The Spences Bridge Gold Belt in British Columbia continues to impress with Westhaven Gold reporting the best gold-silver drill intercepts since announcing the South Zone discovery at Shovelnose in late-2017 (Exhibit 1).

Hole SN22-212 drilled in the FMN Zone intercepted 23.03 metres of 37.24 grams per tonne (g/t) gold and 214.7 g/t silver, which at 857.64 gram-metres, represents the highest gold-silver intercept to date. This intersect is over 2km for the heart of the South Zone illustrating the potential for expansion and new discoveries.

The latest results from 22 drill holes underline the 100%-owned, large, 17,623-ha property’s continued discovery potential. It is not uncommon in enriched epithermal systems to discover multiple high-grade gold chutes.

The company expects the ongoing exploration success to potentially add more open-pittable, bulk-tonnage resources.

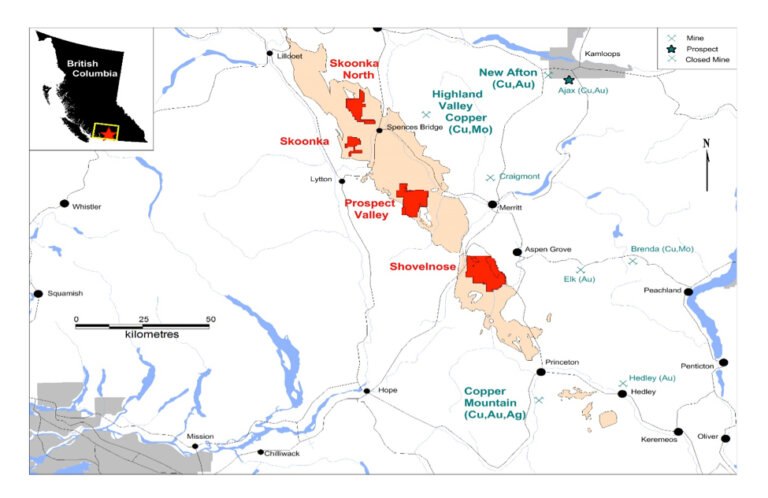

Exhibit 1. Location Map of Westhaven Gold’s Four Spencer Bridge Gold Belt Properties in British Columbia.

Source: Westhaven Gold Corp.

