Fury Gold Mines (Fury) is a newly-formed, Canadian-asset focussed, exploration and development company cooking with three flagship Projects. The meat is the flagship Eau Claire Project located in the Eeyou Istchee Territory in the James Bay region of Quebec with an established Resource and massive land package. The Spice is the return to exploration on the Homestake Ridge Gold Project. To-date, a high-grade polymetallic (gold-silver-copper) Resource has been defined at Homestake Ridge and a Preliminary Economic Assessment (PEA) was completed this year. The sizzle is served up with the earliest-stage exploration Project of the three flagships, the Committee Bay Project in Nunavut, where Fury controls a 300km-long prospective belt hosting the high-grade Three Bluffs Deposit.

The three projects mentioned above form the core of Fury’s aggressive 18-month exploration plan, expected to tally more than 80,000m of drilling. The planned drilling is broken up as follows:

- >50,000m at Eau Claire – two rigs currently on-site for Deposit expansion and exploration drilling

- >20,000m at Homestake focused on definition and resource expansion (expected to begin mid-July 2021)

- >10,000m at Committee Bay (expected early-July 2021)

Combined, in situ gold Resources for the three flagship project tally 1.543mln Measured and Indicated ounces and 2.037mln Inferred ounces – Project Mineral Resource Estimates (MRE) are outlined further in ‘Company Highlights’.

On top of starting with strong assets, Fury begins well-funded after officially launching this past October 2020. The launch followed the completion of Auryn Resources Inc.’s (AUG-TSX) acquisition of Eastmain Resources Ltd. (ER-TSX). Part of the re-arrangement involved spinning off Auryn’s Peruvian assets and the outcome is a Canadian-asset focussed Company. Upon completion of the Fury Gold formation transaction, net proceeds from the previously completed C$23mln financing were received. Management reports there are enough funds for at least >50,000m of drilling at Eau Claire and 12 months of working capital.

The 18-Month Exploration Plan Begins with Eau Claire

By design, the 18-month plan is expected to result in steady news flow and it begins with the Eau Claire Project where drilling is ongoing (first assay results are expected in the new year). Two rigs are on-site, one is infill drilling the Southwest Margin of the Eau Claire Deposit (announced on Nov. 9, 2020) and the other is exploration drilling a 1km down-plunge extension of the Eau Claire Deposit (announced on Nov. 25, 2020).

The current MRE for the high-grade Eau Claire Deposit (853,000 ounces gold (oz Au) Indicated and 500,000 oz Au Inferred – details below) defines open pit Resources as being down to 150m depth (comprising 27% of Measured and Indicated Resources) and underground Resources from 150m to 860m.

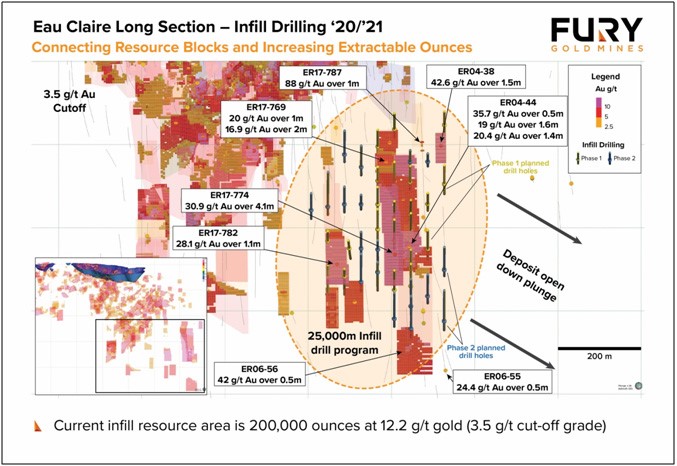

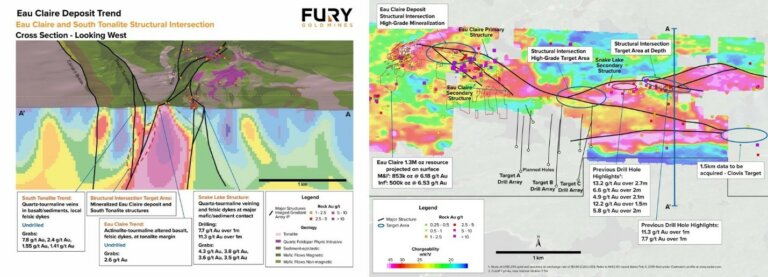

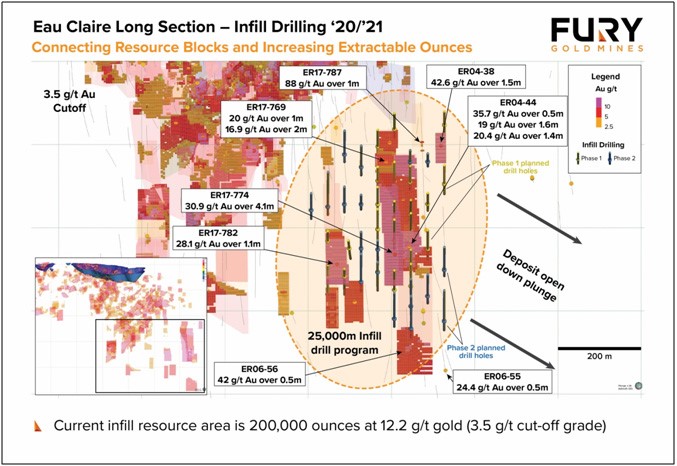

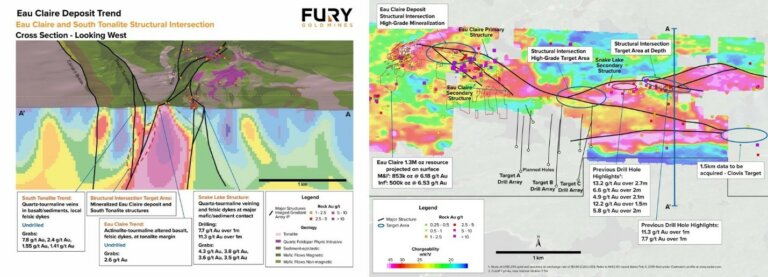

Selective infill drilling at the southeast margin of the Deposit is expected to tally ~25,000m and could result in new accretive ounces and the possible conversion of Inferred Resources to the higher-confidence Indicated Category (Exhibit 1). As noted by Fury, the infill area being targeted is currently estimated to contain 200,000 ounces grading 12.2g/t gold in the Inferred Category (3.5g/t gold cut-off grade).

