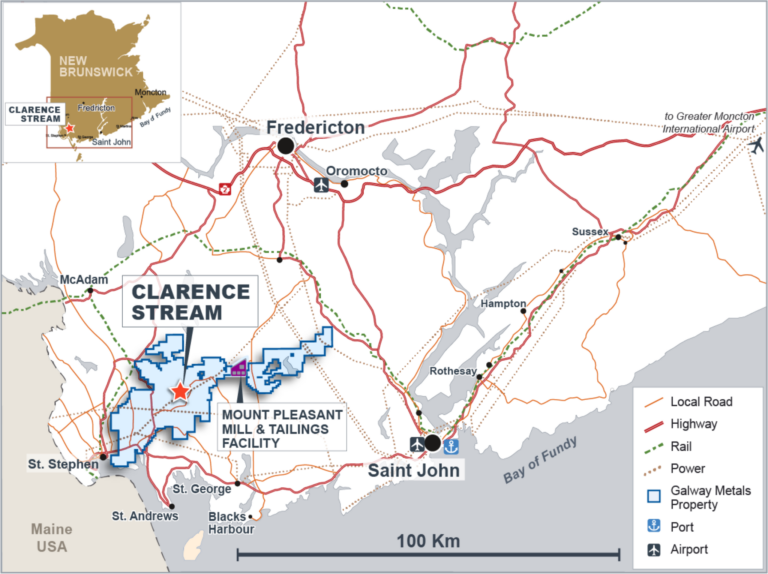

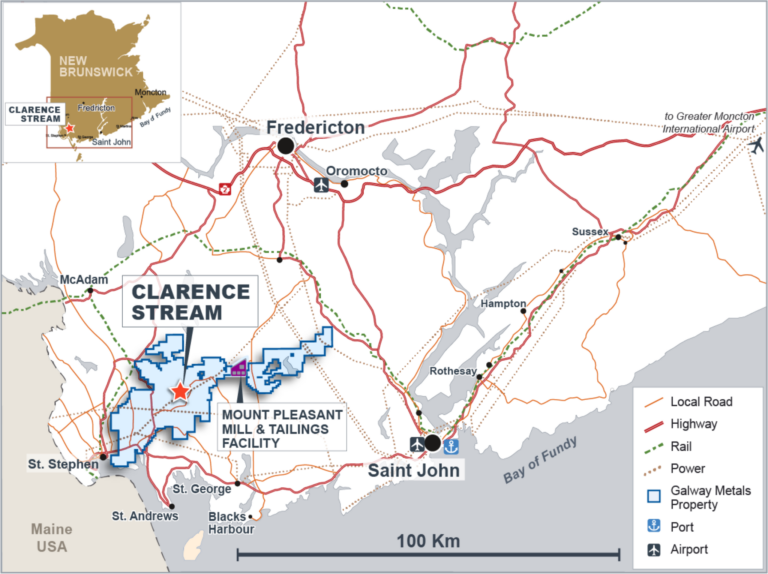

Galway’s extensive drill programs connecting mineralization from the initial discovery areas have resulted in a substantial increase in resources. Since the previous estimate (Sept. 2017), 106,272m of drilling in 337 holes has been conducted. Recall that Galway’s Clarence Stream Deposit is located in New Brunswick and is readily accessible with excellent infrastructure (Exhibit 1).

Exhibit 1. General Location Map of Clarence Stream in New Brunswick

Source: Galway Metals Inc.