The Significance

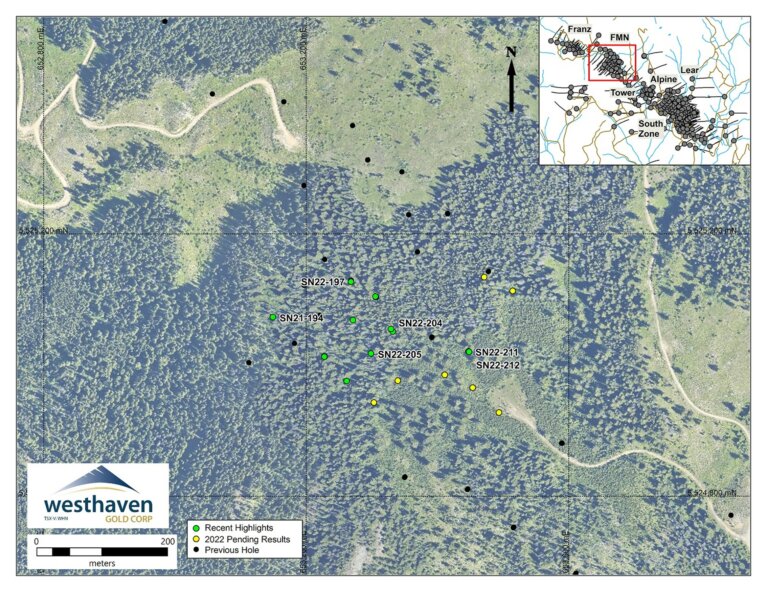

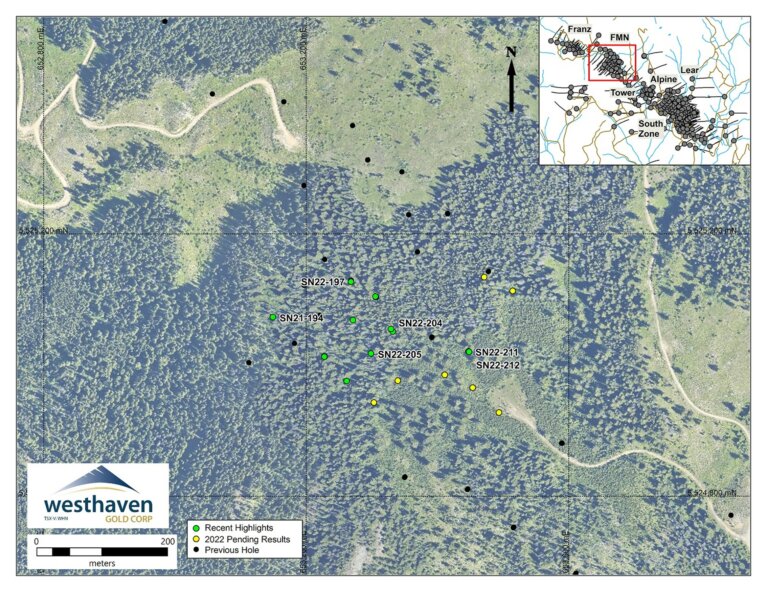

Drilling on the Shovelnose gold project started this year at the FMN Zone (see Exhibit 2) to follow up on higher grade intersections from last year’s drilling, such as hole SN21-161, which returned 9.15 g/t gold over 15.97m. In addition, last year, the company intercepted broader intervals of near-surface mineralization, such as hole SN21-188, which returned 0.76 g/t gold over 57.8m.

Westhaven’s efforts at FMN continue to intersect these two styles of mineralization.

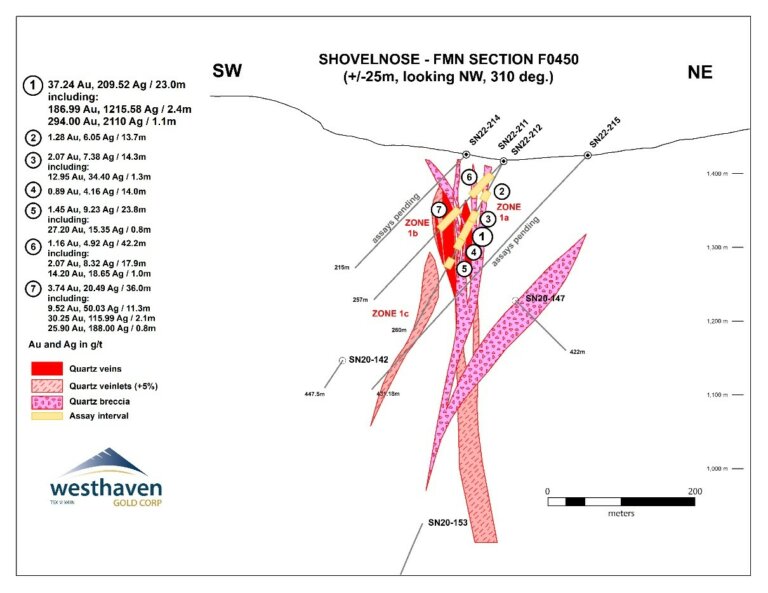

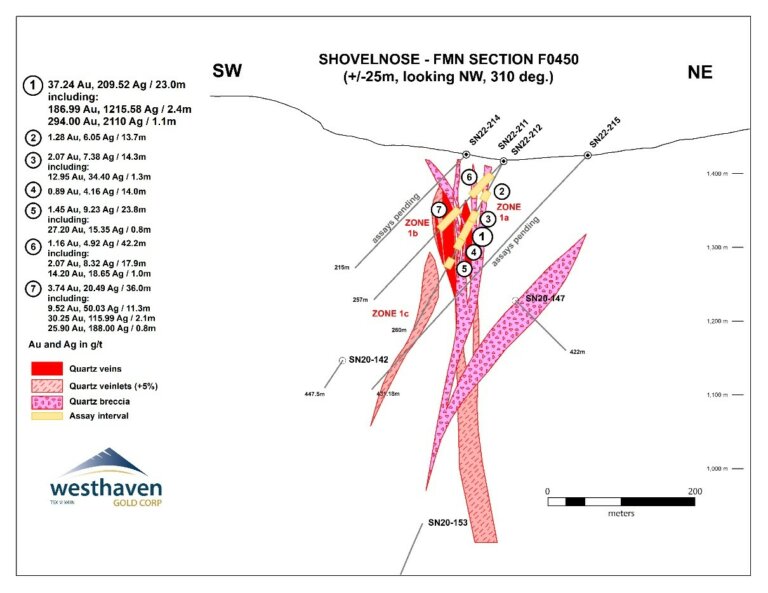

The company reports the gold-bearing intervals are hosted in quartz-adularia veins in Vein Zone 1 and heterolithic breccias containing mineralized quartz fragments derived from Zone 1 veins.