Exhibit 1. Eau Claire Long Section with Infill Target Area Highlighted

Source. Fury Gold Mines Ltd.

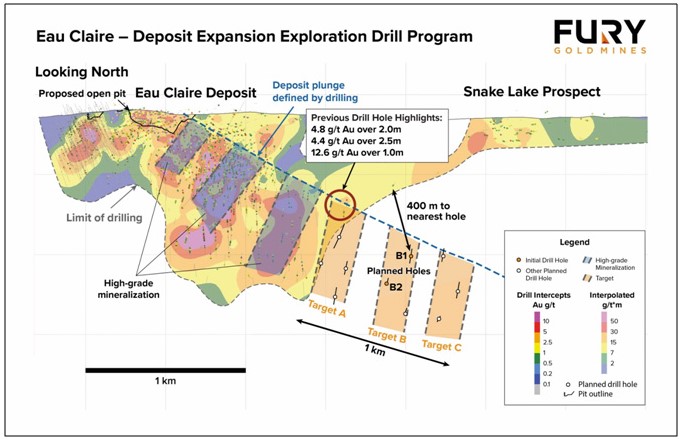

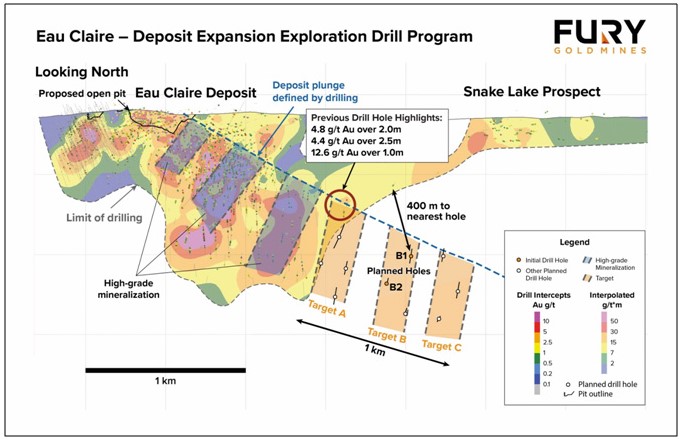

The second rig in the +50,000m Eau Claire drill program is after scale and is expected to test a potential 1km down-plunge extension of the Eau Claire Deposit with ~12,000m of drilling. To this effect, the step-outs have been constrained to three target areas over the 1km-long extension – Target Areas A, B and C (Exhibit 3). The first holes of this phase of the exploration drilling are expected to be planned Holes B1 and B2 within the Target B Area. The Target B area is situated between 500m and 700m down-plunge from the limit of the existing Eau Claire Resource and between 400m and 700m down-dip from the nearest historical drill hole. Target A and Target C are located up-plunge and down-plunge from Target B, respectively (Exhibit 2). Positive intersections down-plunge could be followed by an infill program to establish continuity. We note the presently-defined Eau Claire Deposit mineralization has shown good continuity.

Target Details:

- Target A – Historical mineralization is associated with quartz-tourmaline veins and secondary shear zone alteration

- Target B – Possible intersection of the primary shear zone (Eau Claire Deposit Structure) and secondary shear zones (Snake Lake Structure) Similar structural intersections at the Eau Claire deposit have been associated with high-grade mineralization.

- Target C – Also situated along the same structural intersection of the Snake Lake and Eau Claire Structures

Exhibit 2. Exploration Targets A, B and C

Source. Fury Gold Mines Ltd.

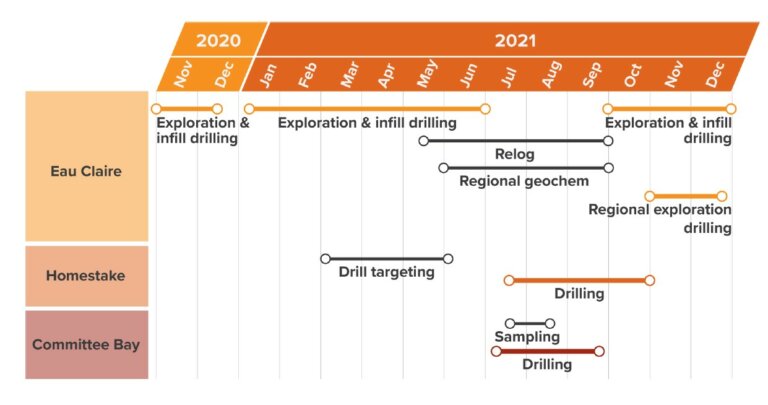

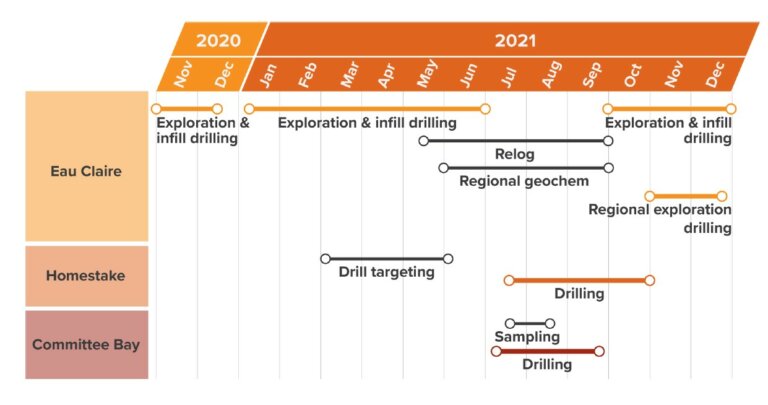

The 18-Month Plan

With exploration kicked off on Eau Claire we expect steady action over the ensuing months through 2021 as outlined in the timeline from Fury’s latest corporate presentation (Exhibit 3). The spread-out exploration approach ensures consistent news exposure and keeps investor interest piqued. The staggered exploration between the three flagship projects also allows for proper data analysis in between surveys and projects. We note a re-log and regional geochemical survey is planned between drilling phases at Eau Claire. Starting at Eau Claire also allows for proper drill targeting at Homestake.

Breakdown of planned drilling:

- Eau Claire Project – Two rounds of drilling planned

- Nov 2020 to End of June 2021 – exploration and infill

- Oct 2021 to December 2021 – exploration and infill + regional exploration drilling

- Homestake

- Mid July 2021 to end of Oct 2021

- Committee Bay

- Early July 2021 to Late September 2021

Exhibit 3. 18-Month Exploration Schedule

Source. Fury Gold Mines Ltd.

