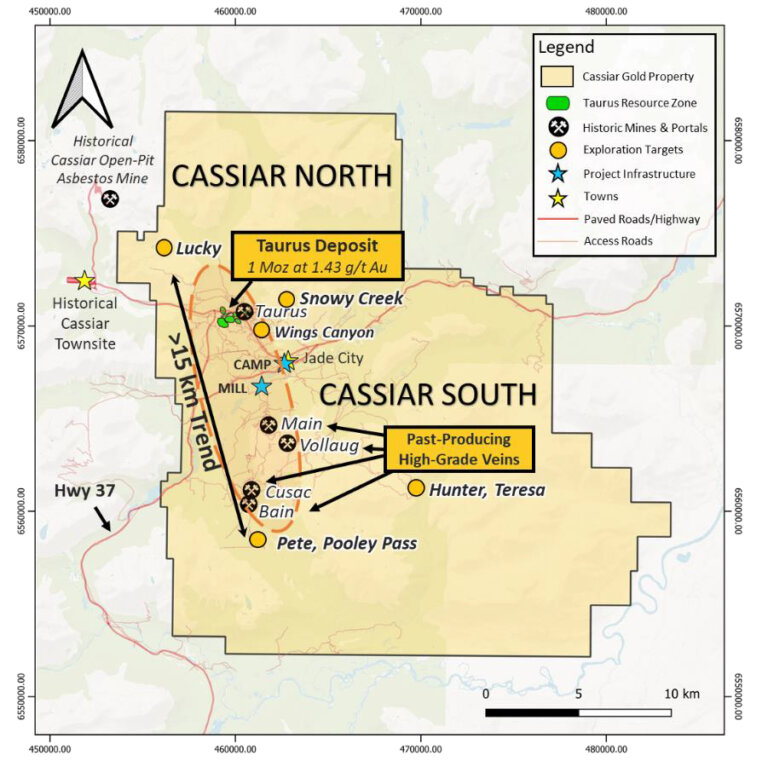

Cassiar Gold reported bonanza grade drill results from its cornerstone Cassiar gold property 115 km south of Watson Lake, British Columbia. Cassiar holds a 100% interest in 59,000 ha of ground encompassing two known gold occurrences. Cassiar North hosts a bulk-tonnage potential deposit and Cassiar South is a high-grade, structurally controlled, quartz vein system.

The drill results released on October 12 comprise assay results for six of a planned 21-hole program at the Cassiar South project area, which hosts a swarm of high-grade quartz vein targets associated with several historical underground mines. All six holes were completed at the Bain vein target, testing lateral and down-dip extensions of the previously mined vein.

Among the highlight intercepts was 35.1 g/t gold over 4.8m including 105.0 g/t gold over 0.50m and 270 g/t gold over 0.4 metres at 183 m depth in hole 21EB-300. (see Exhibits 1 and 2).

Exhibit 1. Location Map of the Cassiar Gold Property in British Columbia

Source: Cassiar Gold

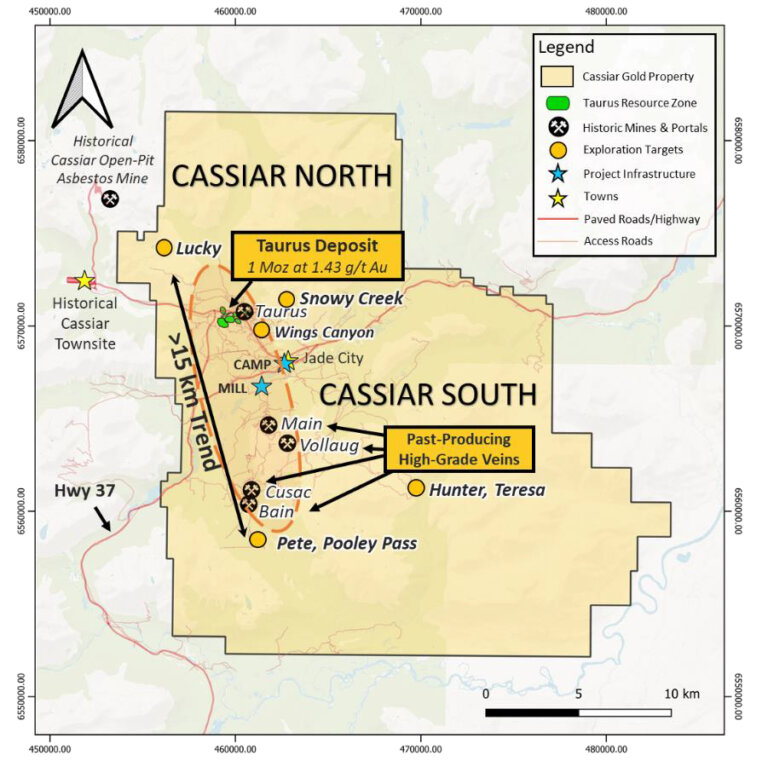

Exhibit 2. Plan Map of the Cassiar Gold Property Showing Priority Exploration Targets

Source: Cassiar Gold Corp.

