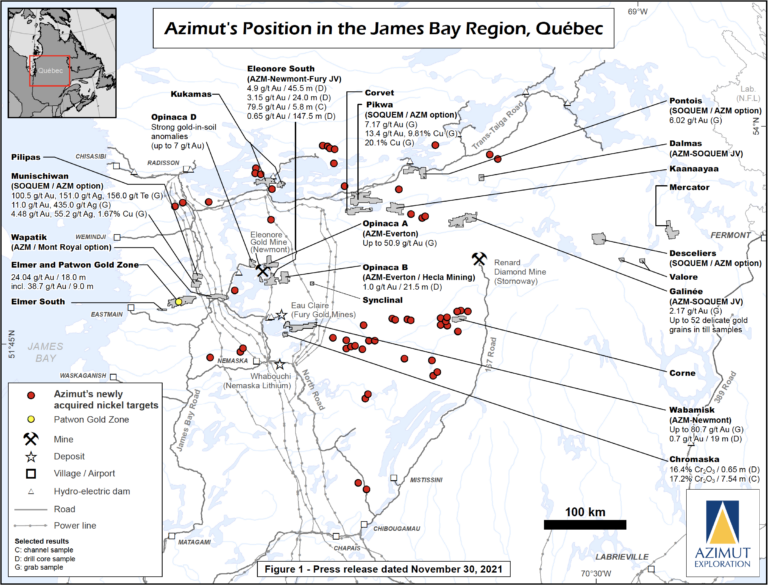

Quebec- focused project generator Azimut Exploration Inc. has released the results from six drill holes targeted to test the depth extent of the Patwon Zone on its 100%-owned Elmer Property in the James Bay Region (see Exhibit 1).

The company reported that mineralization had now been traced to a depth of at least 600m and the deposit remains open at depth.