Key Project Backgrounds

Below we provide more details on Fury’s three flagship projects and discuss some of the exploration upside they have.

The Eau Claire Project

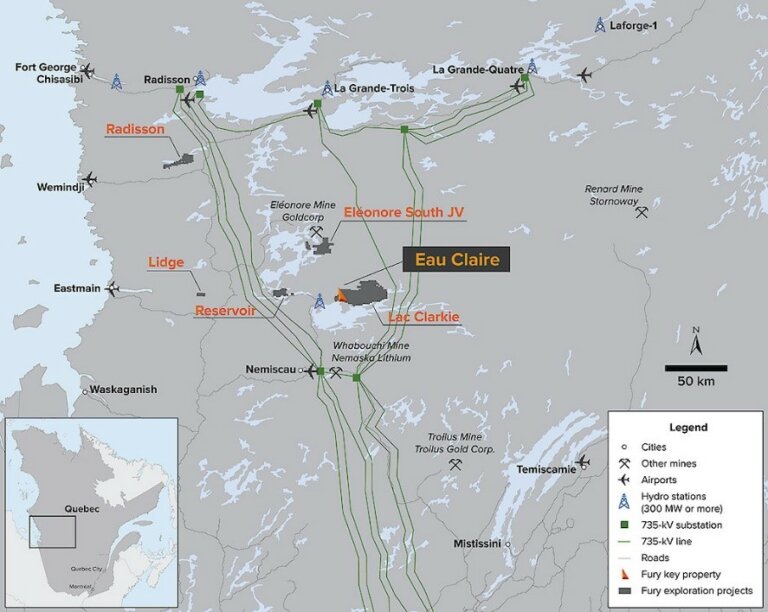

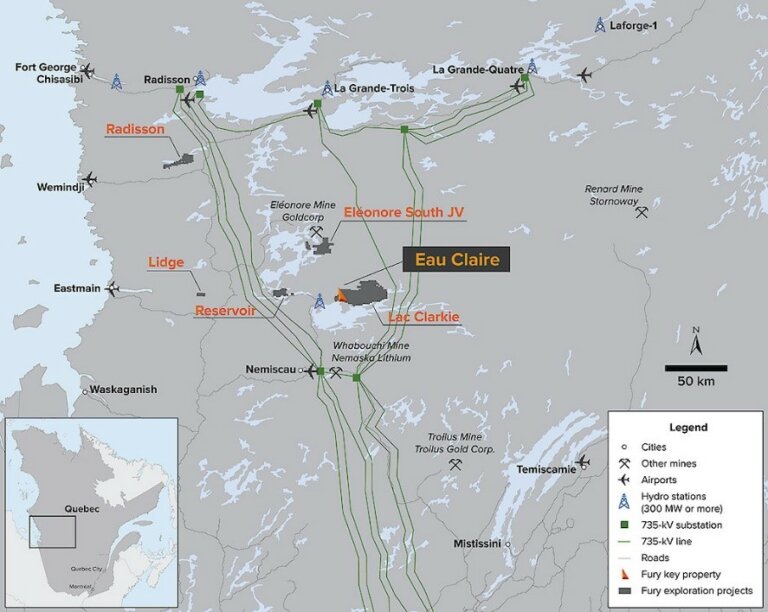

Location and Infrastructure

The wholly-owned, +24km2 Eau Claire Project is located in the Eeyou-Istchee/James Bay Region of Quebec. The Newmont-owned (NGT-TSX) Eleonore Mine, and accompanying mine-supporting infrastructure, is only 57km to the north (Exhibit 4). The Project’s exploration base camp is 5km form the permanent road network and the Eau Claire Deposit is ~2.5km from a Hydro Quebec service road. Potential clean power is found ~10km to the northeast with Hydro Quebec’s EM-1 hydroelectric power facility.

Exhibit 4. Eau Claire Project Location and Infrastructure (note Eleonore South JV to the Northwest)

Source. Fury Gold Mines Ltd.

Latest Technical Reports

A Mineral Resource Estimate and Preliminary Economic Assessment (PEA) were completed in 2018. A Deposit advantage is the high-grade Open-Pit Resources which could be a potential stepping off point before envisioned underground operations.

For the MRE1, Open-Pit and underground were estimated at the following:

- Open-pit Resources (surface to 150m depth)

- Measured and Indicated Resources: 1.210mln tonnes (Mt) averaging 5.86g/t gold for 228,000 contained ounces gold (oz Au)

- Inferred Resources: 0.043Mt averaging 5.06g/t gold for 7,000 contained oz Au

- Underground Resources (150m to 860m depth)

- Measured and Indicated Resources: 3.084Mt averaging 6.30g/t gold for 625,000 contained oz Au

- Inferred Resources: 2.339Mt averaging 6.56g/t gold for 493,000 oz Au

1-Key MRE assumptions: Open pit cut-off grade (COG) of 0.5g/t gold within a conceptual pit shell. Underground Mineral Resources COG of 2.5g/t gold. Assumed gold price of US$1,250 per ounce, a foreign exchange rate of US$0.80, and a gold recovery of 95%. For details, see the relevant technical report.

Highlights from the 2018 Eau Claire PEA2 :

- After-tax Net Present Value using a 5% discount rate (NPV(5%))= C$260mln

- After-tax IRR = 27%

- Estimated Life-of-Mine (LOM) = 12 years (3 years open pit and 10 years underground)

- LOM Production = 951,000 oz Au

- Production Rate = 79,000 ounces gold per year

- Total Capex = C$283mln

- Diluted Grade: 3.78g/t gold Open Pit; 5.24g/t gold underground

- Estimated Mill Gold Recovery = 95%

2-Key PEA assumptions: Open pit COG of 0.5g/t gold within a conceptual pit shell. Underground Mineral Resources COG of 2.5g/t gold. Assumed gold price of US$1,250 per ounce, a foreign exchange rate of US$0.80, and a gold recovery of 95%. For all details, see the relevant technical report.

Geology and Mineralization

The high-grade, structurally-controlled Eau Claire Deposit is located on the south limb of an antiform (a convex-up fold). The Deposit straddles felsic volcaniclastic rocks and overlying mafic volcanic rocks. Gold mineralization is characteristic of Archean, Greenstone-hosted, quartz-carbonate vein deposits and is locally hosted in a series of broadly east-west-trending, sheeted, en-echelon quartz-tourmaline (QT) veins. Gold mineralization is also found in east-southeast-trending, gold-bearing alteration zones comprising amphibole-biotite-chlorite mineralization. The QT veins are grouped in two differently-oriented vein sets (known as the 450W and 850W Zones) which form a crescent-shaped body ~100m wide by 1.8km in lateral extent by 900m vertical depth.

