Two press releases in the first seven days of September brought refreshing news from Galway Metals. The company reported solid exploration momentum at both of its core projects – the flagship Clarence Stream gold project, in southwest New Brunswick and the polymetallic Estrades project in the Northern Abitibi of western Quebec.

First up was an update from Estrades, where it appears the company is starting to unlock the mineral potential of this brownfield asset, essentially in the headframes of former notable mines on the Casa Berardi Deformation Zone. Recent drilling at the former high-grade mine has returned encouraging intercepts of zinc, copper and gold mineralization.

Galway also continues to make steady progress with drilling at the district-scale series of discoveries at Clarence Stream, where the latest round of drill results demonstrates consistent high grades in previously untested areas.

Estrades Gets Interesting… Again

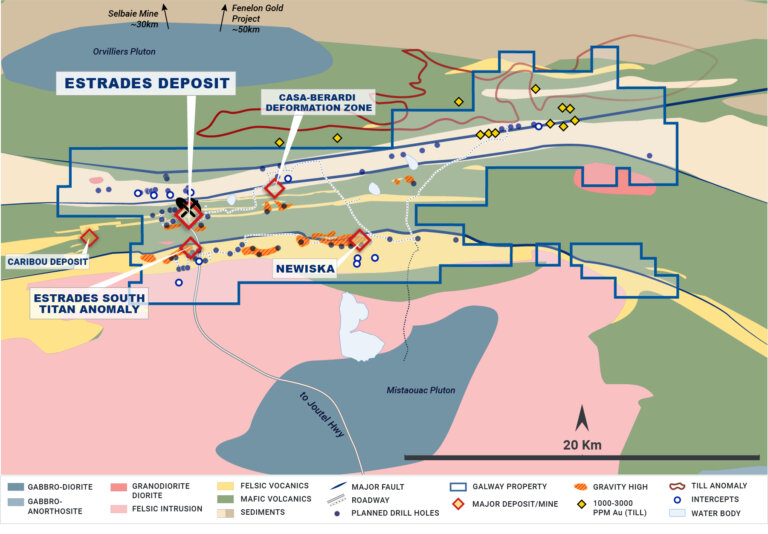

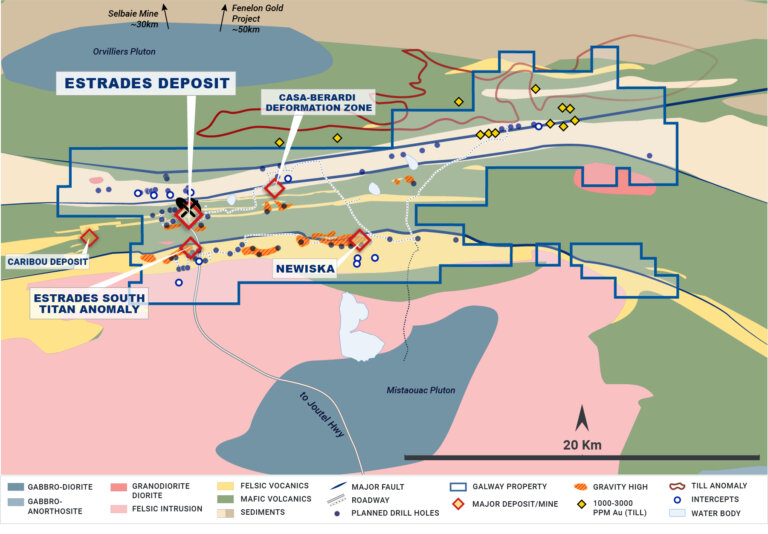

Exhibit 1. Map of the Estrades Property, Western Quebec

Source: Galway Metals

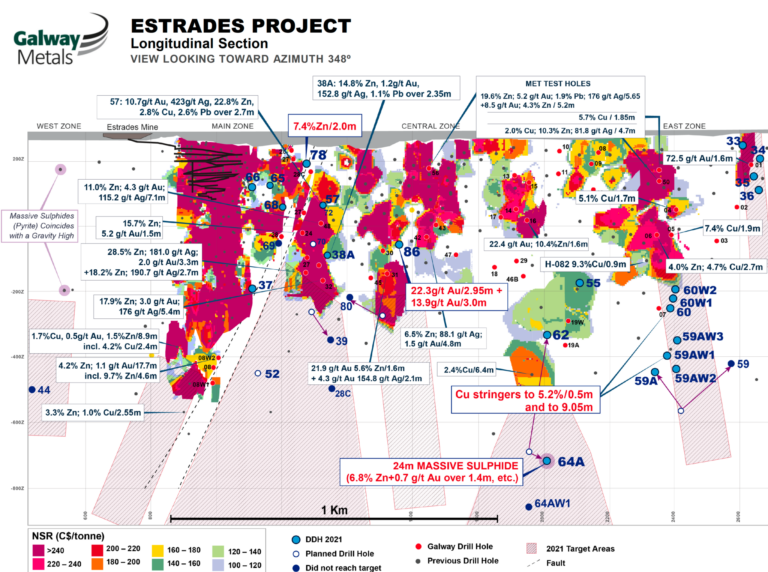

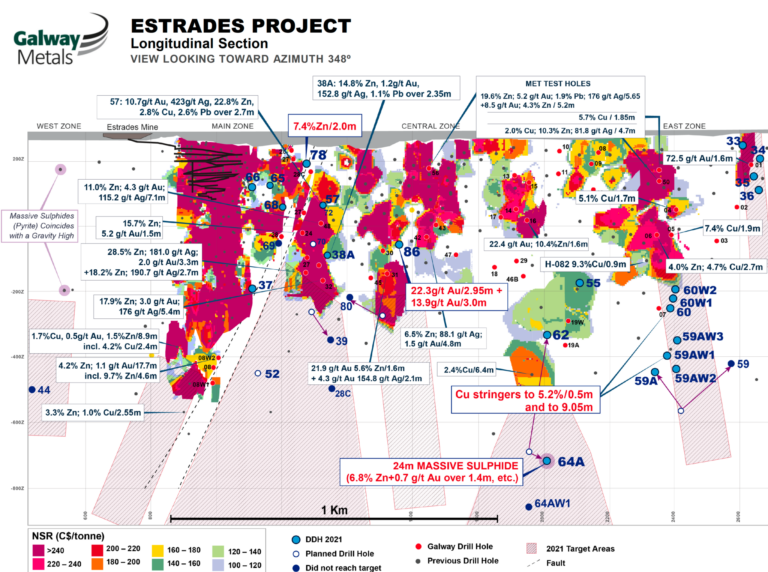

On September 2, Galway released a second batch of exploration drill results from the ongoing campaign at the Estrades property. Among the results is the deepest-yet intersection of massive sulphides at 1km depth – returning intersections as wide as 24m (16.1m true width) with zinc grading up to 11.4% in hole 64A (see Exhibit 2).

Galway encountered the mineralization below the copper-rich eastern portion of the Estrades Resource area.

While drilling did not all return resource grades, grades as high as 11.4% zinc plus 1 gram per tonne (g/t) gold over 0.7m provide Galway with enough conviction to, in conjunction with other drill results plus Titan IP and EM as well as gravity geophysical surveys, vector into a potential high-grade and wide source vent in the area.

Exhibit 2. Longitudinal section of Estrades

Source: Galway Metals

Another hole 300m below a prior copper-rich resource hole also returned 9m of copper stringers with results up to 5.2% copper over 0.5m (see Exhibit 3).

Two new holes, 59A and 60, were drilled with five wedges (three from 59A and two from 60). Galway has received the results for two intersections, hitting copper stringer zones with an intercept of 1.9% copper over 3.75m in wedge hole 59AW1 (again, see Exhibit 3).

It is located 300m below the deepest resource hole that returned 9.3% copper over 0.9m.

The 9m of stringers also hosted 1.4% copper over 1.85m. The other intersection was received from hole 60, which returned 4.1g/t gold-equivalent over 9.05m (1.2g/t gold, 11.9g/t silver, 1% zinc, and 1.3% copper.