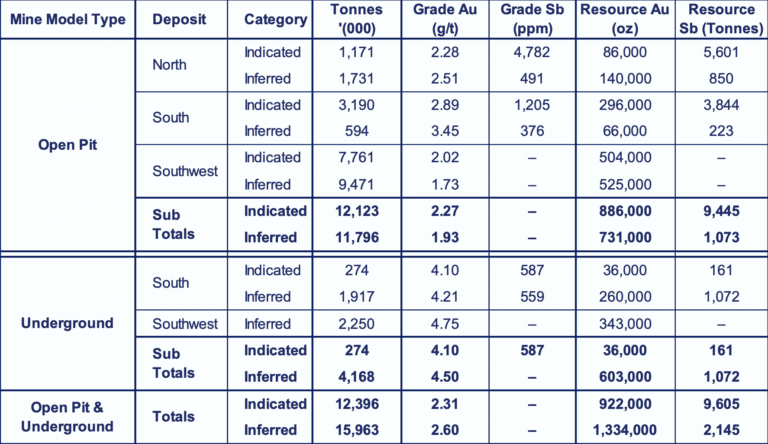

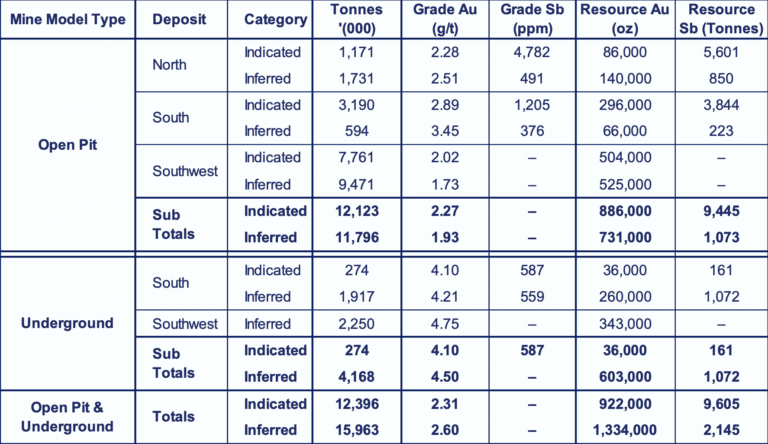

Prepared by SLR Consulting Canada, Clarence Stream now hosts an open-pit, constrained, Indicated Resource of 12.1 million tonnes grading 2.27 grams per tonne (g/t) gold for 886,000 ounces and an Inferred Resource of 11.8 million tonnes grading 1.93 g/t for 731,000 oz gold. The company also reports an underground, Indicated Resource comprising 274,000 tonnes at 4.1 g/t for 36,000 oz and an Inferred Resource of 4.2 million tonnes grading 4.50 g/t containing 603,000 oz gold (Exhibit 2). The new Mineral Resource Estimate (MRE) reports increased Indicated and Inferred Resources of 136% and 382%, respectively from the previous MRE.

Exhibit 2. Clarence Stream Updated Mineral Resource Estimate

Source: Galway Metals Inc. and PearTree

The Growth and Success

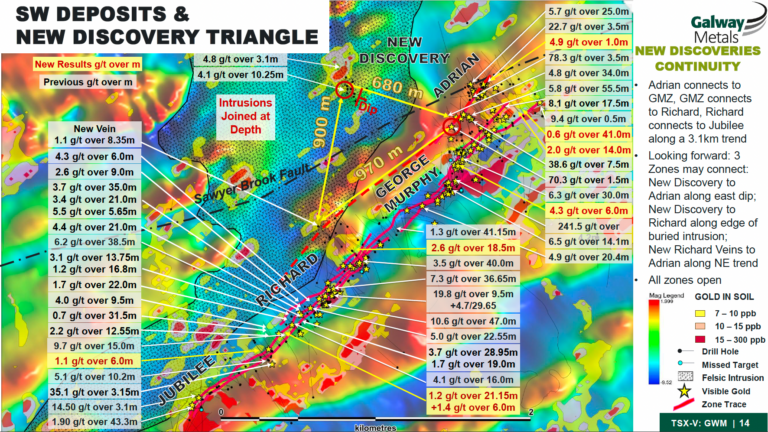

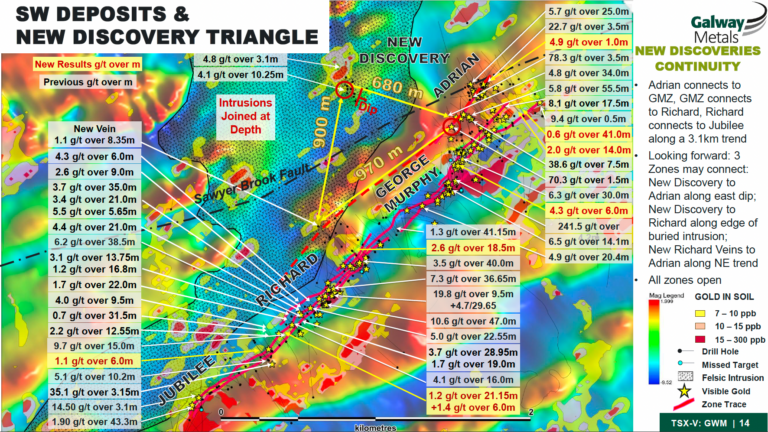

Galway’s discovery of the Adrian, George Murphy (GMZ) and Richard Zones, and the subsequent focused exploration drilling to establish a connection between these formerly separate deposits, and with the previously known Jubilee Zone, now combine for a 3.1-kilometre mineralized trend called the SW Zone. It is thought to remain open and contains high-priority drill targets for follow-up (see Exhibit 3).

Exhibit 3. Location of Deposits and Recent Drill Intercepts.

Source: Galway Metals Inc.