Exploration Upside

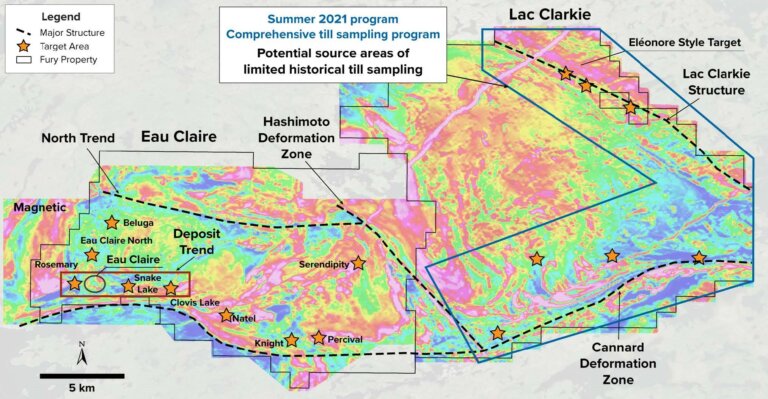

There is plenty of upside beyond the Eau Claire Deposit. With the help of a new Gradient IP survey, multiple intersections of prospective deep structures have been identified. The intersection of the 7km-long Eau Claire Trend and the Snake Lake Structure is viewed as highly prospective in terms of a potential repeat of the Eau Claire Deposit’s structural setting.

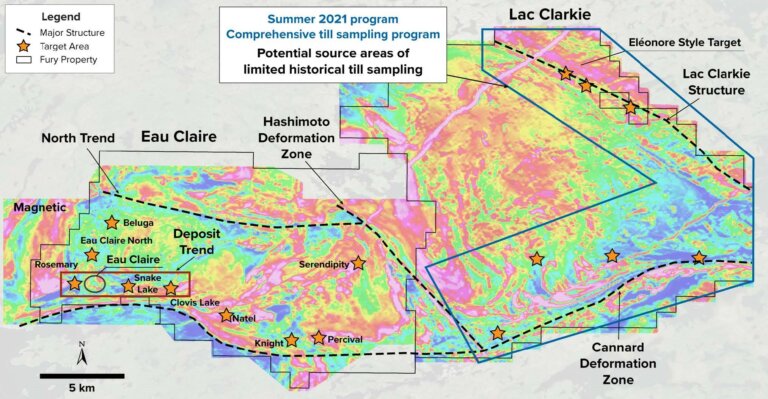

Exhibit 5. Prospective Structures and Trends near the Eau Claire Deposit

Source. Fury Gold Mines Ltd.

Other early-stage exploration opportunities include the Project’s 30km of the Cannard Deformation Corridor, the ‘North Trend’ to the north of the Eau Claire Trend and the Lac Clarkie Block to the East. The regional Cannard Deformation Zone runs through the Property and hosts several showings with gold-quartz-tourmaline mineralization including Knight, Natel and Clovis (Exhibit 6). On the North Trend, gold-bearing quartz-tourmaline veins were identified but the area is under-explored. To the east, historical till sampling outlined multiple targets in the Lac Clarkie Block. More exploration targets could be generated by a comprehensive till sampling program expected in Summer 2021.

Exhibit 6. Regional Exploration Opportunities

Source. Fury Gold Mines Ltd.

Homestake Ridge

Location and Infrastructure

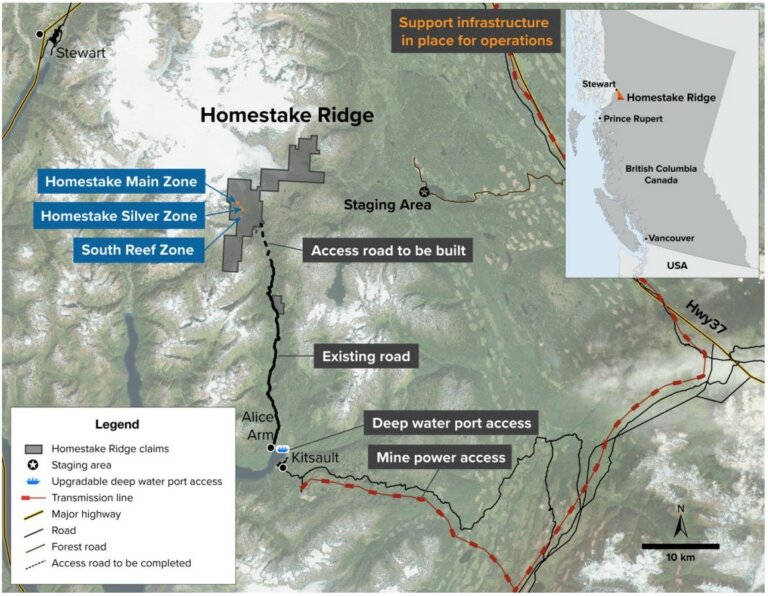

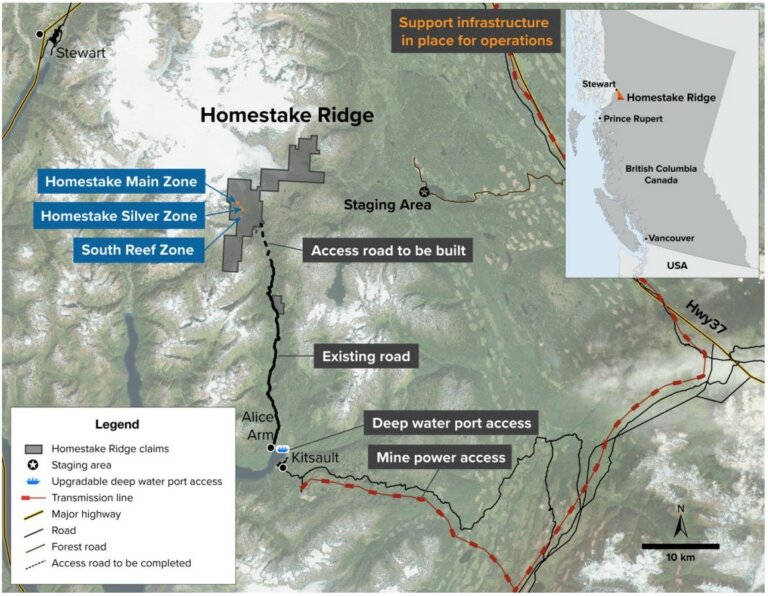

The 75km2 Homestake Ridge Project is located within the Iskut-Stewart-Kitsault Belt in Northwest British Columbia. The Project is 32km southeast of Stewart and 32km north of the historic mining towns of Kitsault and Alice Arm. Access is currently via boat (or barge) from Kitsault to Alice Arm and then by service roads that reach 6km from the Deposit.