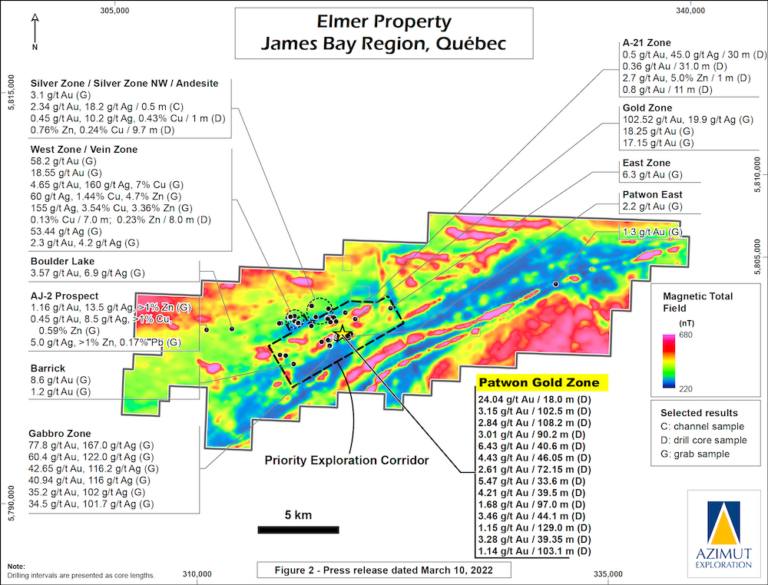

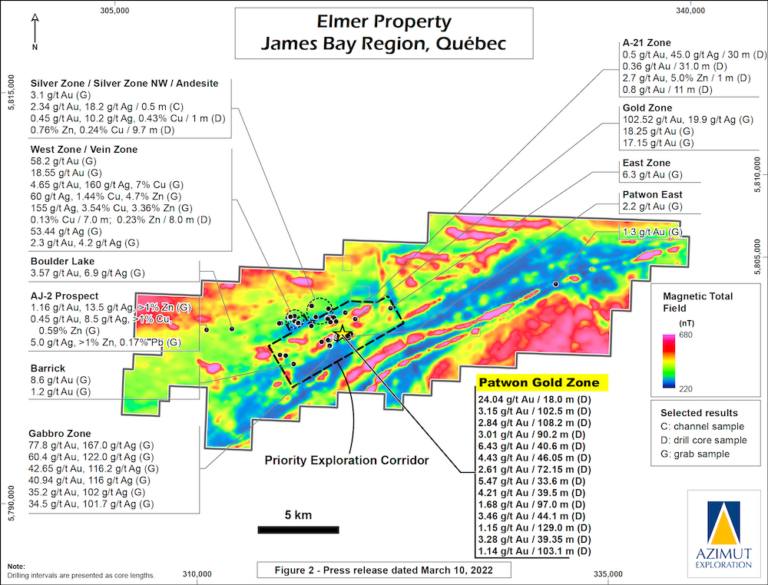

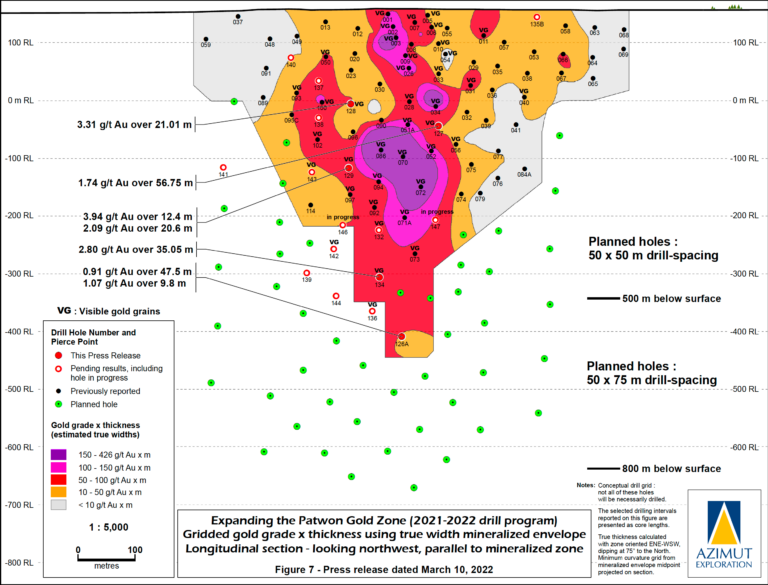

The ongoing 20,000m, fourth drilling campaign on the property was designed to test for mineralization to at least 800m depth. The drill results will feed into a maiden resource estimate currently in the works (see Exhibit 2).

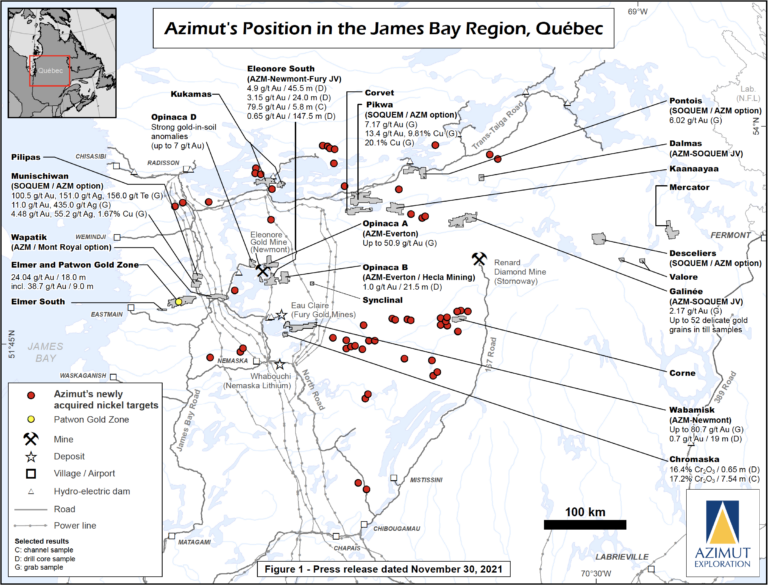

Exhibit 1. Azimut’s Landholdings in the James Bay Region of Quebec.

Source: Azimut Exploration Inc.

Exhibit 2. Critical Mineralized Zones of the Elmer Property, Quebec.

Source: Azimut Exploration Inc.