Resource Details

The substantial jump in resources was a combination of the new discoveries, lower cut-off grades for the open-pit constrained (reduced from 0.42 g/t gold to 0.38 g/t gold) and underground resources (reduced from 2.55 g/t gold to 2.00 g/t gold). These lower cut-off grades were driven by an increase in the gold price applied to the resource estimate from US$1,350/oz to US$1,650/oz. The newly termed SW Deposit (comprised of Adrian, George Murphy, Richard and Jubilee Zones) MRE incorporates three sizable open pits plus smaller cuts (See Exhibit 4).

Exhibit 4. The Bulk of Clarence Stream Resource Growth Came from The Newly Coined SW Deposit.

Source: Galway Metals Inc.

Notably, the MRE does not include several of the company’s previous discoveries allowing for further expansion and new discoveries. These include:

- Mineralization recently extended 340m north at the east end of the Richard Zone

- Richard North veins – these may line up with another previously-reported discovery 900m north-northeast

- New discovery area highlighted by holes CL-72 and CL-111 – these are located 680m west-north-west and up-dip from a 385m deep intersect in the Adrian Zone

According to Galway, the Richard to Adrian, Richard to the discovery to the NNE, and the discovery to Adrian might be linked, providing a large triangle with the potential to host significant gold mineralization – all outside the current resource areas but near them (See Exhibit 3).

Moving Forward

With an updated MRE in hand, Galway plans to initiate a Preliminary Economic Assessment (PEA). Galway has communicated the focus of its ongoing drilling program is to continue to expand the existing zones that are all open, to follow up on the three previous discoveries outlined above that weren’t included in the MRE, and to make more discoveries to enhance the emerging gold district further.

The previous discoveries represent high-priority targets outside the resource areas where Galway is planning follow-up drilling in its 150,000-metre program, using six drill rigs through 2023.

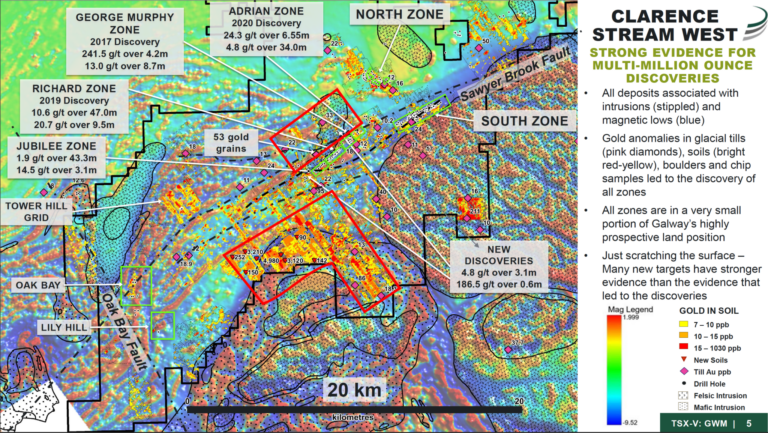

Another previously released discovery Galway plans to follow up is Oak Bay. Oak Bay is 19 km to the west of The South Zone. The zone at Oak Bay has been drill-delineated with strong, consistent intersections.

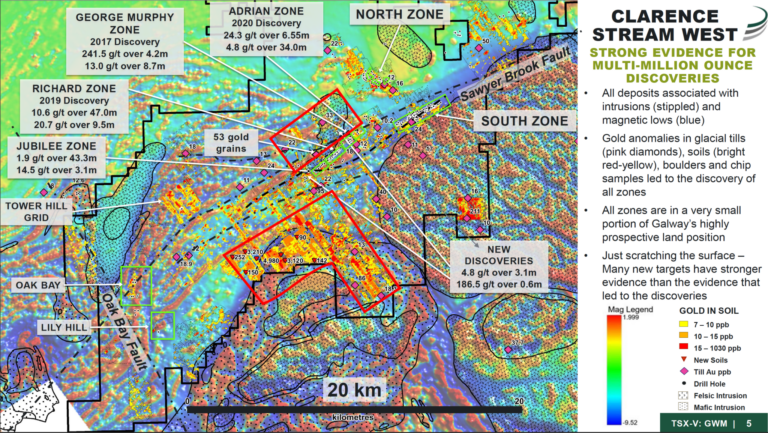

Besides drilling to expand the existing zones, and the discoveries that are not part of the updated resource, several high-priority targets have yet to be drilled at Clarence Stream. These are said to exhibit better evidence for gold discoveries than the evidence that existed before Galway’s discoveries (see Exhibit 5). Note the extensive and high-grade soil sample results from Tower Hill and a zone southeast of Tower Hill. Note that these targets are interpreted to have similar characteristics to existing deposits – high soil anomalies, mafic intrusives around felsic intrusives and proximal to the Sawyer Brook Fault.

