Since the April budget we have been actively alerting both the charity and resource communities about the potentially devastating impact of the new Income Tax Act changes to the Alternative Minimum Tax (AMT) rules coming into force on January 1, 2024. These rules are hard to understand and apply differently depending on circumstances. The legislation is now tabled and unless walked back in whole or part will have significant negative impact on both charitable fundraising and independently on resource exploration investment. Bobby Kleinman will again provide his insights and lead a discussion among well informed insiders about these new rules. This webinar will provide common examples of the impacts, some potential one-time 2023 mitigating strategies and a primer on messaging if reaching out to members of Parliament.

Featuring Robert (Bobby) Kleinman, Troy McEachren, Partner, Miller Thomson & Brian Ernewein, Senior Advisor, KPMG and previous General Director of Tax Legislation, Federal Department of Finance, and moderated by PearTree Canada Founder & CEO, Ron Bernbaum.

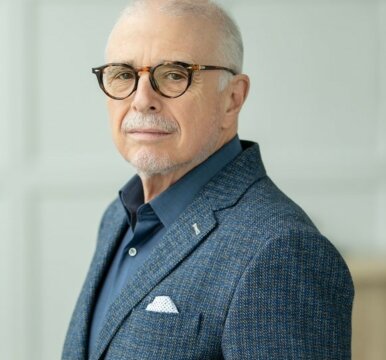

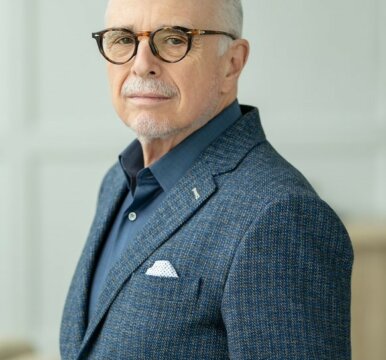

| Robert (Bobby) Kleinman FCPA, FCA. Bobby started in philanthropy in August of 1994 by becoming the Executive Director of the Jewish Community Foundation of Montreal (JCF) which is seen to be Canada’s most donor-centred foundation. Previously a Partner in Taxation at Ernst and Young, he is now a Planned Giving Consultant specializing in tax-assisted giving. Bobby has helped many Canadian charities design their planned giving programmes, and has written numerous articles on the subject. He is also Past-President of the Conseil de la Philanthropie du Quebec, the Table Ronde du Quebec of the CAGP, JIAS Canada, JIAS Montreal, and the Mount Royal Tennis Club. |

|

|

Troy McEachren An experienced estate and trust lawyer. Troy focuses his practice on tax and estate planning, family business succession planning, wills and trusts, and corporate reorganizations.

Troy provides counsel to private clients, businesses, investment groups, trust companies, and philanthropists and also advises institutional and individual trustees and fiduciaries in the estates, trusts, tax planning, and charities areas. Troy is often involved in multijurisdictional legal and tax issues.

In addition, he is recognized as a leading expert on charities and not-for-profit organizations. Troy provides tax and corporate advise on a wide range of issues including relations with tax authorities, corporate governance, planned giving, commercialization activities and social enterprise. Troy is asked to speak regularly throughout the country on issues related to charities, NPOs and planned giving. |

|

|

Brian Ernewein A Senior Advisor at KPMG in Canada’s National Tax Centre, with over 35 years of experience in the Tax Policy Branch of the Canadian Department of Finance. Within the Department of Finance, Brian served as the General Director (and latterly, Assistant Deputy Minister) for Tax Legislation. He was also Canada’s representative to the OECD’s Committee on Fiscal Affairs, serving between 2013 and 2020 as a member and Vice-Chair of the CFA Bureau and the Steering Group of the Inclusive Framework. As such, he was heavily involved in the development of both the BEPS Action Plan as well as the ongoing OECD-led work on Pillars One and Two. Brian’s work includes assessing the impact of current OECD-led work on digital taxation and a global minimum tax, working closely with KPMG’s Global Tax Policy team. Brian also provides advice on tax policy implications for Canadian multinationals and industry groups of current and proposed Canadian tax legislation, such as the pending interest deductibility legislation, and possible changes to the general anti-avoidance rule. |

|

|