Quebec-focused, project generator Azimut Exploration Inc. continues to expand the Patwon Gold Zone while conducting additional exploration in the immediate area and regionally. Azimut has signed 32 strategic alliances and joint-venture agreements with numerous majors and juniors with reportedly aggregate potential investment of $150 million (See Exhibit 1). The most advanced of these projects is Patwon. Azimut has systematically delineated a gold zone along 580m of strike, down to at least 700m depth with an interpreted 35m average width (you do the math!). The zone is steeply dipping and reportedly has no intrusives which would contribute internal dilution.

Exhibit 1. Azimut’s Land Holdings in the James Bay Region of Quebec.

Source: Azimut Exploration Inc.

Azimut recently released results from nine additional holes from Patwon at its wholly-owned Elmer Property in the James Bay Region of Quebec. The results confirm mineralization to at least 700 metres depth with several intervals containing visible gold noted in core from the deepest hole completed to date.

With systematic drilling, Azimut is making solid progress toward delineating a high-grade mineralized zone at Patwon down to at least 700m depth. The company reports that the work will underpin an initial resource estimate.

From the current program, Azimut has drilled 32 holes totalling 15,487m out of a budgeted 20,000m, with the bulk of the work focused on Patwon and the rest on surrounding targets (see Exhibit 2).

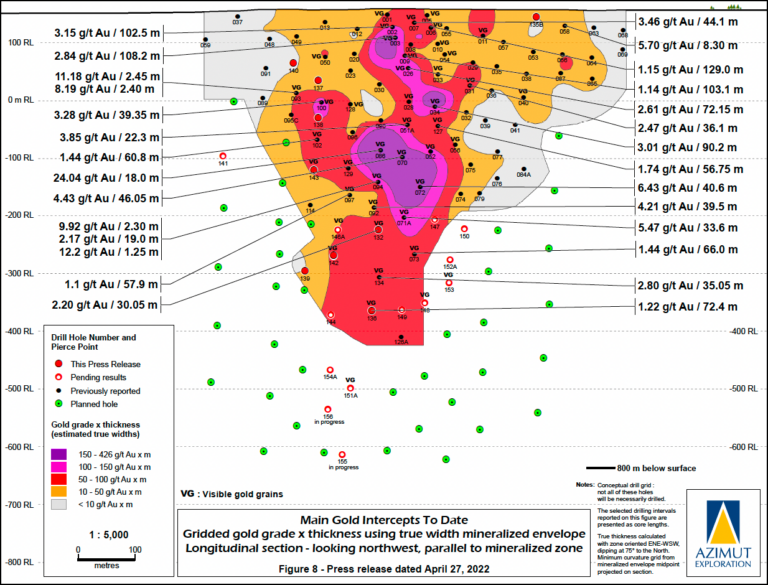

Exhibit 2. Drill Hole Locations and Select Drill Intercepts from the Elmer Property To-Date.

Source: Azimut Exploration Inc.

While drilling continues unabatedly at Patwon, Azimuth’s exploration efforts continue aimed at identifying new zones of mineralization under areas of muskeg. The company drilled 507 Reverse Circulation (RC) holes totalling 6,681m testing down to the bedrock surface. With limited outcrop exposure, the RC drilling is a cost-efficient tool to map and sample the bedrock. The results of this program are expected to form the basis of a summer core drilling program.

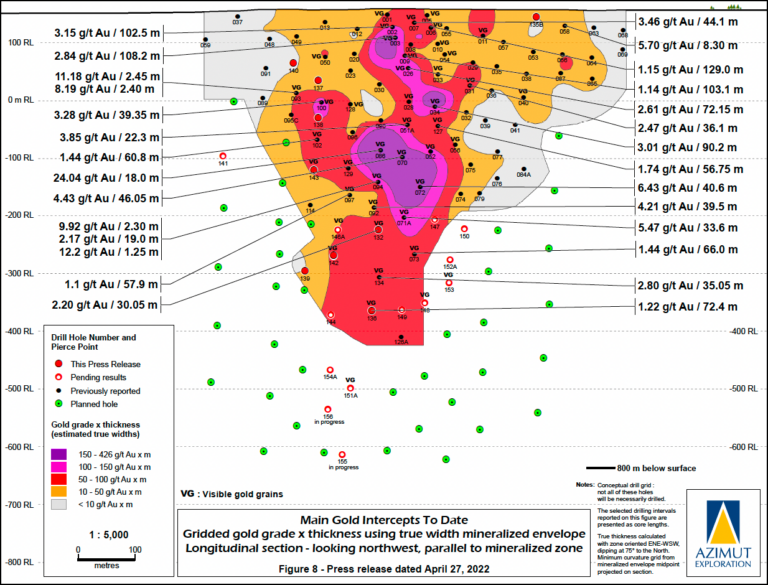

From the recent drilling at Patwon, the deepest hole completed to date, ELM22-151A (ending at 882m), displayed several wide, mineralized intercepts from 732m to 837m (105m along the hole), including numerous occurrences with visible gold grains. Assay results are pending for this hole, but generally visible gold leads to higher assay intervals and according to the company grade (g/t) x thickness (m) (GT) values close to or exceeding 50. Of the 27 delineation holes drilled during the current program, 13 display visible gold grains.