Exhibit 7. Homestake Ridge Location and Infrastructure

Source. Fury Gold Mines Ltd.

Technical Reports

Before the completed merger, Auryn filed an amended and restated technical report for the Homestake Ridge Project dated June 24, 2020. The report comprised a PEA and a MRE update. A potential underground mining scenario was employed for the PEA with a COG of 2.0g/t gold equivalent (AuEq).

The main gold-silver-copper zones of the Homestake Ridge Deposit are:

- Homestake Main (HM) – Most copper-rich zone but gold and silver are present. Possible trend of increasing copper grade with depth.

- Homestake Silver (HS) – Very little copper, relatively higher in silver content

- South Reef (SR) – Comprised of two narrow, sub-parallel tabular bodies dipping 70 to 80 degrees.

The Homestake Deposit Zones are commonly vertically zoned with precious metal rich tops and silver-rich base metal bottoms over a vertical range of 250m to 350m.

Key MRE and PEA Base Case3 Highlights (amended June 24, 2020):

- The MRE:

- Total Indicated Resources: 0.736Mt grading 7.02g/t gold, 74.8g/t silver and 0.18% copper for contained metal of 165,993 oz Au, 1.8mln ounces silver (Moz Ag) and 2.87mln pounds copper (Mlbs Cu)

- Total Inferred Resources: 5.545Mt grading 4.58g/t gold, 100.0g/t silver and 0.13% copper for contained metal of 816,719 oz Au, 17.8Moz Ag and 15.87Mlbs Cu

- PEA Highlights:

- After-tax NPV(5%) = US$108mln

- After-tax IRR = 23.6%

- Pre-production capital costs = US$88mln

- After-tax Payback Period = 3 years

- All-in-sustaining-costs (AISC) per ounce = US$670

- PEA life of mine (LOM) = 13 years

- LOM metal production gold equivalent ounces = 590,040 AuEq ounces

- LOM average diluted head grade = 6.42g/t AuEq

- Mining scenario of 900 tonnes per day

3-Key Base Case assumptions: Gold price of US$1,350/oz, silver price of $12/oz, copper price of $3.00/lb. A USD/CAD exchange rate of 0.70 was used.

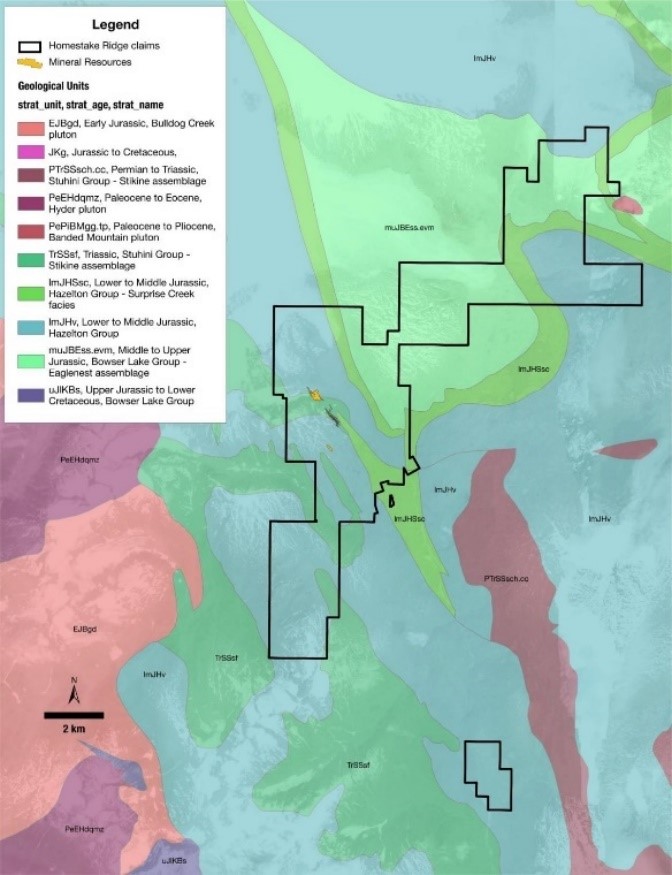

Geology and Mineralization

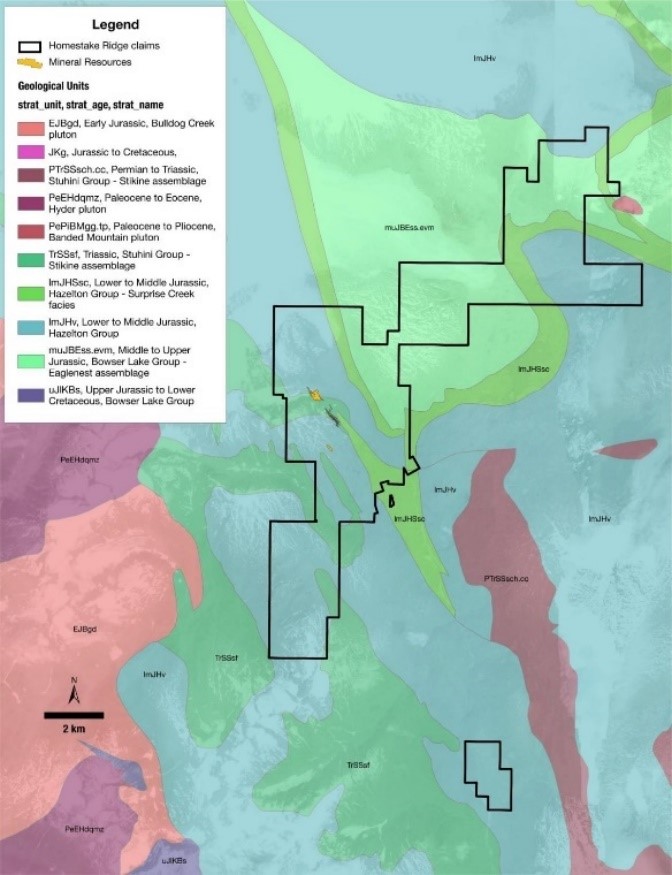

The Homestake Ridge Gold Project lies within the metallogenic region known as the Stewart Complex. The Project covers the transition between the sedimentary and volcanic rocks of the Upper Triassic to Lower Jurassic Stuhini Group. In the northern portion of the Project, felsic volcanic rocks occur at the base of the Salmon River sediments and in the eastern portion of the Project hosts the Middle-to-Upper Jurassic-aged Bowser Basin Group which conformably overlies the thin bedded graphitic argillites of the Salmon River formation (Exhibit 8).