Exhibit 3. Copper stringers associated new holes 59A and 60

Source: Galway Metals

Galway also reported the results from a drill hole designed to follow up on a strong intersect from 2018, hole 31, which was the deepest intersect in the middle of the deposit to date which returned 26.6 g/t gold-equivalent over 1.6m. The new hole 86 intersected three massive sulphide horizons, one with assays pending and two returning 24g/t gold-equivalent over 2.95m (22.3g/t gold plus 46.2g/t silver), plus 16.1g/t gold-equivalent over 3.0m (13.9g/t gold plus 50.7g/t silver).

More news expected

According to the company, all of the high-grade mineralization identified to date overlies a strong plumbing system, and Galway is intent on trying to find that potentially rich and much wider plumbing system.

Estrades has been only shallowly drilled to date relative to many polymetallic VMS deposits.

To date, Estrades has seen 220,000m of drilling along its three mineralized horizons. The company undertakes to continue the effort, and has expanded its 2021 drill program to 25,000m, up from 10,000m initially.

The property is extremely prospective for economical mineralization, being located immediately adjacent to, and west of the Agnico Eagle (AEM-TSX) / Maple Gold (MGM-TSX.V) Joutel Joint Venture, which hosts 3.9 million ounces gold between historic production at Telbel and current gold resources at Douay. Agnico has agreed to spend $18 million on exploration here beginning February 2021.

The property is also 24km east of Hecla Mining’s Casa Berardi gold mine, which is currently producing, and has 6.1 million ounces of gold between total production and current Reserves and Resources.

Three prospective horizons for mineralization occur on the property – the past-producing host Estrades VMS mine, the Newiska horizon located south and the Casa Berardi Break located to the north of the Estrades horizon (see Exhibit 1).

