Azimut Exploration Inc.’s new assay results from seven holes on the Patwon Gold Zone, part of the more significant Elmer Property in the James Bay region of Quebec, appear set to confirm more broad mineralized intersects at the targeted vertical depth of 800m.

The Patwon Zone appears to display remarkable continuity from surface to a minimum vertical depth of 800m (about 900m along dip), where it remains open at depth and possibly along strike. The zone has been outlined over a strike length of nearly 600 metres with an average estimated true width of 35m. The zone is steeply dipping and reportedly has no intrusives, which would contribute to internal dilution – both big positive features for bulk mining!

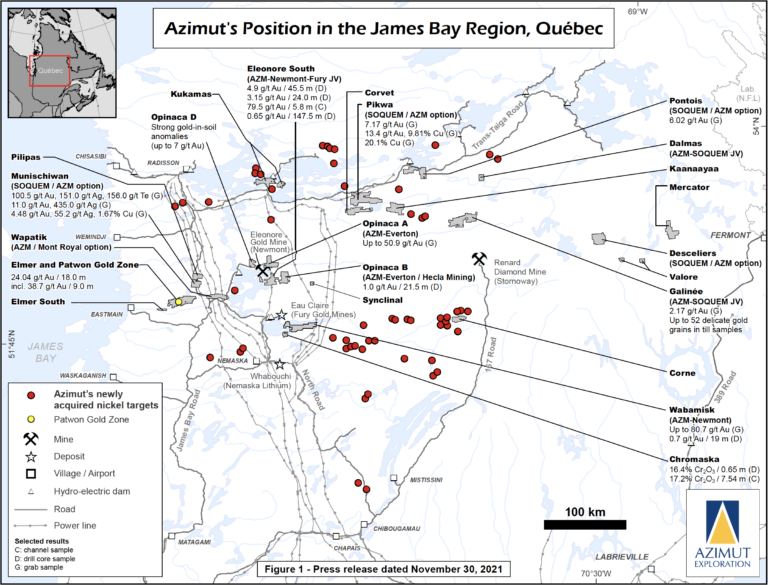

Azimut is a project generator and has signed 32 strategic alliances and joint-venture agreements with numerous majors and juniors with a reportedly aggregate potential investment of $150 million (See Exhibit 1). The most advanced of these projects is Patwon.

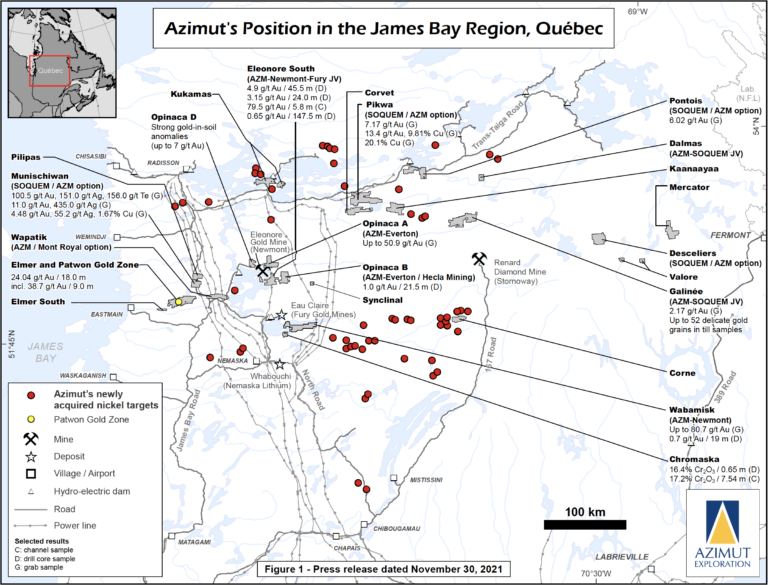

Exhibit 1. Azimut’s Land Holdings in the James Bay Region of Quebec.

Source: Azimut Exploration Inc.