There are multiple styles of mineralization including stratabound sulphide zones, stratabound silica-rich zone, sulphide veins and disseminated or stockwork sulphides. Mineralization is related to Early Jurassic-aged sub-volcanic intrusion and felsic volcanism, and commonly is associated with pyrite and sericite alteration.

Exhibit 8. Homestake Ridge Project Geology

Source. Fury Gold Mines Ltd.

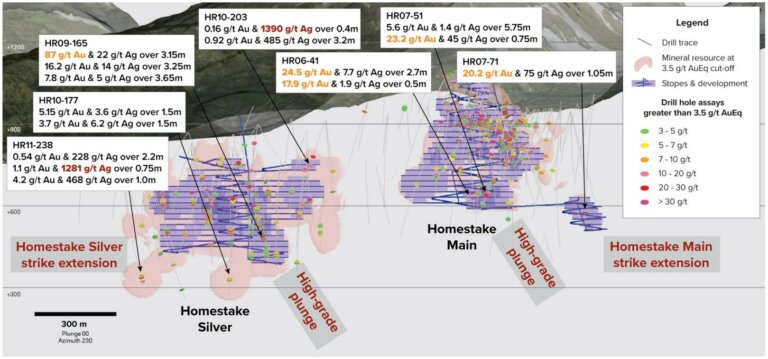

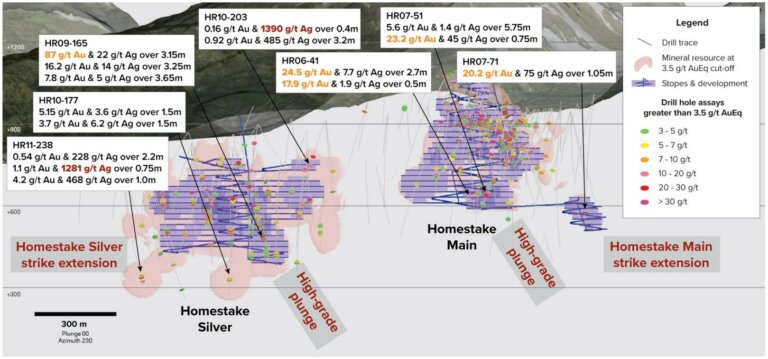

Exploration Upside

A return to exploration has been planned for Homestake. In 2021, we expect a focus on expanding the Homestake Deposit at depth and laterally. Given the large Inferred Resource, we see potential to upgrade Resources to the Indicated Category. Additionally, potential Resource accretion could come from targeting the plunge-extensions of high-grade breccia and vein sets found at the Deposit.

Exhibit 9. Homestake Expansion Potential

Source. Fury Gold Mines Ltd.

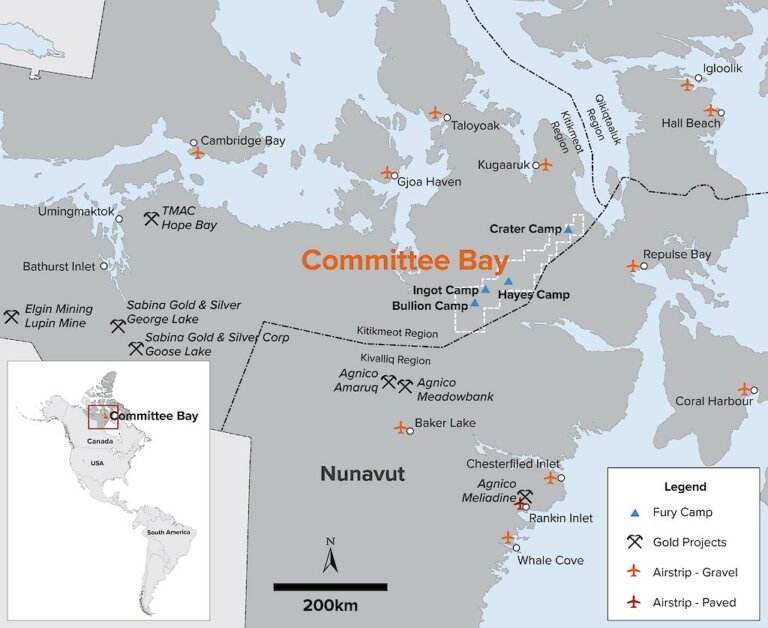

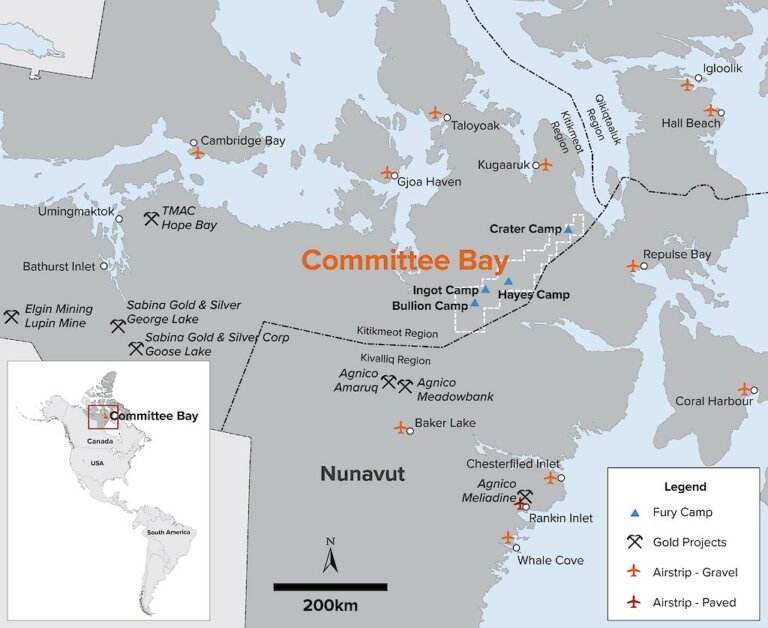

Committee Bay

Location and Infrastructure

The Committee Bay Project is located approximately 430 km northwest of the town of Rankin Inlet, in the eastern part of the Kitikmeot Region of Nunavut. The Project comprises over 2,700km2 of the 300km-long Committee Bay Greenstone Belt (CBGB).