Clarence Stream Expansion

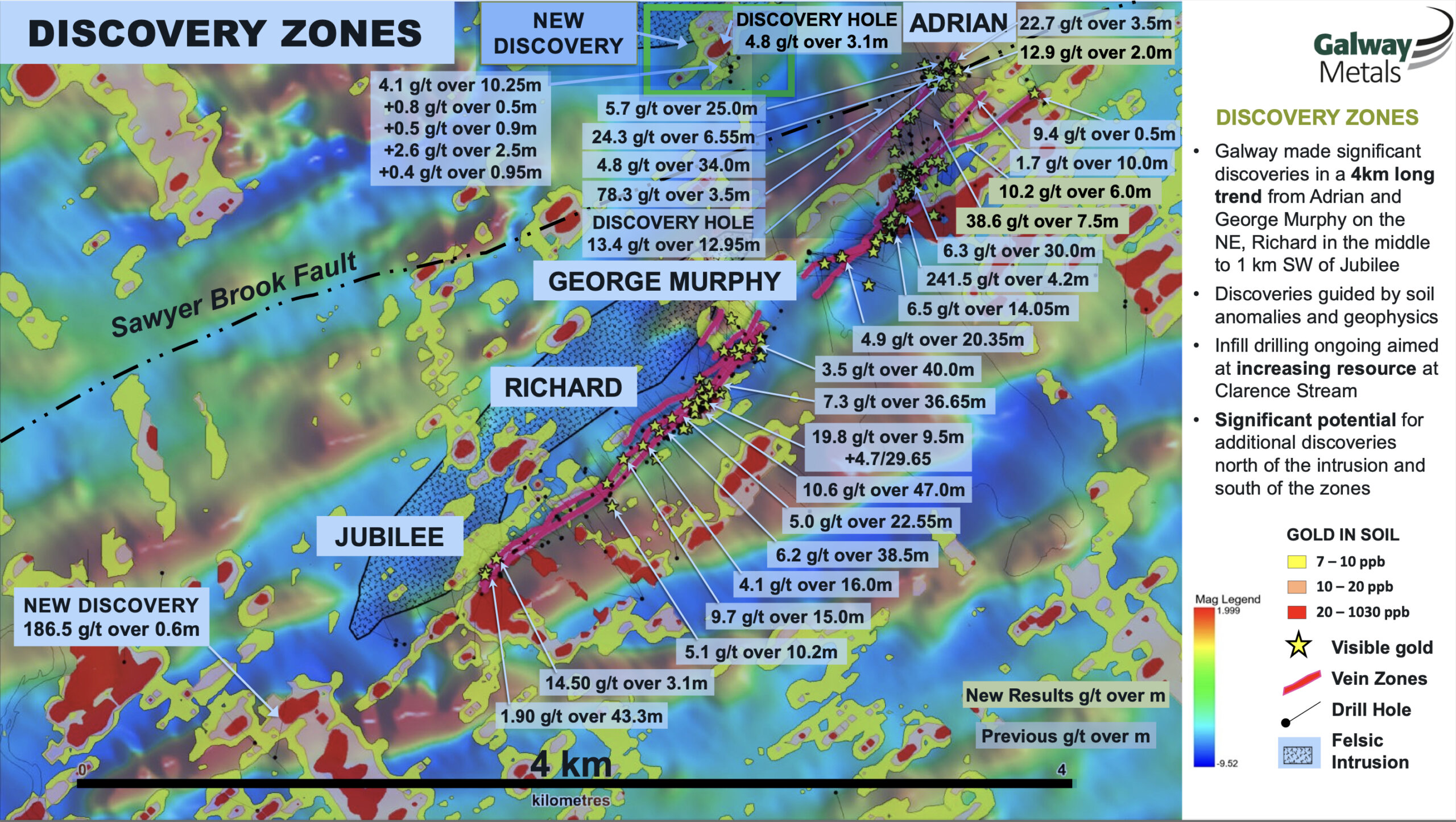

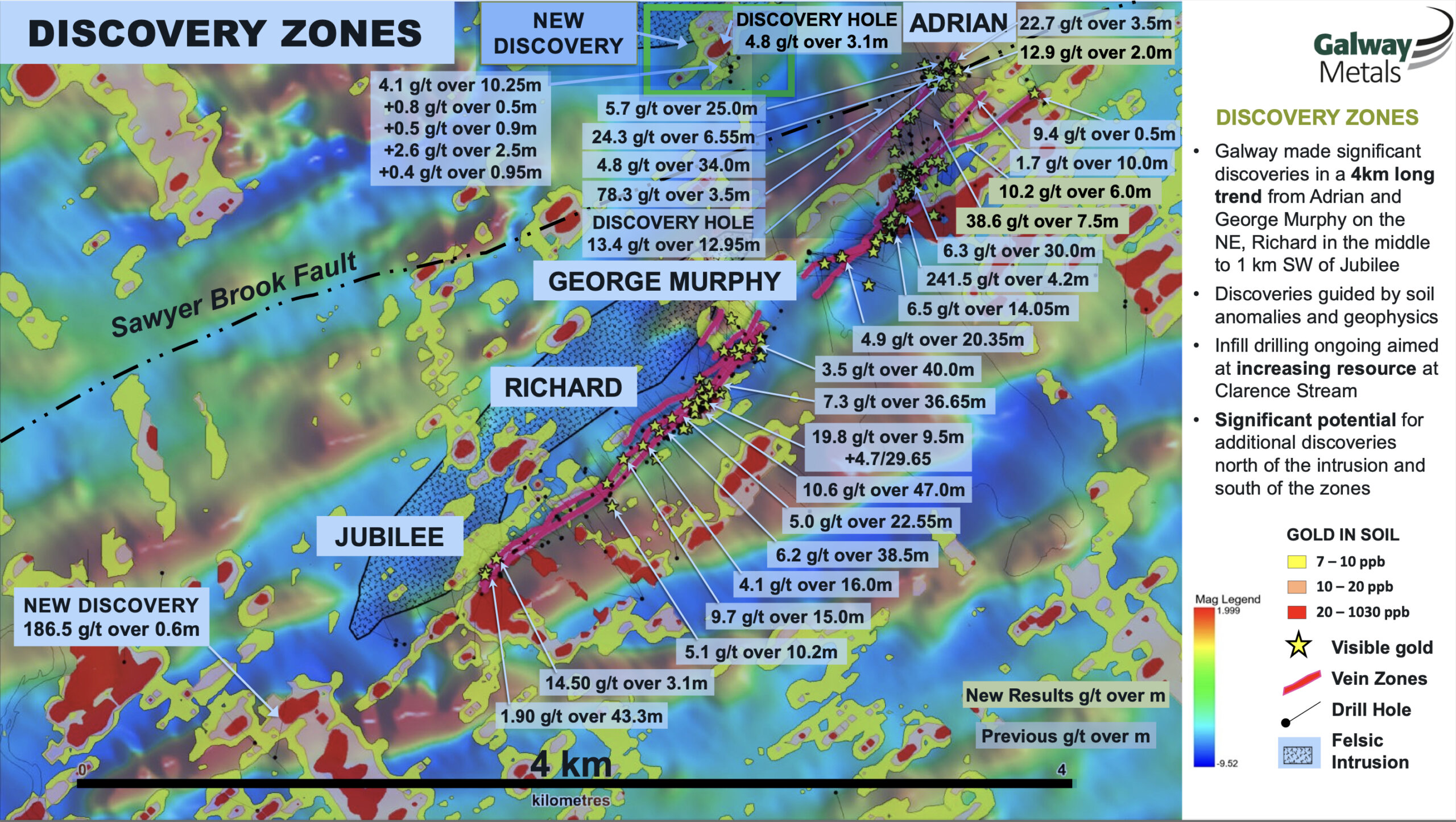

On September 7 Galway released another batch of exploration drill results from the ongoing Clarence Stream program (see Exhibit 4), which expanded the Adrian Zone 44m east in the central gap area, and the overall zone to the southeast, as well as provided additional results within the eastern portion of the George Murphy Zone (GMZ).

