As Galway continues to advance the large, Clarence Stream gold property in New Brunswick, the company is also advancing the Estrades base-metal- gold property in northern Quebec.

Galway released high-grade assay results from large-diameter, PQ-sized core samples and from exploration drilling beneath the current Estrades Resource.

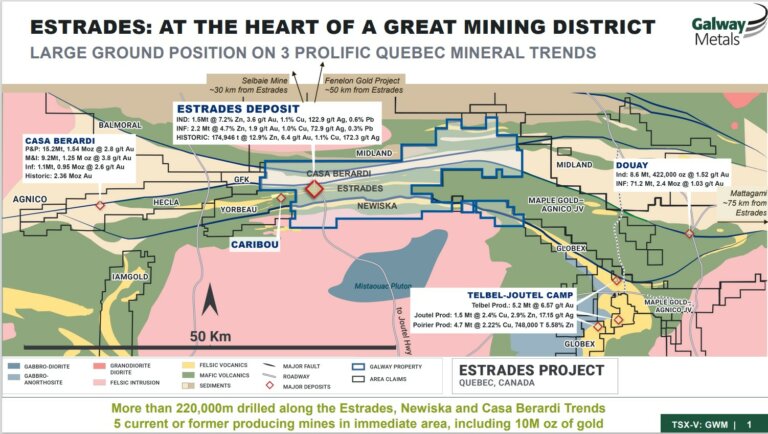

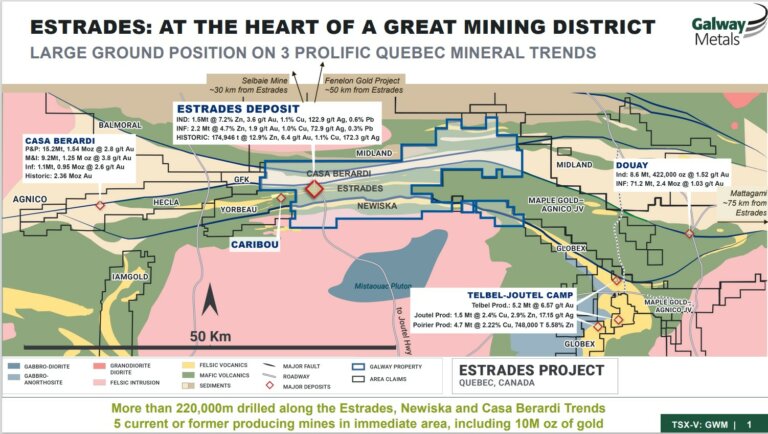

Galway also provided an update on the expanded Estrades drill programme. Three drills are turning as part of a 25,000m programme. Potential copper source vents, below and on both sides (east and west) of the Estrades Resource, are stated to be high priority targets. Other drill targets mentioned include volcanogenic massive sulphide (VMS) targets reported along both the Estrades Horizon and along the Newiska Horizon to the south (Figure 1). Drilling is said to be underway on both horizons.

Figure 1. Property Location Showing the Casa Berardi, Estrades and Newiska Horizons

Source. Galway Metals Inc.

The Estrades Resource

The Estrades Indicated Resource (effective September 10, 2018) totals 1.497mln tonnes with average grades of 3.55g/t gold (Au), 122.9g/t silver (Ag), 7.2% zinc (Zn), 1.06% copper (Cu) and 0.60% lead (Pb) for contained metal of 170,863 ounces (oz) Au, 5.9mln oz Ag, 237.6mln pounds (lbs) Zn, 35.0mln lbs Cu and 19.8mln lbs Pb and 2.199mln tonnes grading 1.93g/t Au, 72.9g/t Ag, 4.72% Zn, 1.01% Cu and 0.29% Pb for contained metal of 136,452 oz Au, 5.2mln oz Ag, 228.8mln lbs Zn, 49.0mln lbs Cu and 14.1mln lbs Pb in the Inferred category – see ‘Company Highlights’ below for key assumptions. We note that the Estrades Deposit is gold and zinc dominant.

The Estrades Resource comprises stratiform, massive sulphide mineralization, spatially related to felsic volcanic rocks known historically as the ‘Main Felsic Unit’. In the Western block of the Resource, two mineralized horizons are separated by a mafic intrusion, or by a younger assemblage of extrusive felsic rocks, in conformable contact with the mineralization. The sheet-shaped mineralized horizons have been traced to a depth of approximately 750m on the eastern fault-block side of the Resource and to a depth of 1000m on the western fault-block side. From July 1990 to May 1991, 174,946 tonnes of ore grading 1.1% Cu, 13% Zn, 6.35g/t Au and 172g/t Ag were produced from previous operator Breakwater Resources.