The Significance of the Patwon Intersections

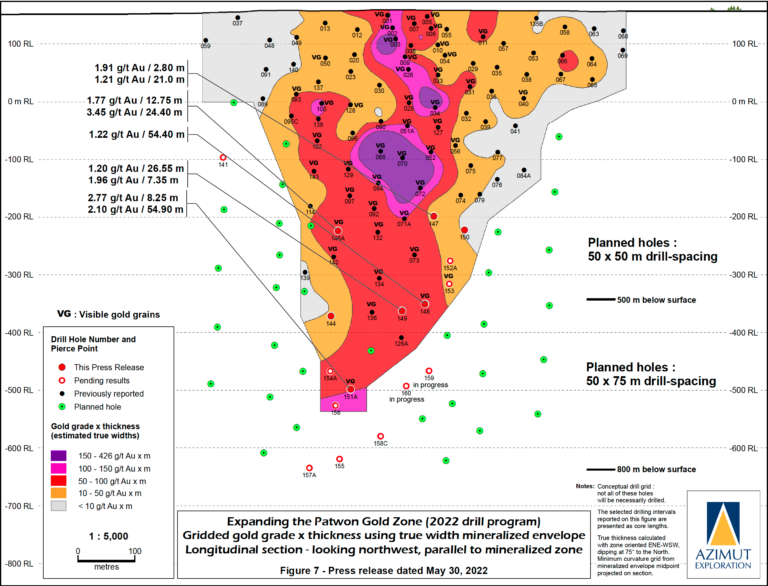

Azimut has, from the outset, planned to drill-test the Patwon Zone to a depth of at least 800m. Azimut has now systematically tested the gold zone along 580m of strike, down to at least 800m depth with an interpreted 35m average width delineating a sizeable mineralized body.

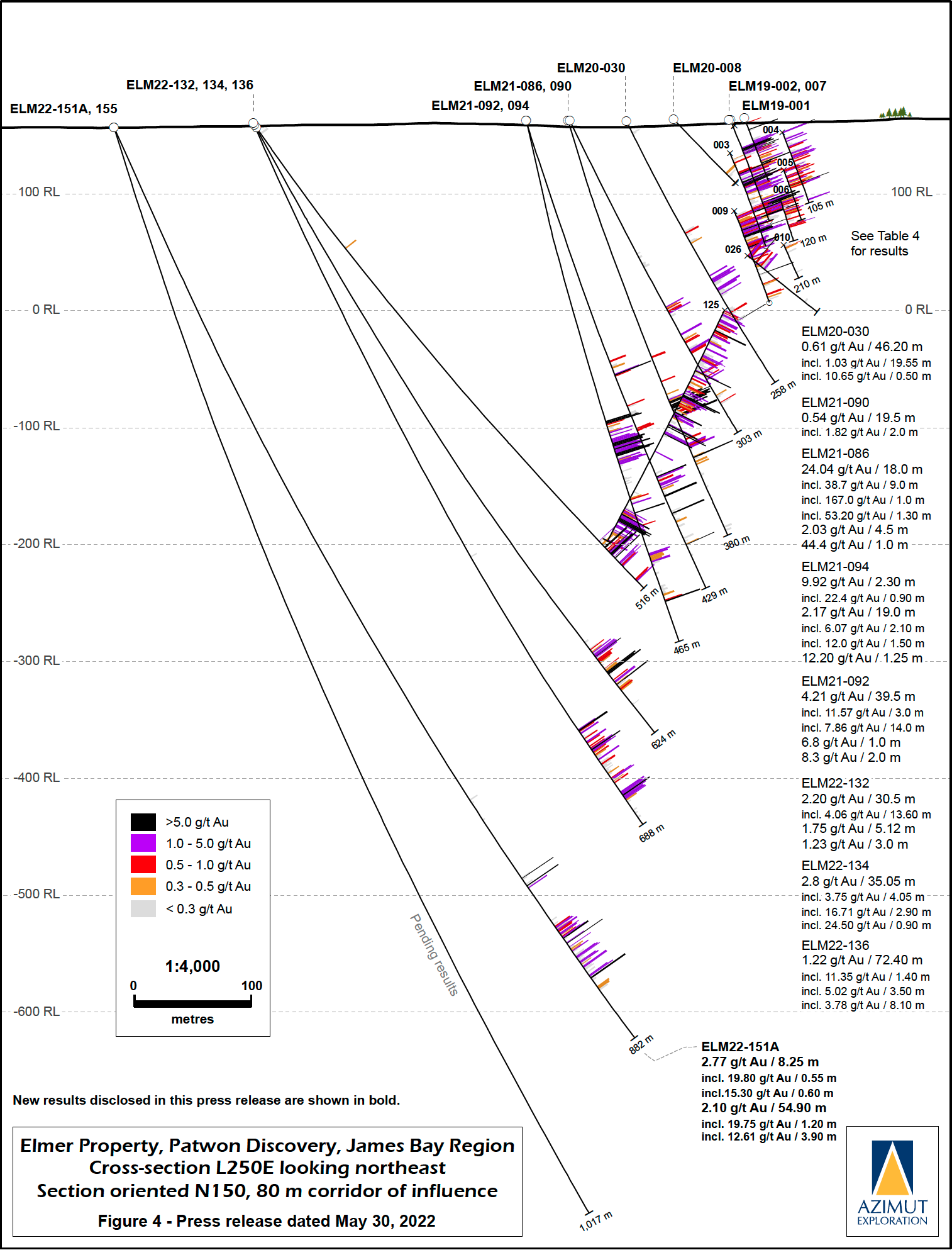

Three holes, namely ELM22-155, -157A, and -158C, had surpassed the 800m depth, demonstrating continued broad intervals below the 800m level with visible gold. Assays remain pending for these deep holes (see Exhibits 2 & 3).