Exhibit 4. Galway’s Discovery Zones at Clarence Stream, New Brunswick

Source: Galway Metals

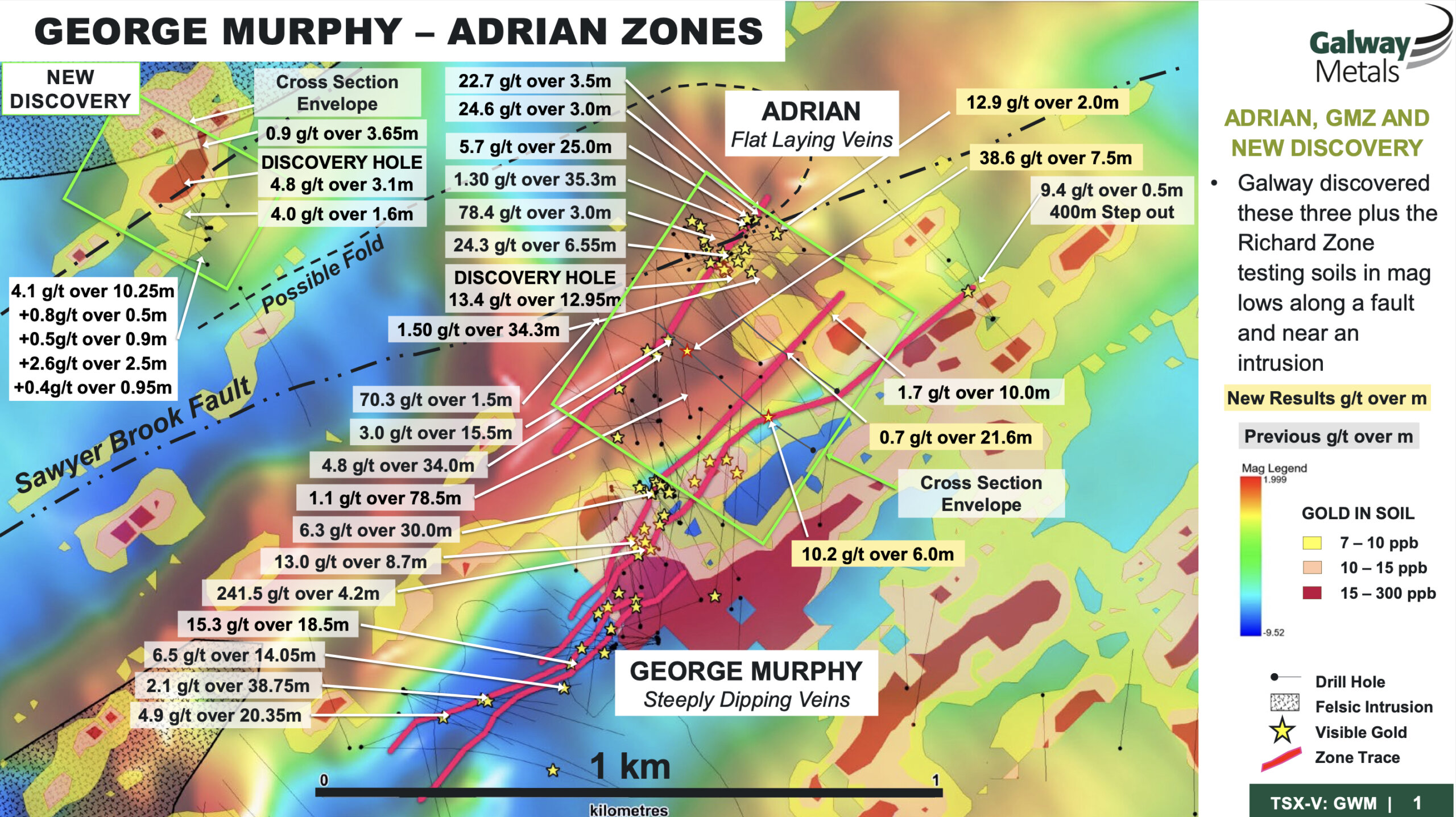

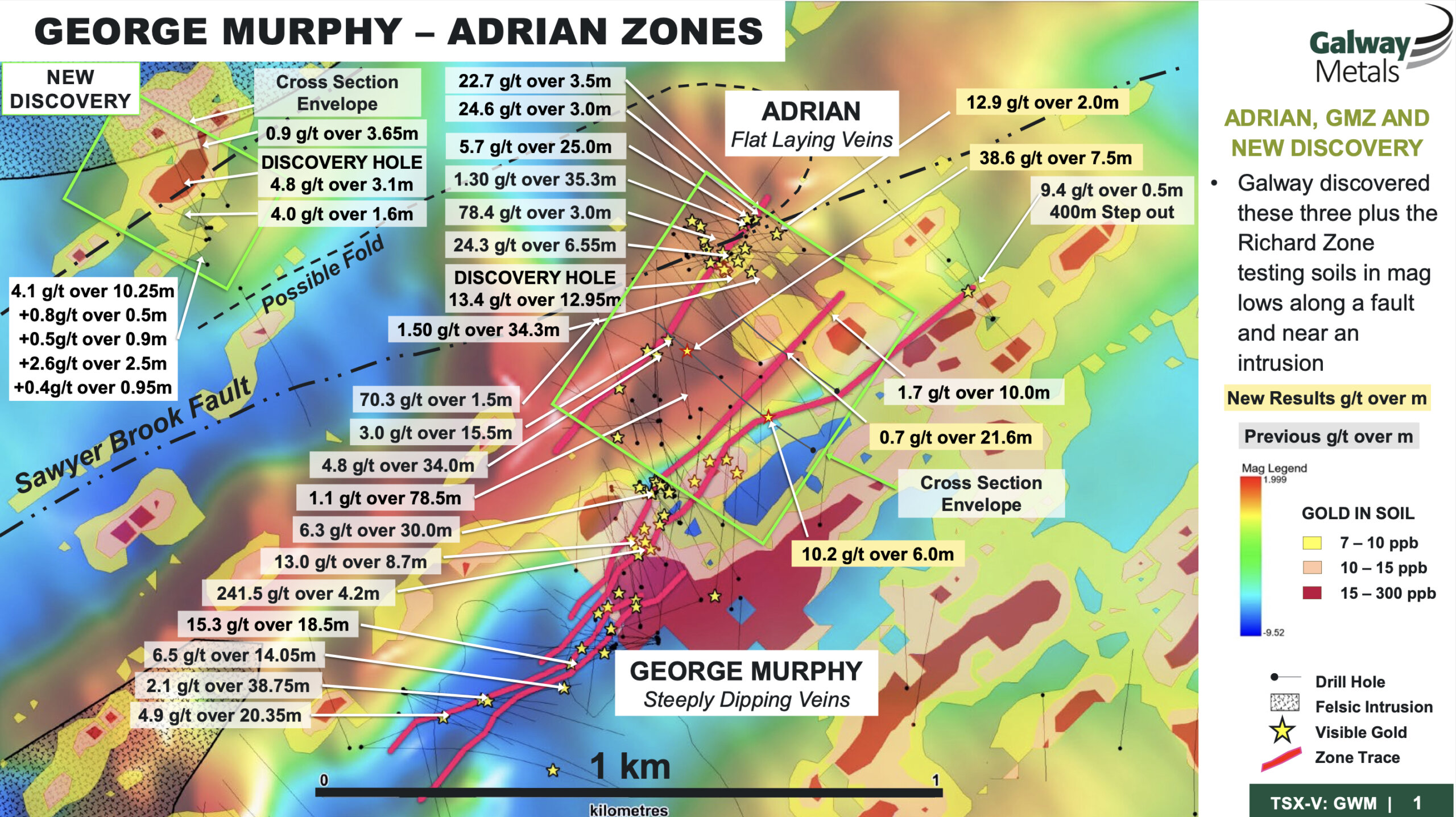

Hole CL-122 returned 38.6 g/t gold over 7.5m at the relatively new Adrian Zone (see Exhibit 5).

Also released were the first assay results from hole CL-116, which was previously reported to contain visible gold (VG) that expanded Adrian 49m to the southeast. Partial results received for the core sample returned 48.2 g/t gold over 0.5m within 12.9 g/t gold over 2m. Both these intersections remain open for expansion once all assays are received.

At the GMZ (see Exhibit 5), drilling returned 10.2 g/t gold over 6m, and 0.7 g/t gold over 21.6m in holes CL-120 and CL-119, respectively. Most assays are pending for both holes.

Exhibit 5. Exploration results from the Adrian, GMZ and New Discovery Zones

Source: Galway Metals

The holes were drilled within the eastern portion of the GMZ where Galway recently reported a 50% expansion to more than 1.1km with holes CL-75 and CL-109.

Hole CL-75 was a 400m wildcat step-out that was drilled to test the eastern edge of the soil anomaly that originally led to the discovery of the GMZ. This hole returned 9.4g/t gold over 0.5m.

Galway then drilled hole CL-109, which was approximately centered between the 400m step-out hole and the previous eastern limit of the zone. The hole returned 1.7g/t gold over 10m.

Stay Tuned

Galway is convinced all seven deposits discovered to date at Clarence Stream remain open in every direction. Further upside is present in the district-scale potential that we envision for Galway’s 65km long, 60,000-hectare land position.

A Clarence Stream resource update targeted for the third quarter is now scheduled for the first half of the fourth quarter.

Galway has more than 5,000 samples pending assay results at the labs. There is generally an 8-to-12-week delay in receiving results, and the company wants to incorporate key pending assays into the update.

Galway plans on incorporating Adrian, GMZ, Richard and Jubilee, which cover a strike length of 3.1km, as well as the existing South and North Zones, into the resource update.

For complete information, visit the Galway Metals website at galwaymetalsinc.com.

Company Highlights

- Forthcoming MRE update incorporating new mineralized zones at Clarence Stream, New Brunswick.