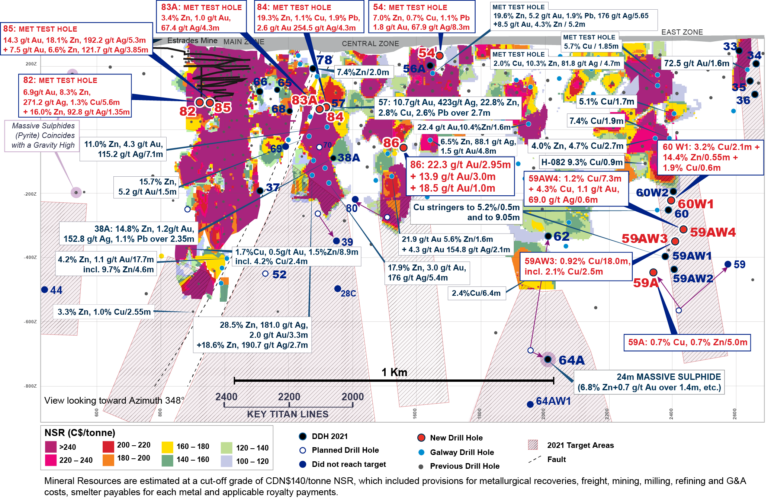

High-Grade Assays from Core Drilled for Metallurgical and Ore Sorting Tests

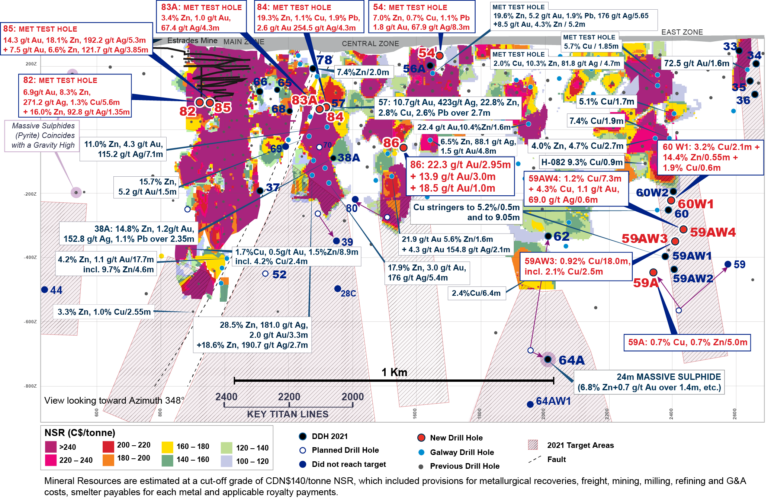

Four new, large-diameter, PQ-sized holes were drilled for metallurgical and ore sorting purposes. Holes 82 and 85 were located directly below historical workings. Holes 83A and 84 were drilled to pierce the deposit proximal to previously-reported hole 57 (10.7g/t Au, 423g/t Ag, 22.8% Zn, 2.8% Cu and 2.6% Pb over 2.7m) west of center and beneath the Central Zone (Figure 2). These four holes intersected the massive sulphide mineralization and disseminated sulphide mineralization as intended. In addition to providing material for testing purposes, they increase the drilling density in those areas which can help improve the local Resource modelling.

Figure 2. Pierce Points Shown in Cross Section looking 348 degrees (New Hole Pierce Points shown as Large Red Dots)

Source. Galway Metals Inc.

Newly reported assay highlights from core retrieved for metallurgical testing included:

- Hole GWM-21E-85 (Hole 85): 14.0g/t gold equivalent (AuEq) or 25.7% zinc equivalent (ZnEq) (7.5g/t Au, 121.7g/t Ag, 6.6% Zn, 0.2% Cu, and 1.7% Pb) over 1.80m True Width (TW) at 186m below surface and 28.0g/t AuEq or 51.5% ZnEq (14.3g/t Au, 192.2g/t Ag, 18.1% Zn, 0.2% Cu, and 1.6% Pb) over 2.50m TW at 194m below surface.

- The above massive sulphide intercepts were noted to have a Mine opening in between

- Hole GWM-21E-82 (Hole 82): 15.6g/t AuEq or 28.7% ZnEq (4.3g/t Au, 240.8g/t Ag, 11.1% Zn, 0.7% Cu, and 1.3% Pb) over 0.3m TW at 192m below surface, 17.9g/t AuEq or 32.9% ZnEq (6.9g/t Au, 271.2g/t Ag, 8.3% Zn, 1.3% Cu, and 0.9% Pb) over 2.6m TW at 200m below surface and 21.6% ZnEq (0.7g/t Au, 92.8g/t Ag, 16.0% Zn, and 0.6% Cu) over 0.6m TW at 228m below surface.