The company’s preliminary observations of the drill core suggest the mineralized body extends to depth.

Additional highlight results Azimuth released were:

- Hole ELM22-151A: 2.77 gram per tonne (g/t) gold over 8.25m (from 732.25 to 740.5m), including

- 19.80 g/t over 0.55m

- 15.30 g/t over 0.60m

2.10 g/t over 54.90m (from 782.0 to 836.9m), including - 19.75 g/t over 1.20m and

- 12.61 g/t over 3.90m

- Hole ELM22-146A: 1.77 g/t over 12.75m (from 429.65 to 442.4m), including

- 10.5 g/t over 0.5m;

3.45 g/t over 24.40m (from 457.7 to 482.10m), including - 15.43 g/t over 4.25m

- Hole ELM22-148: 1.22 g/t gold over 54.40m (from 486.0 to 540.4m), including

- Hole ELM22-149: 1.20 g/t over 26.55m (from 578.45 to 605.0m);

1.96 g/t over 7.35m (from 665.15 to 672.5m), and - Hole ELM22-147: 1.91 g/t over 2.80m (from 348.2 to 351.0m)

1.21 g/t gold over 21.00m (from 392.5 to 413.5m), including

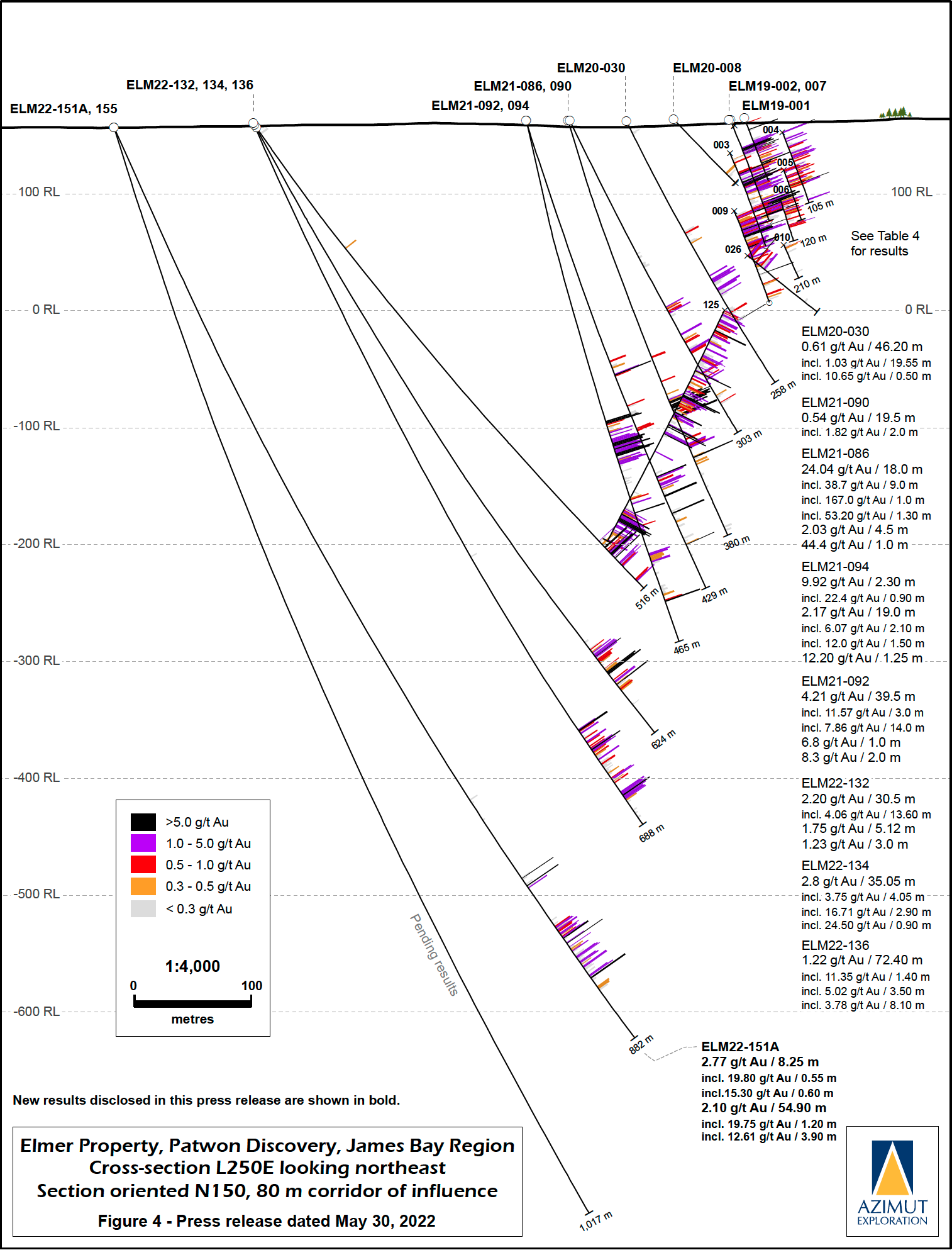

Exhibit 2. Drill Hole Locations and Select Drill Intercepts from the Elmer Property To-Date.