Upcoming catalysts would also include metallurgical and ore sorting tests.

Exhibit 5. Map Showing Galway Metals’ Clarence Stream Priority Drill Targets

Source: Galway Metals Inc.

In addition to the gold resource, the deposits host antimony, one of Natural Resources Canada’s (NRCAN) critical minerals.

For full details from the Press Release, please click here.

Company Highlights

- Newly updated MRE incorporating new mineralized zones at Clarence Stream, New Brunswick.

- Expanded, fully funded exploration drill programme at Clarence Stream from 100,000m to 150,000, utilizing six drill rigs through 2023.

- Clarence Stream Deposit Resource1 (April 2022)

- North, South, including the new Southwest Zones Open Pits

- Indicated: 12.12 mln tonnes grading 2.27 g/t for 886,000 oz gold.

- Inferred: 11.8 mln tonnes grading 1.93 g/t for 731,000 oz gold.

- South and SW Zones Underground

- Indicated: 274k tonnes grading 4.10 g/t for 36,000 oz gold.

- Inferred: 4.17 mln tonnes grading 4.50 g/t for 603,000 oz gold.

- Clarence Stream Project Highlights

- 65km (non-contiguous) of prospective strike and discoveries as indicated by gold-in-till, soil, boulder and chip samples, and magnetic lows (aligning with the Sawyer Brook Fault); the belt is under-explored and proximal to excellent infrastructure.

- Significant Resource Expansion Potential.

- Excellent Access and Infrastructure – well located only 70km south-southwest of Fredericton in southwestern New Brunswick. Excellent road access cutting through the property, readily accessible power and a local workforce. Proximal to the border with Maine.

- Estrades Deposit Resource2, Quebec – former producing, high-grade Volcanogenic Massive Sulphide (VMS) Mine

- Indicated: 1.497 mln tonnes grading 3.55 g/t gold, 122.9 g/t silver, 7.2% zinc, 1.06% copper and 0.6% lead for contained metal of 170,863 oz gold, 5.9 mln oz silver, 237.6 mln lbs zinc, 35.0 mln lbs copper and 19.8 mln lbs lead.

- Inferred: 2.199 mln tonnes grading 1.93 g/t gold, 72.9 g/t silver, 4.72% zinc, 1.01% copper and 0.29% lead for contained metal of 136,452 oz gold, 5.2 mln oz silver, 228.8 mln lbs zinc, 49.0 mln lbs copper and 14.1 mln lbs lead.

- Estrades Highlights

- September 10, 2018 Resource Estimate increased the Indicated Resource by 15% and the Inferred Resource by 80% over the August 2016 estimate.

- An expanded 25,000m drill programme using three rigs targeting the three main mineralized horizons at the Estrades property is underway.

- Well-financed – Approximately $15 mln in cash (reported in the April 2022 Corporate Presentation) with no debt.

- Management and Shareholder’s interest are aligned – ~21% ownership by Management, Friends and Family.

- Institutional Ownership 52%.

- Seasoned management team – the same key management team that sold Galway Resources for US$340 mln in 2012.

Notes (from relevant technical reports):

1 – Mineral Resources are reported at cut-off grades of 0.38 g/t Au and 2.00 g/t Au for open pit and underground, respectively. Mineral Resources are estimated using long-term gold price of US$1,650/oz, a long term antimony price of US$10,000/t and a US$/C$ exchange rate of 1.33. A minimum mining width of 1.5m was used. Bulk density is 2.83 t/m3 for North Zone mineralization, 2.90 t/m3 for South Zone mineralization, and 2.73 t/m3 for SW Deposit mineralization. There are no Mineral Reserves at Clarence Stream. Open pit Mineral Resources are reported within conceptual open pits. Underground Mineral Resources are reported within three-dimensional shapes outlining volumes of continuous blocks which satisfy the cut-off grade and minimum width criteria.

2 – Mineral Resources are estimated at long-term metal prices (USD) as follows: gold $1,450/oz, Ag $21.00/oz, Zn $1.15/lb, Cu $3.50/lb and Pb $1.00/lb; Mineral Resources are estimated using an average long-term foreign exchange rate of US$0.80 per CDN$1.00; Mineral Resources are estimated at a cut-off grade of CDN$140/tonne NSR, which included provisions for metallurgical recoveries, freight, mining, milling, refining and G&A costs, smelter payables for each metal and applicable royalty payments; Metallurgical recoveries for resource estimation are: Zn 92%, Cu 90%, Pb 85%, Gold 80% and Ag 70%.

*For a complete description of Resource assumptions, please review the relevant technical reports.