gold completed the 2021 drill campaign covering both the Cassiar North and Cassiar South project areas on November 1.

34 Drill holes totalling 11,288m were completed consisting of 4,098m in 15 holes within or close to the Taurus Deposit at Cassiar North, and 7,000m in 19 holes targeting high-grade vein systems at Cassiar South.

At Cassiar North, additional assay results for seven drill holes remain pending.

At Cassiar South, results remain pending for 13 drill holes that were completed at the East Bain, Cusac, Hot, and Vollaug veins.

For complete information on Cassiar Gold, please visit the corporate website at cassiargold.com.

Company Highlights

- Cassiar holds projects in two important Orogenic Gold Districts in British Columbia

- Flagship Cassiar Gold project in Northern BC

- 100% owned 59,000 ha property with +15km strike of gold targets

- Site of historic Cassiar placer gold rush from 1874-95 which produced more than 74,000 oz of placer gold

- Cassiar North hosts an NI 43-101 Inferred Resource Estimate of +1Moz gold grading, on average, 1.43 g/t with significant resource expansion potential

- Cassiar South hosts multiple, high grade (+15 g/t gold) vein targets with access from 25km of underground workings; past production of about 315,000oz from 1979-97

- Excellent infrastructure with permitted 300 t/d mill (gravity/flotation), Highway 37, property access roads, permanent camp, water

- Sheep Creek in Southeast British Columbia

- 3rd largest past-producing Orogenic Gold District in BC

- Historical gold production (1899-1951) of almost 800,000 oz gold grading on average 4g/t

- Excellent exploration potential

- Experienced leadership team

- $5.6M in cash (as of November 24, 2021)

- Potential M&A target in a highly supportive mining jurisdiction in Northern BC, Canada