The latest batch of fire assay results from Radisson Mining’s ongoing 130,000-metre drilling campaign on the flagship O’Brien gold project, located along the legendary Larder Lake-Cadillac Break in Quebec, demonstrates significant shallow upside potential to the currently defined resource base.

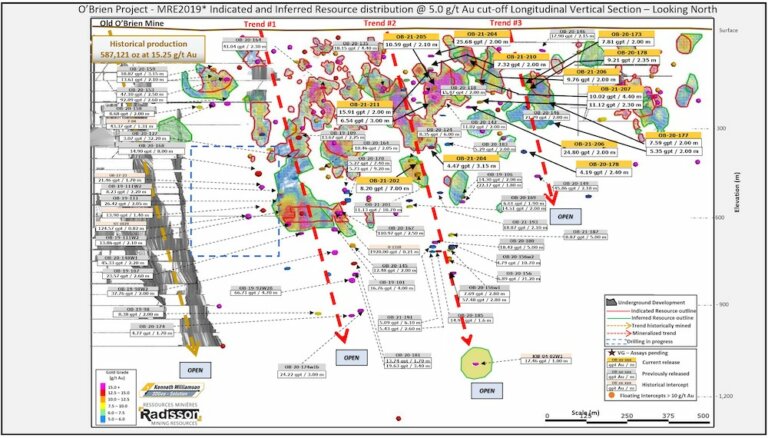

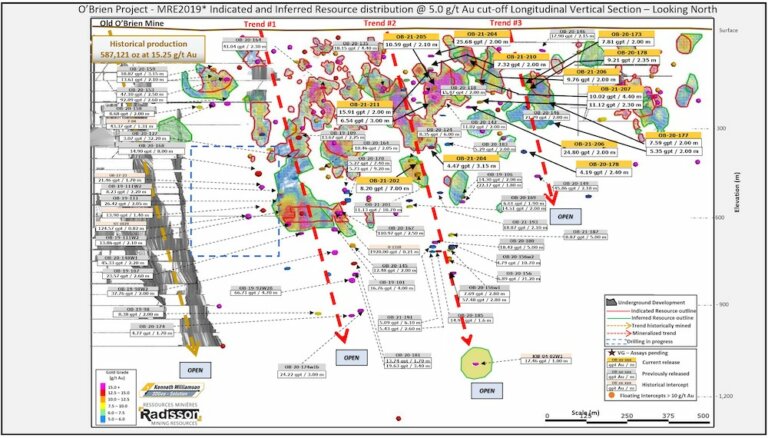

In the September 9 press release, the company reported significant shallow high-grade intercepts outside defined resources in the upper 450m along Trend #2, as well as the upper 200m along Trend #3 (see Exhibits 1 and 2).