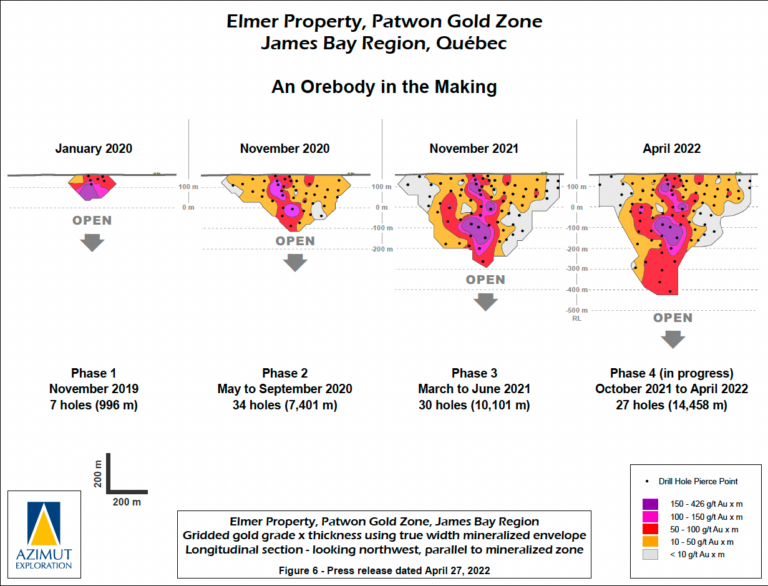

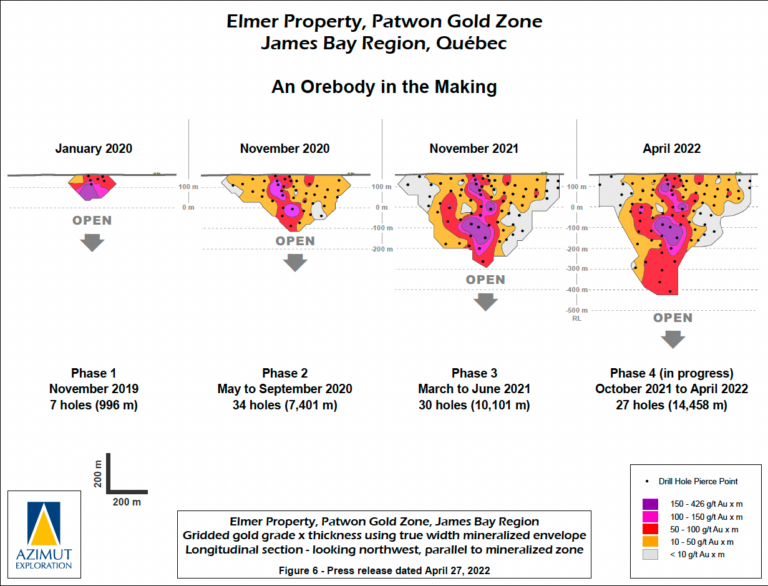

Exhibit 3. The Evolution of the Patwon Gold Zone.

Source: Azimut Exploration Inc.

While results remain pending for hole ELM22-151A, it is a familiar story for several of the company’s previous holes for which results have been received.

Among the highlight results in the latest report were holes:

- ELM22-138 which returned 3.05 grams per tonne (g/t) of gold over 23.0m (from 193.5 to 216.5m), including 4.27 g/t over 5.0m and 5.44 g/t over 7.0m

- ELM22-132 which returned 2.20 g/t over 30.05m (from 459.95 to 490.0 m), including 4.06 g/t over 13.6m and 6.59 g/t over 5.05m

- ELM22-136 which returned 1.22 g/t gold over 72.4m (from 589.4 to 661.8m), including 1.84 g/t over 23.1m and 3.78 g/t over 8.1m

Going Forward

The company plans to continue the delineation drill program structured on a systematic spacing of 50m centres from the surface to 500m depth and a systematic spacing of 50m to 75m centres down to 800m depth. Patwon may be open along strike, and additional holes will test this (see Exhibit 4).

The company has engaged InnovExplo Inc. to prepare the initial resource estimate. The current program results will be incorporated into a maiden Mineral Resource Estimate supported by a technical report compliant with National Instrument 43-101.

Exhibit 4. The Main Patwon Zone Gold Intercepts To Date.

Source: Azimut Exploration Inc.

For more details and drill intercepts from the press release of April 27th, please click here.

For corporate information, please visit the Azimut website.

Company Highlights

- Azimut focuses on target generation and partnership development. The company uses a pioneering approach to big data analytics (the proprietary AZtechMineTM expert system) to generate exploration opportunities.

- Azimut’s competitive edge against exploration risk is based on systematic regional-scale data analysis and multiple active projects.

- The company has a strong partnership with SOQUEM (two regional strategic alliances for six gold properties in the James Bay Region and three gold-copper properties in the Nunavik Region). It holds Quebec’s most extensive mineral exploration portfolio.

- The flagship Elmer Property comprises 515 claims covering 271.3 km2 over a 35km strike length. The property is 285km north of Matagami, 60km east of the village of Eastmain, and 5km west of the paved James Bay Road, a major all-season highway.

- The region benefits from high-quality infrastructure, including significant road access, a hydroelectric power grid and airports

- The company maintains rigorous financial discipline and has kept share dilution to a minimum – only 81.8 mln shares outstanding (87.3 mln fully diluted) as of February 24, 2022.

- Azimut has $25 million in working capital and no debt (as of February 24, 2022)

- Strong, experienced technical and managerial board to lead to company