According to Cassiar, the first-pass drill results confirm the former mine’s high-grade nature and associated quartz vein thicknesses.

Hole 21EB-300 was drilled roughly 160m from historical mine workings in the East Bain Deposit. The hole appears to confirm both the high-grade nature and associated quartz shear vein thicknesses of the historical Bain Mine and increases the extent and confidence in the high-grade continuity of the unmined portions of the vein system to the east (see Exhibit 3).

Another hole, 21EB-301, intersected 12.6 g/t gold over 6.4m, including 85.4 g/t gold over 0.8m and 25.7 g/t gold over 2.95m from 143.8m to 150.1m downhole. This hole was drilled about 180m away from historical mine workings between two historical drill holes 30m apart and further supports the continuity of high-grade, gold mineralization.

Exhibit 3. Diamond Drill Results to Date for Bain Area, Cassiar South.

Source: Cassiar Gold Corp.

The Significance

Cassiar’s early success at East Bain suggests the potential of a significant gold endowment and demonstrates the company’s ability to effectively target these vein systems with surface drilling.

The Cassiar South gold mineralization is typical in the style of orogenic gold systems globally. The company believes it has similarities in style and setting to the high-grade Beta Hunt Mine in Western Australia and closer to home, the Barkerville Mine in British Columbia.

The project has comparable epizonal, gold-sulphosalt mineral assemblages in high-grade veins, also present in Newfound Gold’s Keats Zone and at Fosterville in Victoria.

We believe the potential exists for discovering additional parallel, and stacked, high-grade shear veins and vein systems through exploration over the more than 10km-long trend in the central parts of the Cassiar property.

The company is also in the unique position of having near-term production potential at Cassiar South. There is underground access close to the veins, and permits are already in hand, providing several options to advance the project. In addition, the property has a permitted 300 tpd mill with gravity and flotation circuits. Access is easy as Hwy 37 transects the property.

The historical Bain and Cusac mines together produced 114,000 oz of gold, grading more than 15 g/t gold.

Next Steps

Cassiar Gold plans to return to the East Bain target to drill two follow-up, down-dip holes at the end of the current drill campaign based on the significant exploration results. Results are pending for three more holes, two of which were drilled 450m east of the Bain Mine workings.

Over 6,000m of drilling in 15 holes have been completed to date at Cassiar South, and two drill rigs continue to test high-grade targets until the end of October.

In September, Cassiar Gold provided an update on the ongoing drill program. It has completed an expanded 15-hole campaign on Cassiar North in mid-August, for which results remain pending.

Cassiar North hosts the Taurus near-surface, bulk-tonnage NI 43-101-compliant Inferred Mineral Resource of one million ounces gold grading on average 1.43 g/t.

The company has deferred part of the 15,000m campaign to early 2022 after reporting slower-than-expected drilling and laboratory assay turnaround times.

Cassiar Gold now expects to complete between 12,000 to 14,000m of drilling this season, with drilling at Cassiar South expected to total between 8,000 to 10,000m in 18 to 22 holes to test the lateral and down-dip extensions of known or previously mined high-grade veins.

For complete information, please visit the company’s website at cassiargold.com.

Company Highlights

- Holds projects in two important orogenic gold districts in British Columbia.

- The flagship Cassiar Gold project in Northern BC

- 100% owned 59,000 ha property with +15km strike of gold targets

- Site of historic Cassiar placer gold rush from 1874-95 which produced more than 74,000 oz placer gold

- Cassiar North hosts an NI 43-101 Inferred Resource Estimate of +1Moz gold grading on average 1.43 g/t with significant resource expansion potential

- Cassiar South hosts multiple high grade (+15 g/t gold) vein targets with access from 25km of underground workings; past production of about 350,000oz from 1979-98

- Excellent infrastructure with permitted 300 t/d mill (gravity/flotation), Highway 37, property access roads, permanent camp, water

- Sheep Creek in Southeast British Columbia

- 3rd largest past-producing orogenic gold district in BC

- Historical gold production (1899-1951) of 736,000 oz gold grading on average 13 g/t

- Excellent exploration potential but not prioritizing for 2021

- Experienced leadership team

- Tightly held share structure; $5.6 million treasury as of October 8, 2021