Source: Azimut Exploration Inc.

With systematic drilling, Azimut is making solid progress toward delineating a high-grade mineralized zone at Patwon down to at least 800m depth. The company reports that the work will underpin an initial resource estimate.

Azimut has drilled 36 holes from the current program totalling 19,980m out of a budgeted 20,000m, with the bulk of the work focused on Patwon and the rest on surrounding targets.

Exhibit 3. Patwon Discovery Zone Cross-Section L250E Looking Northeast Showing Hole ELM22-151A.

Source: Azimut Exploration Inc.

Going Forward

Azimut is planning a significant summer core drilling program to test new targets in the vicinity of Patwon to follow up on the 507-hole reverse circulation drilling campaign (for 6,681m) completed earlier this year.

The company considers the discovery potential for additional mineralized zones along strike or subparallel to Patwon as « excellent. »

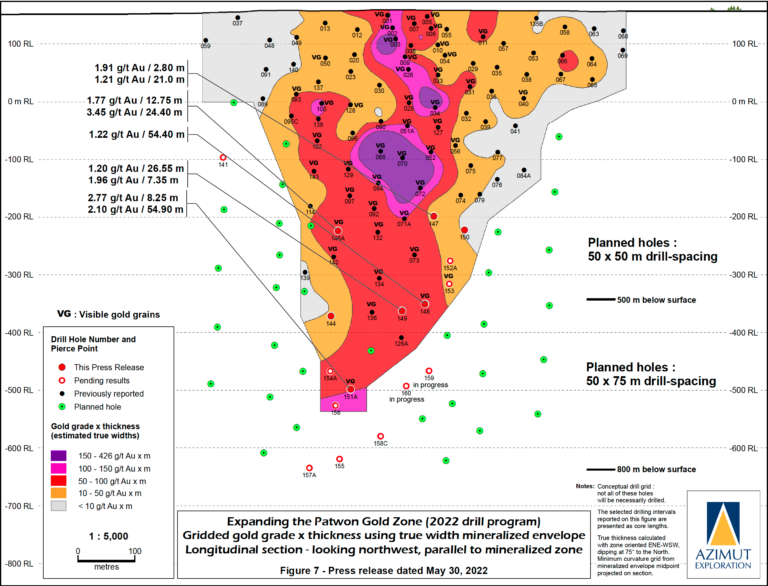

The company plans to continue the delineation drill program structured on a systematic spacing of 50m centres from the surface to 500m depth and a systematic spacing of 50m to 75m centres down to 800m deep. Patwon may be open along strike, and additional holes will test this (see Exhibit 4).

The company has engaged InnovExplo Inc. to prepare the initial resource estimate. The current program results will be incorporated into a maiden Mineral Resource Estimate supported by a technical report compliant with National Instrument 43-101.

Exhibit 4. The Main Patwon Zone Gold Intercepts To Date.

Source: Azimut Exploration Inc.

For more details and drill intercepts from the press release of April 27, please refer to:

https://azimut-exploration.com/wp-content/uploads/2022/05/azimut_pr_20220530.pdf

For corporate information, please visit the Azimut website at http://www.azimut-exploration.com.

Company Highlights

- Azimut focuses on target generation and partnership development. The company uses a pioneering approach to big data analytics (the proprietary AZtechMineTM expert system) to generate exploration opportunities.

- Azimut’s competitive edge against exploration risk is based on systematic regional-scale data analysis and multiple active projects.

- The company has a strong partnership with SOQUEM (two regional strategic alliances for six gold properties in the James Bay Region and three gold-copper properties in the Nunavik Region). It holds Quebec’s most extensive mineral exploration portfolio.

- The flagship Elmer Property comprises 515 claims covering 271.3 km2 over a 35km strike length. The property is 285km north of Matagami, 60km east of the village of Eastmain, and 5km west of the paved James Bay Road, a major all-season highway.

- The region benefits from high-quality infrastructure, including significant road access, a hydroelectric power grid and airports

- The company maintains rigorous financial discipline and has kept share dilution to a minimum – only 81.8 mln shares outstanding (87.3 mln fully diluted) as of February 24, 2022.

- Azimut has $25 million in working capital and no debt (as of February 24, 2022)

- Azimut has a strong, experienced technical and managerial board to lead to company