The Significance

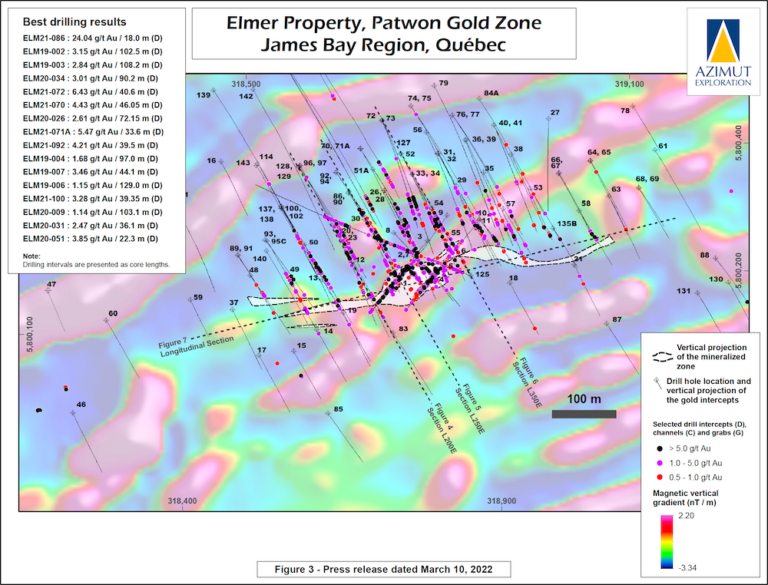

Among the highlight holes (see Exhibit 2 and 3) recently released is hole ELM21-129, which returned 3.94 grams per tonne (g/t) gold over 12.4m, from 263.05 to 275.45m including 13.85 g/t gold over 2.5m. Additional intersections include 2.09 g/t gold over 20.6m from 300.7 to 321.3m including 7.50 g/t gold over 4.0m.

Hole ELM21-128 returned 3.31 g/t gold over 21.01m from 211.82 to 232.84m including 5.37 g/t gold over 5.83m and 6.63 g/t gold over 4.98m.

Hole ELM22-134 returned 2.80 g/t gold over 35.05m from 536.75 to 571.8m including 16.71 g/t gold over 2.9m and 24.5 g/t gold over 0.9m.

Hole ELM21-127 returned 1.74 g/t gold over 56.75m (from 189.25 to 246m) including 12.2 g/t gold over 1.2m and 7.25 g/t gold over 3.5m.

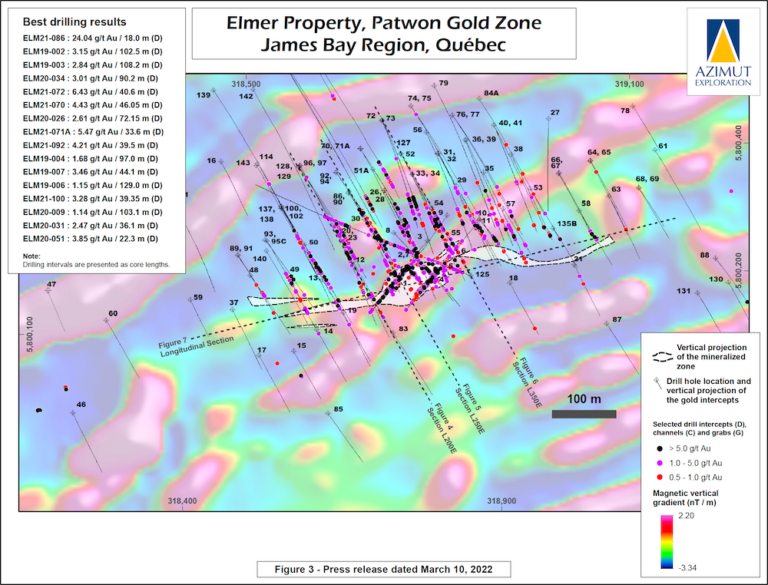

Hole ELM21-125, which Azimut drilled at a low angle through the mineralized envelope to provide more information about its geometry and continuity (see Exhibit 3) returned 1.08 g/t gold over 286.9m. For this hole, Azimut said core length intervals were reported as mineralized down-hole lengths thus true widths have not been estimated for this hole.

Exhibit 3. The Patwon Gold Zone at the Elmer Property, Quebec.

Source: Azimut Exploration Inc.

The wide interval in Hole ELM21-125, intersected mineralization from 27.6 to 314.15m, and included 4.43 g/t gold over 40.0m from 274.5 to 314.5m which included 10.54 g/t gold over 5.9m and 8.14 g/t gold over 10.7m. The hole further returned 1.35 g/t gold over 75m from 390.7 to 465.7m, including 6.54 g/t gold over 7.7m.