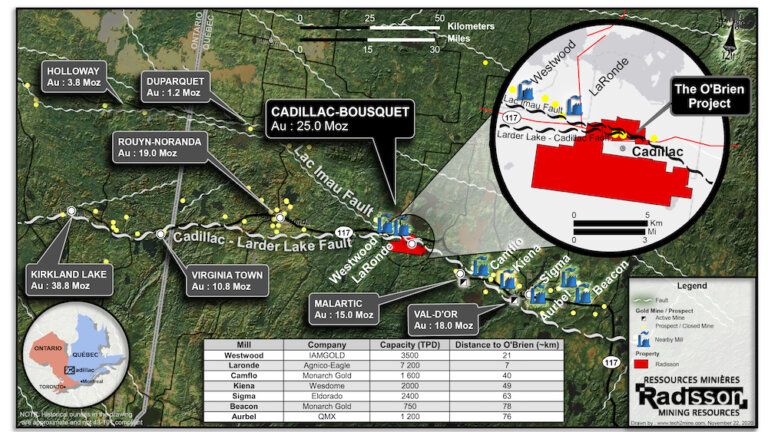

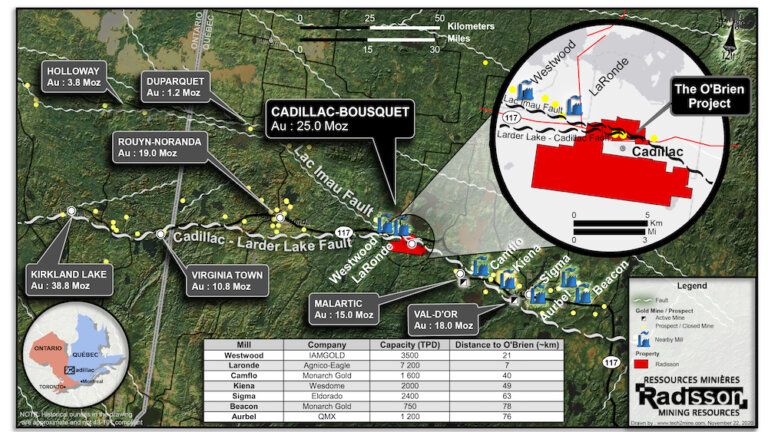

Exhibit 1. Map showing the location of O’Brien along the Cadillac-Larder Lake Fault

Source: Radisson Mines

Drill results have also traced mineralization at depth, well below currently defined resources, down to 800m along Trend #2 (current resources are mostly within the upper 400m) and down to 500m along Trend #3 (current resources are mostly within the upper 240m).

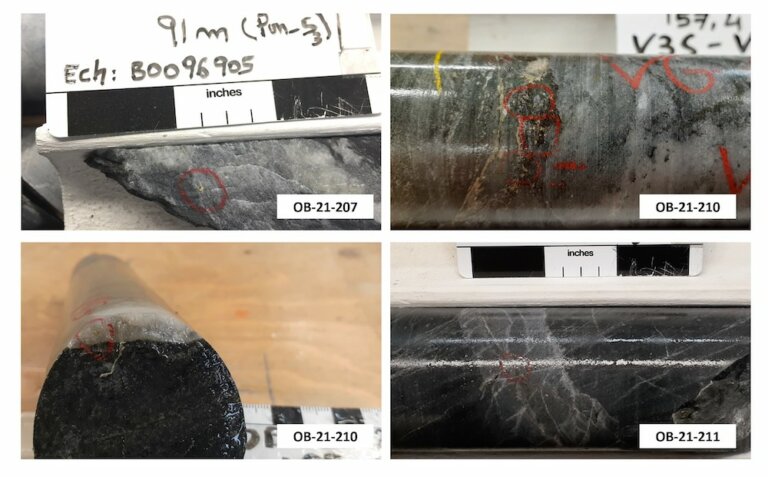

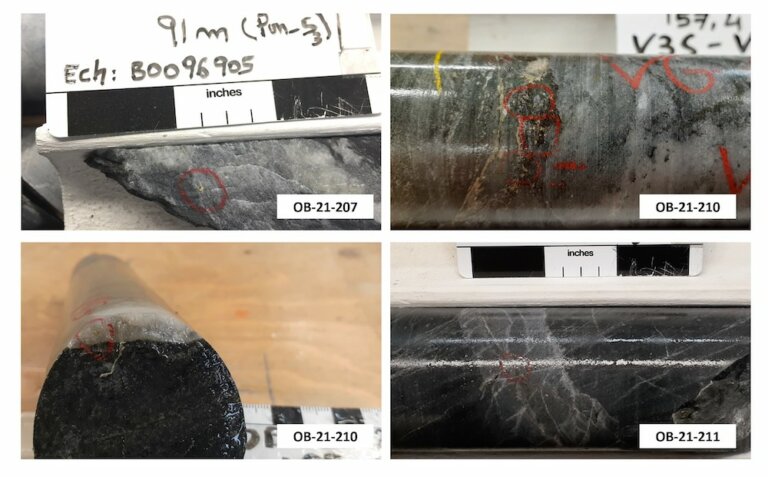

Of particular interest are results from hole OB-21-207 (see Exhibit 3) in Trend #3, which included 10.02 grams per tonne (g/t) gold over 4.4m and 24.8g/t over 1.3m. The hole was aimed at expanding one of the highest-grade resource blocks in the 2019 Mineral Resource Estimate (MRE).