- Hole GWM-21E-84 (Hole 84): 35.9% ZnEq (2.6g/t Au, 254.5g/t Ag, 19.3% Zn, 1.1% Cu, and 1.9% Pb) over 3.6m TW at 217m below surface.

- GWM-21E-83A (Hole 83A): 8.3% ZnEq (1.0g/t Au, 67.4g/t Ag, 3.4% Zn, 0.3% Cu, and 0.4% Pb) over 3.1m TW, including 3.9g/t Au, 146.9g/t Ag, 15.4% Zn, 0.3% Cu, and 1.5% Pb over 0.5m TW, at 217m below surface.

- GWM-21E-54 (Hole 54): 15.2% ZnEq (1.8g/t Au, 67.9g/t Ag, 7.0% Zn, 0.7% Cu, and 1.1% Pb) over 6.10m TW at 36m below surface.

Drilling Below the Current Resource Boundary at Depth Hits More Mineralization

Newly released assay results from exploration drilling extend known mineralization at depth in the copper-rich eastern portion of the deposit (Figure 2). These holes are located between 146m to 343m below the deepest hole included in the Resource.

Hole 86, found in the middle of the long section in Figure 2, intersected a third, deeper massive sulphide horizon, adding to two previously reported high-grade intercepts for the same Hole (26.6g/t AuEq over 1.6m and 7.0g/t AuEq over 2.1m). Hole 86 closes a gap located roughly 80m above a previously reported high-grade intercept from Hole 31 (26.6 g/t AuEq over 1.6m and 7.0 g/t AuEq over 2.1m).

The other four holes were drilled to pierce below the current Resource outline on the eastern-most side of the deposit.

New assay highlights from exploration drilling included:

- GWM-21E-86 (Hole 86): 20.8g/t AuEq (18.5g/t Au, 70.7g/t Ag, 1.4% Zn and 0.3% Cu) over 0.5m TW at 423m below surface

- Previously reported intervals from this follow-up to previously-drilling Hole 31 in the central portion of the Resource included 16.1g/t AuEq (13.9 g/t Au, 50.7 g/t Ag, 1.1% Zn, and 0.5% Cu) over 1.3m TW at 377m below surface and 24.0g/t AuEq (22.3g/t Au, 46.2g/t Ag, 1.3% Zn, and 0.2% Cu) over 1.3m TW at 401m below surface.

- GWM-21E-60W1 (Hole 60W1): 2.4% Cu, 0.7g/t Au, 35.9g/t Ag and 0.7% Zn over 1.7m TW, including the sub-interval of 3.2% Cu, 0.8g/t Au, 46.5g/t Ag, and 0.8% Zn over 1.1m TW at 514m below surface. Other Highlights from GWM-21E-60W1 include 14.4% Zn over 0.30m TW at 520m below surface, 0.4% Cu, 0.2g/t Au, 6.6g/t Ag and 0.4% Zn over 2.3m TW at 530m below surface and 1.9% Cu over 0.3m TW at 559m below surface.

- The first interval is noted to be 146m below the closest hole incorporated in the Resource.

- GWM-21E-59AW4 (Hole 59AW4): 4.3% Cu, 1.1g/t Au and 69.0g/t Ag over 0.4m TW at 579m below surface, 1.4g/t Au, 1.7% Zn and 6.6g/t Ag over 1.2m TW at 584m below surface, 1.2% Cu, 0.5g/t Au and 6.3g/t Ag over 4.6m TW, including sub-intervals grading 5.3g/t Au over 0.30m TW, 2.7% Cu over 0.3m TW and including 4.8% Cu over 0.30m TW at roughly 625m below surface and 240m below the closest hole in the Resource.

- GWM-21E-59AW3 (Hole 59AW3): 0.92% Cu, and 5.3g/t Ag over 11.30m TW, including 2.1% Cu over 1.6m TW, at 637m below surface.

- This copper zone is noted to be 252m below the closest hole in the Resource

- GWM-21E-59A (Hole 59A): 0.7% Cu, 0.3g/t Au, 21.5g/t Ag, and 0.7% Zn over 2.50m TW at 727m below surface.

- This copper zone is 343m below the closest hole in the Resource.

The Significance

Current gold, silver, copper and zinc metal prices are in favourable territory these days relative to the price assumptions used in the 2018 Resource Estimate. Presumably, this has driven a renewed focus for Galway on Estrades, while they continue to outline an emerging gold district at Clarence Stream in New Brunswick (see Company Highlights below). The Company believes there remains strong potential for discovery of deeper mineralization along the projected depth extensions of at least five high-grade shoots of mineralization as indicated by the hatched 2021 target areas depicted in Figure 1.