With the release of the latest results, the Patwon Zone has now been outlined along a 580m strike length and now extends from 450 to 600m, with an average estimated actual width of 35m.

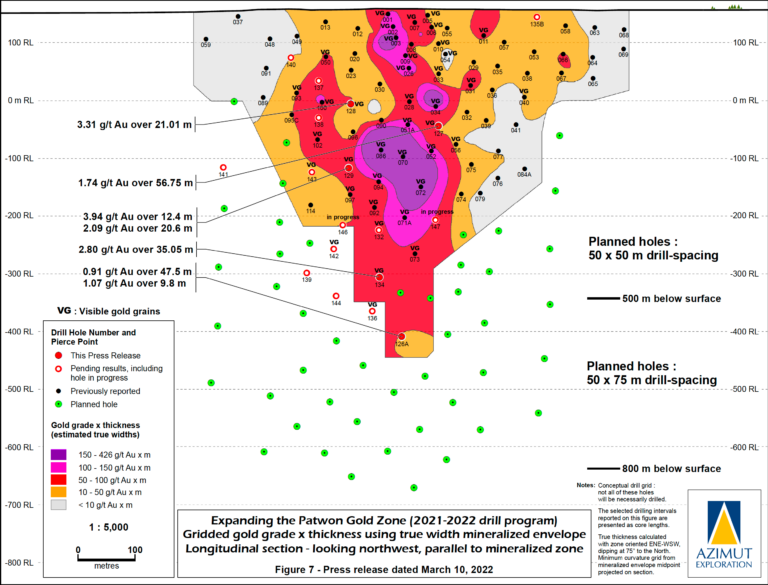

Patwon remains open at depth « with a robust and consistent » core zone, according to the Company, with grade times thickness (GT) factors higher than 50 based on true estimated widths (see Figure 4).

According to Azimut, visible gold at Patwon generally appears to be a reliable predictor for GT factors close to or higher than 50. Of the 18 delineation holes drilled to date, nine have displayed visible gold.

Exhibit 4. A Conceptual Resource Model for the Patwon Deposit.

Source: Azimut Exploration Inc.

Going Forward

The company plans a delineation drilling program structured on a systematic spacing of 50m centres from the surface to 500m depth and a systematic spacing of 50m by 75m centres down to 800m depth. Patwon may likely be open along strike and additional holes will test this.

The company has engaged InnovExplo Inc. to prepare the resource estimate. The current program results will be incorporated into a maiden Mineral Resource Estimate supported by a technical report compliant with National Instrument 43-101.

To date, Azimut has drilled 23 holes for 9,516m, including 18 on Patwon for 8,487m and five on surrounding targets for 1,029m.

Meanwhile, Azimut is in parallel defining prospective targets near Patwon with an extensive reverse circulation drilling (RC) program. To date, 214 RC holes have been drilled through the glacial sediment cover to collect bedrock samples over a structural corridor containing strong gold anomalies in till. A diamond drilling phase is planned to follow up on these results.

For more information, visit the Azimut website at http://www.azimut-exploration.com.

Company Highlights

- Azimut focuses on target generation and partnership development. The company uses a pioneering approach to big data analytics (the proprietary AZtechMineTM expert system) to generate exploration opportunities.

- Azimut’s competitive edge against exploration risk is based on systematic regional-scale data analysis and multiple active projects.

- The company has a strong partnership with SOQUEM (two regional strategic alliances for six gold properties in the James Bay Region and three gold-copper properties in the Nunavik Region). It holds Quebec’s largest mineral exploration portfolio.

- The flagship Elmer Property comprises 515 claims covering 271.3 km2 over a 35km strike length. The property is 285km north of Matagami, 60km east of the village of Eastmain, and 5km west of the paved James Bay Road, a major all-season highway.

- The region benefits from high-quality infrastructure, including significant road access, a hydroelectric power grid and airports

- The company maintains rigorous financial discipline and has kept share dilution to a minimum – only 81.7 mln shares outstanding (87.3 mln fully diluted) as of December 21, 2021.

- Azimut has $30 million working capital and no debt (as of Aug 31, 2021)

- Strong, experienced technical and managerial board to lead to company