Committee Bay exploration is supported by three exploration camps, the Hayes Camp, the Bullion Camp and the Ingot Camp. Project access is via air from either Rankin Inlet or Yellowknife, NWT.

Exhibit 10. Committee Bay Project Location

Source. Fury Gold Mines Ltd.

Technical Reports

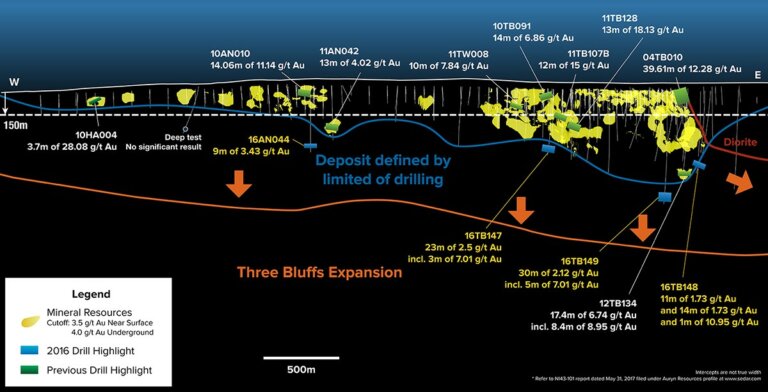

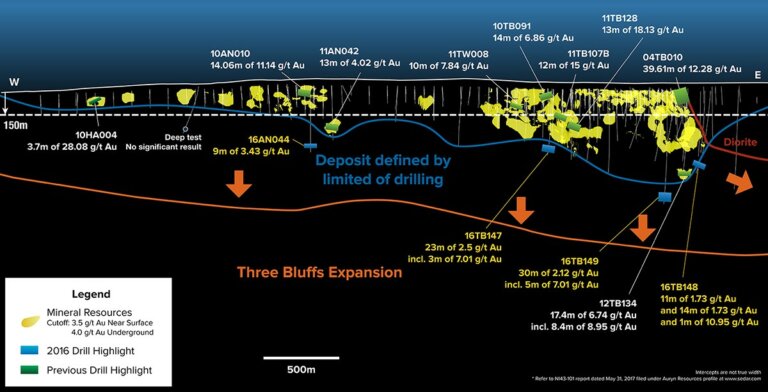

The Committee Bay Project’s Resources are derived from the Three Bluffs Gold Deposit. The MRE4, amended and restated as of May 31, 2017 estimated the following:

- Indicated Resources: 2.070Mt grading 7.85g/t gold for 524,000 contained oz Au

- Inferred Resources: 2.930Mt grading 7.64g/t gold for 720,000 contained oz Au

4-Key MRE assumptions: Open pit COG of 3.0g/t gold and an underground COG of 4.0g/t gold. Assumed gold price of US$1,200 per ounce and a CAD/USD rate of 1.25. For more details, see the relevant technical report.

Geology & Mineralization

The Committee Bay Project hosts Archean-aged rocks of the Prince Albert Group, part of the Rae Domain, within the Western Churchill Province. Two major faults systems, the northeast-striking Kellet Fault and the northwest-striking Hayes River Fault, intersect the central portion of the CBGB.

In general, gold occurrences in the CBGB have been spatially associated to major shear systems and related sub-structures. At the Three Bluffs Deposit (Exhibit 11), which hosts folded iron formation in the nose of an upright fold, gold mineralization is hosted in silicate, oxide and/or sulphide facies iron formation. Shear-hosted quartz veins in sedimentary and volcanic rocks are also known to host gold mineralization at the Deposit.

Exhibit 11. Three Bluffs Deposit Long Section

Source. Fury Gold Mines Ltd.

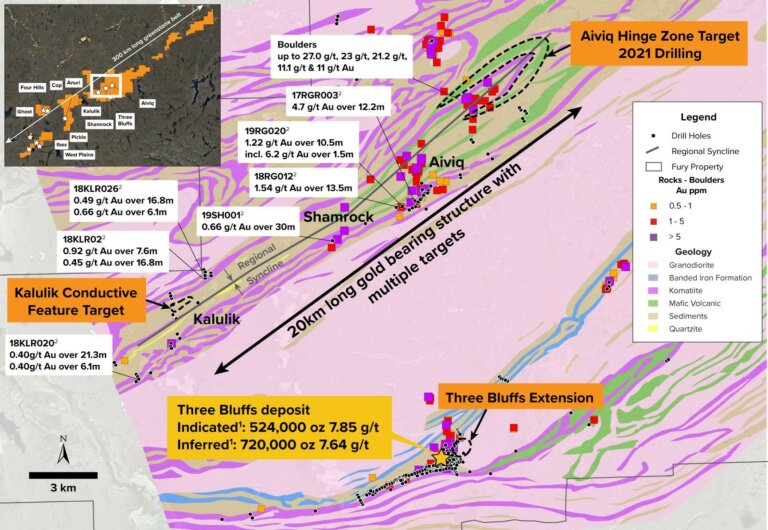

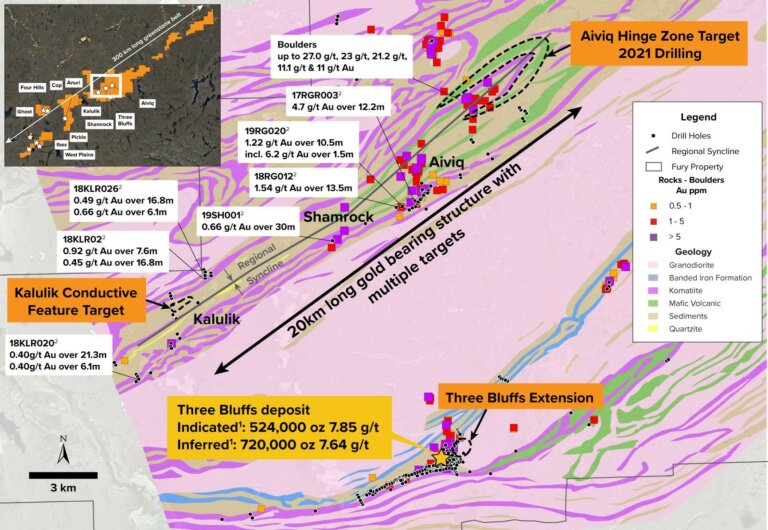

Exploration Upside

The early-stage Committee Bay Project has wide-open exploration potential given the massive land holding in the CBGB. However, at this time Fury plans to transition from belt-wide work to selective targeting of potential high-grade mineralization. We expect Fury to leverage recent belt-wide geochemical and geophysical data as Fury begins more selective targeting.