Next Steps at Estrades

Engineering, metallurgical and ore sorting efforts continue. Ore sorting tests are underway to test the potential to reject waste rock and lower mill feed dilution. If successful, there is potential to reduce transportation and mill costs and create less tailings, all potential wins from a cost basis and in terms of reducing the environmental footprint.

All required metallurgical samples for testing have been acquired. The work is expected to be conducted later this year. Historical recovery rates using conventional processing methods were 93% zinc, 90% copper, 86% lead, 78% gold and 63% silver.

Exploration drilling aimed to the expansion of the Estrades Deposit at depth and both to the east and west of the Deposit is expected to continue.

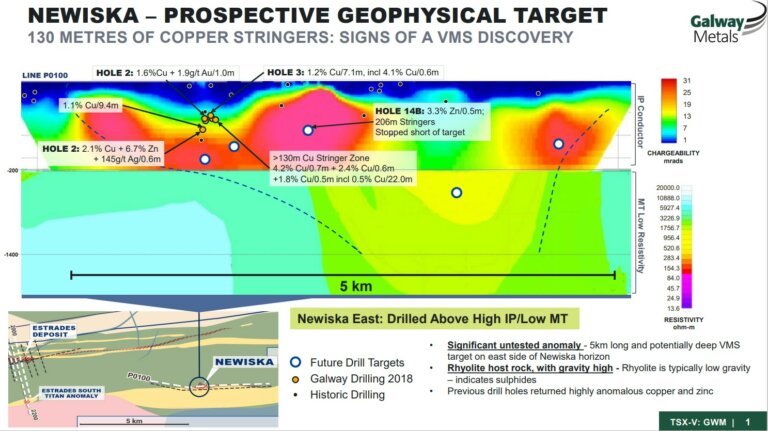

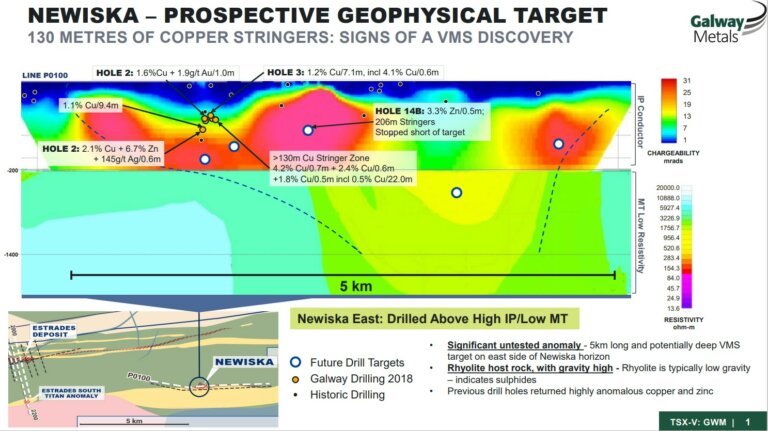

Exploration Drilling on the Newiska Horizon could also bear fruit. The Newiska VMS Horizon south and to the east of the Estrades Deposit (Figure 3) is host to extensive copper stringer zones over 132m and sizeable geophysical anomalies over a 5km strike length. In the area, TITAN-delineated strong conductors are reportedly co-incident with gravity high anomalies in the host rhyolite. Typically, felsic rocks are less dense and present a gravity low anomaly, therefore the gravity highs could potentially indicate the presence of high concentrations of sulphides.

We note that 20km to the east, the Newiska VMS Horizon is home to the past-producing Telbel Gold Mine (1.1mln ounces at 6.6g/t Au in 5.2mln tonnes) and the former producing Joutel and Poirier VMS mines.

Figure 3. Newiska VMS Horizon Longitudinal Section Showing the Target Geophysical Anomalies

Source. Galway Metals Inc.

Directly to the south of the Estrades Deposit, another TITAN conductor is a high-priority target where previous drilling intersected 3.1m of massive pyrite within rhyolite. Galway stated the plan is to drill below the pyrite and test the strong conductor. Five historical drill holes in the area returned narrow intervals with high-grade copper anomalies. (Figure4).

Figure 4. Estrades South TITAN Anomaly on the Newiska Horizon

Source. Galway Metals Inc.

Additional geophysical surveys are expected this winter for target generation as follow-up to a previous FALCON gravity survey and a previous TITAN IP/MT survey. Expected survey areas include along the current Estrades Resource and on the east-west extensions, as well as along the Newiska Horizon.