The breccias are interpreted to form broad intervals of near-surface gold mineralization, as evidenced in the 1.1 g/t gold over 34m in hole SN22-205 and 1.16 g/t over 42.17m in SN22-211.

Westhaven reports drilling continues to intersect higher-grade intervals in Vein Zone 1 as well, as seen deeper downhole in SN22-21, which returned 9.52 g/t gold over 11.26m, including 30.25 g/t gold over 2.12m, and 37.24 g/t gold over 23.03m in hole SN22-212.

The highlighted drill hole SN22-212 (see Exhibit 3) included an interval of 1.12m grading 294 g/t gold and 2,110 g/t silver. The hole is located just more than 2km from the heart of the South Zone open-pit resource.

In January, Westhaven outlined an open-pit Indicated Resource for the South Zone totalling 10.6 million tonnes grading 2.32 g/t gold and 11.43 g/t silver, plus an Inferred resource of 9.2 million tonnes grading 0.89 g/t gold and 3.47 g/t silver.

The company believes the FMN Zone has the potential to contribute significantly to the property-wide future precious metals inventory.

Given the robust nature of this system and low drill density in this area, we believe Westhaven has a district-scale opportunity to discover more high-grade chutes along about 4km of highly prospective trend.

Exhibit 2. FMN Zone Drill Location Map.

Source: Westhaven Gold Corp.

Next Steps

Drilling at FMN is planned to continue along 50m fences on strike toward the southeast to follow up on additional mineralization uncovered during 2020 drilling.

In addition to the drill currently located at the FMN Zone, a second rig has been added at the Alpine Zone focused on following up on hole SNR21-55, which intersected 3.13 metres of 45.23 g/t gold and 195.64 g/t silver.

Recent drilling at the Alpine Zone encountered similar geology to that encountered in SNR21-55, including intervals containing marcasite, adularia and ginguro bands.

Additional results remain pending from both the FMN Zone and South Zone expansion holes, providing an expected steady flow of news.

Exhibit 3. Section FMN Section F0450 Showing Best Hole SN22-212.

Source: Westhaven Gold Corp.

For more details and relevant drill cross-sections, click here, and click here for the latest Westhaven Gold news release.

Company Highlights

- High-grade gold discovery at Shovelnose (discovery hole intersected 17.7 metres of 24.5 g/t gold and 107.92 g/t silver at the South Zone in October 2018).

- Maiden Mineral Resource Estimate1 on Shovelnose South Zone in January 2022:

- 841,000 Indicated ounces at 2.47 g/t gold-equivalent.

- 277,000 Inferred ounces at 0.94 g/t gold equivalent.

- 95% gold and 96% silver recoveries in preliminary metallurgical test results

- Mineralization is reportedly non-refractory and amenable to recovery by a standard industry process flowsheet.

- The Shovelnose property is situated off a major highway, near power, rail, large producing mines, and within commuting distance from the City of Merritt, which translates into low-cost exploration.

- District-scale discovery potential in the emerging Spences Bridge Gold Belt where the company’s four projects, Shovelnose, Prospect Valley, Skoonka Creek and Skoonka North, cover 17,623 hectares.

- Shareholder alignment – insiders own 25% and have a track record of successful mine development.

Notes (from relevant technical reports):

1 – The Shovelnose MRE is estimated using metal price assumptions of US$1,675 per ounce for gold and $21.50per ounce for silver, with a USD:CD FX of 0.77. C$ operating costs used were $3 per tonne mineralized material mining, $2.50 per tonne waste mining, $2.00 per tonne overburden mining, $18 per tonne processing and $5 per tonne G&A.

The pit slopes used were 50º in rock and 30º in the overburden.