- Expanded, fully funded exploration drill programme at Clarence Stream from 75,000m to 100,000m utilizing seven drill rigs, up from the current six

- Clarence Stream Deposit Resource1 – (North and South Zones only)

- Measured: 236,000 tonnes grading 1.82g/t gold for 14,000 contained ounces gold

- Indicated: 5.942 mln tonnes grading 1.97g/t gold for 376,000 contained ounces gold

- Inferred: 3.409 mln tonnes grading 2.53g/t gold for 277,000 contained ounces gold

- Clarence Stream Project Highlights

- 65km (non-contiguous) of prospective strike and discoveries as indicated by gold-in-till, soil, boulder and chip samples along magnetic lows (aligning with the Sawyer Brook Fault); the belt is under-explored and proximal to excellent infrastructure

- Resource Expansion Potential – Only 2 of 7 Clarence Stream Deposits are in the Resource Estimate – George Murphy, Jubilee and Richard Zones are not yet included but are expected in the next Resource Estimate update – Adrian and GMZ North provide additional potential growth

- Excellent Access and Infrastructure – well located only 70km south-southwest of Fredericton in southwestern New Brunswick. Excellent road access cutting through the property, readily accessible power and a local workforce. Proximal to the border with Maine

- Estrades Deposit Resource2, Quebec – former producing, high-grade Volcanogenic Massive Sulphide (VMS) Mine

- Indicated: 1.497 mln tonnes grading 3.55 g/t gold, 122.9 g/t silver, 7.20% zinc, 1.06% copper and 0.6% lead for contained metal of 170,863 oz gold, 5.9 mln oz silver, 237.6 mln lbs zinc, 35.0 mln lbs copper and 19.8 mln lbs lead

- Inferred: 2.199 mln tonnes grading 1.93 g/t gold, 72.9 g/t silver, 4.72% zinc, 1.01% copper and 0.29% lead for contained metal of 136,452 oz gold, 5.2 mln oz silver, 228.8 mln lbs zinc, 49.0 mln lbs copper and 14.1 mln lbs lead

- Estrades Highlights

- Sept 10, 2018 Resource Estimate increased the Indicated Resource by 15% and the Inferred Resource by 80% over the August 2016 estimate

- An expanded 25,000m drill programme using three rigs targeting the three main mineralized horizons at the Estrades property is underway

- Well-financed – Approx.$20 mln in cash (reported in the Sept 2021 corporate presentation) with no debt

- Management and Shareholder’s interest are aligned – ~21% ownership by Management, Friends and Family

- Institutional Ownership 52%

- Seasoned management team – the same key management team that sold Galway Resources for US$340 mln in 2012

Notes (from relevant technical reports):

1 – Pit constrained resources as stated are contained within a potentially economically minable pit; pit optimization was based on an assumed gold price of US$1,350/oz, gold recovery of 90%, a mining cost of CAD$3.00/t, an ore processing and G&A cost of CAD$20.00/t, and pit slopes of 45 degrees; Pit constrained resources are reported using a gold cut-off grade of 0.42 ppm, which incorporates a 3% royalty and gold sales costs of CAD$5.00/oz beyond the costs used for pit constrained optimization; Underground resources as stated are contained within modelled underground stope shapes using a nominal 1.5m minimum thickness, above a gold cut-off grade of 2.55 ppm, and below the reported pit constrained Resource; The underground cut-off is based on an assumed gold price of US$1,350/oz, Gold Recovery of 90%, mining cost of CAD$100/t, an ore processing and G&A cost of US$20.00/t, a 3% royalty, and gold sales costs of CAD$5.00/oz;

2 – Mineral Resources are estimated at long-term metal prices (USD) as follows: gold $1,450/oz, Ag $21.00/oz, Zn $1.15/lb, Cu $3.50/lb and Pb $1.00/lb; Mineral Resources are estimated using an average long-term foreign exchange rate of US$0.80 per CDN$1.00; Mineral Resources are estimated at a cut-off grade of CDN$140/tonne NSR, which included provisions for metallurgical recoveries, freight, mining, milling, refining and G&A costs, smelter payables for each metal and applicable royalty payments; Metallurgical recoveries for resource estimation are: Zn 92%, Cu 90%, Pb 85%, Gold 80% and Ag 70%.

*For a complete description of Resource assumptions, please review the relevant technical reports