Near-Deposit expansion at Three Bluffs is considered prospective as drilling has remained relatively shallow to-date. Additionally, we consider the 20km-long Aiviq-Kalulik (AK) Corridor (a shear zone) marked by favourable hinge structures, conductive targets and clusters of gold showings (Exhibit 12) as having high exploration potential given the congregation of showings.

We expect drilling on Fury’s most prospective targets in early July 2021 to Late September 2021, in addition to a sampling program from mid July to mid August, as reported in the December 2020 corporate presentation.

Exhibit 12. Committee Bay Exploration Targets

Source. Fury Gold Mines Ltd.

Fury’s Management Team is as Strong as their Assets

Not only is Fury grounded by good assets, the management team brings geological and corporate expertise that span decades to the venture. President and CEO Mike Timmins, also a director, brings 20 years of experience as a mining executive, which includes stints at Agnico Eagle Mines (as VP of Corporate Development) and at Placer Dome. With Agnico he played a ‘key role’ in the acquisition of the old Osisko Mining for C$3.9 billion.

Lynsey Sherry, Fury’s CFO, spent eight years with Goldcorp and as VP, Controller, was part of the management team that successfully completed Goldcorp’s merger with Newmont in April 2019.

In addition to having C-suite depth, Fury is well-supported from a technical perspective. Michael Henrichsen, Senior VP of Exploration and structural geologist, leads the Fury technical team. Mr. Henrichsen previously was the global structural geologist at Newmont (NGT-TSX). Mr. Henrichsen has experience in Ghana and at other major gold camps in South America, the Carlin Trend, Guinea and Canada.

On the financing side, Ivan Bebek, the board Chair, has over 20 years of experience in financing, foreign negotiations and acquisitions. Additionally, Mr. Bebek was the President, CEO and co-founder of Cayden Resources which was sold to Agnico Eagle Mines for $205 million in November 2014.

Company Asset Highlights

- Three Projects with sizeable Mineral Resource Estimates

- Eau Claire Mineral Resource Estimatea (effective February 4, 2018)

- Measured and Indicated 4.294mln tonnes (Mt) grading 6.18g/t gold for 853,000 contained ounces gold (oz Au)

- Inferred 2.383Mt grading 6.53g/t gold for 500,000 contained oz Au

- Homestake Ridge Mineral Resource Estimateb (effective December 31, 2019)

- Indicated 0.736Mt grading 7.02g/t gold, 74.8g/t silver and 0.18% copper for contained metal of:

- 165,993 oz Au,

- 1.8mln contained ounces silver (oz Ag)

- and 2.87mln pounds copper (lb Cu)

- Inferred 5.545Mt grading 4.58g/t gold, 100g/t silver for contained metal of:

- 816,719 oz Au,

- 17.8mln oz Ag

- and 15.87mln lb Cu.

- Committee Bay Mineral Resource Estimatec (effective May 31, 2017) – Comprised of the Three Bluffs Deposit

- Indicated 2.070Mt grading 7.85g/t gold for 524,000 contained oz Au

- Inferred 2.930Mt grading 7.64g/t gold for 720,000 contained oz Au

- Two Separate Positive Preliminary Economic Assessments

- Eau Claire PEA (effective Feb.4, 2018) estimated an After-tax Net Present Value of $260mln and After-tax IRR of 27% using a 5% discount rate and US$1,250/oz gold price

- Homestake Ridge PEA estimated an After-tax Net Present Value of US$108mln and After-tax IRR of 23.6% using a 5% discount rate, US$1,350/oz gold price, silver price of $12/oz and copper price of $3.00/lb

- Committee Bay Project Highlights

- Gives control of a 300km-long prospective strike with numerous gold-in-till anomalies and already-defined high-potential targets

- Fury is operator of the Eleonore South Joint Venture where Fury owns a 36.7% interest, Newmont (NGT-TSX) owns 36.7% and Azimut Exploration Ltd. (AZM-TSX.V) owns the remaining 26.6%.

- Well-financed – Fury received the net proceeds of C$23mln upon the formation of Fury Gold Mines Ltd.

Notes (More technical report details can be found on www.sedar.com):

a-Eau Claire MRE assumptions: Open pit cut-off grade of 0.5 g/t gold within a conceptual pit shell and underground Mineral Resources are reported at a cut-off grade of 2.5 g/t gold outside the conceptual pit shell. Cut-off grades are based on a gold price of US$1,250 per ounce, a foreign exchange rate of US$0.80, and a gold recovery of 95%.

b-Homestake Ridge MRE assumptions: 2.0g/t gold equivalent (AuEq) cut-off grade. AuEq values were calculated using a long-term gold price of US$1,300/oz, silver price at US$20/oz and copper price at US$2.50/lb and a USD/CAD exchange rate of 1.2.

c-Committee Bay MRE assumptions: open pit cut-off grade of 3.0 g/t gold and underground cut-off grade of 4.0 g/t gold. Mineral Resources are estimated using a long-term gold price of US$1,200/oz and a USD/CAD exchange rate of 1:25.

Going Forward

Fury has a lot to cook with in three flagship projects underpinned by a combined Resource base of over 3.5mln in-situ ounces of gold, entirely within the safe jurisdiction of Canada. Together the three projects give Fury a deep exploration pipeline with exploration opportunities and two development-level assets in Eau Claire and Homestake Ridge. Though Fury is transitioning to selective high-grade targeting at Committee Bay, sizeable exploration potential in the massive land package should not be ignored.

We look for Fury to develop momentum on Eau Claire and continue refining their ambitious 18-month exploration plan. As outlined in this report, Fury has developed a Canadian-asset base with growth potential and plenty of prospective exploration targets along known structural trends.

Additionally, the 18-month exploration plan is expected to nurture investor interest with steady news flow. The first infill assay result from Eau Claire could come as early as mid-to-late January 2021. In the coming months we expect to see further updates on targeting progress for Homestake Ridge and Committee Bay exploration programs.

For more on Fury, visit the website here.