Lastly, Galway is evaluating alternative long-hole mining methods as a means to potentially improve project economics given the near-vertical dip and continuity of the sheet-shaped Estrades Deposit.

Company Highlights

- Forthcoming MRE update incorporating new mineralized zones at Clarence Stream, New Brunswick.

- Expanded, fully funded exploration drill programme at Clarence Stream from 75,000m to 100,000m utilizing seven drill rigs

- Clarence Stream Deposit Resource1 – (North and South Zones only)

- Measured: 236,000 tonnes grading 1.81g/t gold for 14,000 contained ounces gold

- Indicated: 5.942mln tonnes grading 1.97g/t gold for 376,000 contained ounces gold

- Inferred: 3.409mln tonnes grading 2.53g/t gold for 277,000 contained ounces gold

- Clarence Stream Project Highlights

- 65km (non-contiguous) of prospective strike and discoveries as indicated by gold-in-till, soil, boulder and chip samples along magnetic lows (aligning with the Sawyer Brook Fault); the belt is under-explored and proximal to excellent infrastructure

- Resource Expansion Potential – Only 2 of 7 Clarence Stream Deposits are in the Resource Estimate – George Murphy, Jubilee, Richard, recently discovered Adrian and GMZ North Zones are not yet included but are expected in the next Resource Estimate update.

- Excellent Access and Infrastructure – well located only 70km south-southwest of Fredericton in southwestern New Brunswick. Excellent road access cutting through the property, readily accessible power and a local workforce. Proximal to the border with Maine

- Estrades Deposit Resource2, Quebec – former producing, high-grade Volcanogenic Massive Sulphide (VMS) Mine

- Indicated: 1.497mln tonnes grading 3.55g/t gold, 122.9g/t silver, 7.2% zinc, 1.06% copper and 0.6% lead for contained metal of 170,863 ounces gold, 5.9mln ounces silver, 237.6mln lbs zinc, 35.0mln lbs copper and 19.8mln lbs lead

- Inferred: 2.199mln tonnes grading 1.93g/t gold, 72.9g/t silver, 4.72% zinc, 1.01% copper and 0.29% lead for contained metal of 136,452 ounces gold, 5.2mln ounces silver, 228.8mln lbs zinc, 49.0mln lbs copper and 14.1mln lbs lead

- Estrades Highlights

- September 10, 2018 Resource Estimate increased the Indicated Resource by 15% and the Inferred Resource by 80% over the August 2016 estimate

- An expanded 25,000m drill programme using three rigs targeting the three main mineralized horizons at the Estrades property is underway

- Well-financed – Approximately $15mln in cash (February 2022 corporate presentation) with no debt

- Management and Shareholder’s interest are aligned – ~21% ownership by Management, Friends and Family

- Institutional Ownership 52%

- Seasoned management team – the same key management team that sold Galway Resources for US$340mln in 2012

Notes (from relevant technical reports):

1 – Pit constrained resources as stated are contained within a potentially economically minable pit; pit optimization was based on an assumed gold price of US$1,350/oz, gold recovery of 90%, a mining cost of CAD$3.00/t, an ore processing and G&A cost of CAD$20.00/t, and pit slopes of 45 degrees; Pit constrained resources are reported using a gold cut-off grade of 0.42 ppm, which incorporates a 3% royalty and gold sales costs of CAD$5.00/oz beyond the costs used for pit constrained optimization; Underground resources as stated are contained within modelled underground stope shapes using a nominal 1.5m minimum thickness, above a gold cut-off grade of 2.55 ppm, and below the reported pit constrained Resource; The underground cut-off is based on an assumed gold price of US$1,350/oz, Gold Recovery of 90%, mining cost of CAD$100/t, an ore processing and G&A cost of US$20.00/t, a 3% royalty, and gold sales costs of CAD$5.00/oz;

2 – Mineral Resources are estimated at long-term metal prices (USD) as follows: gold $1,450/oz, Ag $21.00/oz, Zn $1.15/lb, Cu $3.50/lb and Pb $1.00/lb; Mineral Resources are estimated using an average long-term foreign exchange rate of US$0.80 per CDN$1.00; Mineral Resources are estimated at a cut-off grade of CDN$140/tonne NSR, which included provisions for metallurgical recoveries, freight, mining, milling, refining and G&A costs, smelter payables for each metal and applicable royalty payments; Metallurgical recoveries for resource estimation are: Zn 92%, Cu 90%, Pb 85%, Gold 80% and Ag 70%.

*For a complete description of Resource assumptions, please review the relevant technical reports

For more information, find the press release here.