Exhibit 2. Longitudinal Vertical Section (looking north), showing Drill Holes and Current Resource Distribution

Source: Radisson Mining

The Significance

According to Radisson, drilling to date suggests the potential to “at least double” the depth extent of resources along three high-grade mineralized trends within an approximately 1km strike to the east of the old O’Brien Mine.

The results show several shallow holes intersected high-grade mineralized structures outside defined resource blocks in the upper 450m along Trend #2 and in the upper 200m along Trend #3, highlighting opportunities for resource growth in sparsely drilled areas closer to surface.

Radisson’s continued focus on step-out drilling highlights resource growth potential up to 330m below current resources in Trend #2, which is 600m east of the old O’Brien Mine.

Hole OB-21-202 intersected 8.2g/t gold over 7m at a vertical depth of about 440m. This intercept along with several previously released relatively broader intercepts suggest potential for wider mineralized zones, five to ten metres wide between 400 to 700m vertical depth, likely highlighting the impact of cross-cutting high-grade mineralized veins.

The exploration drilling also continues to highlight resource growth potential along Trend #3, 900m east of the old O’Brien mine.

Drill holes OB-21-206 and OB-21-207 (10.02g/t gold over 4.4m) were designed as resource expansion drill holes near one of the highest-grade resource blocks defined in 2019. These results add to high-grade gold intercepts obtained in 2020 in the sector in hole OB-20-149 (45.86g/t gold over 2.1m, 260m below current resources) and OB-20-146 (17.9g/t gold over 2.15m and 21.29g/t gold over 2m).

Exhibit 3. Visible Gold in OB-21-207, OB-21-210 and OB-21-211

Source: Radisson Mining

Newly released intercepts confirm resource expansion and exploration potential along Trend #3, where most of current resources lie from surface down to only 240m depth.

Next Steps

Drilling at O’Brien continues to validate the litho-structural model while highlighting resource growth potential laterally and at depth.

Radisson has to date defined and expand three high-grade mineralized trends, about 300m, 600m and 900m respectively to the east of the old O’Brien mine. The mineralized zones bear similarities with structures previously mined at O’Brien down to a depth of 1,100m, for historical production of 587,000oz grading 15.25g/t gold.

Radisson believes there is significantly more upside to be unlocked from the prospective land package that includes more than 5km of strike length along the prolific Larder Lake-Cadillac Break. Results, so far, all support the thesis of discovering and expanding additional high-grade mineralized trends as the company steps out systematically further along strike and deeper beyond the limits of drilling to date.

Given current geological understanding and the ongoing validation of the litho-structural model, the company estimates there is strong exploration potential for additional high-grade gold trends along the 5.2km prospective land package.

There are more results on the way. Of the 130,000m drilling campaign, Radisson has completed 87,470m to date with assays pending for about another 10,021m.

For complete information, please visit the Radisson Mining website at www.radissonmining.com.

Company Highlights:

- O’Brien is one of the highest-grade undeveloped gold projects in Canada/USA

- Mineral Resource Estimate as of July 2019:

- 289,000oz gold grading 9.48g/t Indicated

- 145,000oz grading 7.31g/t gold Inferred

- 5,800ha land package including 5.2km of prospective strike along the Larder Lake- Cadillac Break

- The landholding includes >2.5km strike to the east and west of the past-producing O’Brien Mine (historical production of 587,000oz at 15.25g/t gold)

- Management team with the right combination of capital markets and technical experience

- Over 10% insider ownership and over 35% institutional ownership

- 5% owned by Rob McEwen; 3.2% owned by Marshall Precious Metals (managed by David Garofalo)

- Cash position of $10.7 million as of August 23, 2021

- 130,000m drill program underway, with 70,000m planned in 2021

- Funded to complete >130,000m of drilling through 2021