- Learn

- Perspectives

Perspectives

PearTree Canada supports industries and communities that operate in a dynamic and fast-paced world. Stay up-to-date with our leadership team’s perspectives on current events and trends.

See All Perspectives

Take Action: Protect Critical Mineral Exploration & Flow-Through Investments

Read More

Pre-Budget Consultations in Advance of the 2024 Budget

Read More

[Webinar] The Impact of AMT on Philanthropy: From Cash Donations to Marketable Securities & More

Watch Now

Take Action: Protect Charitable Giving in Canada

Read More

Expanding the Saskatchewan Mineral Exploration Tax Credit: Regulatory Changes

Read More

Take Action: Protect Critical Mineral Exploration & Flow-Through Investments

Read More

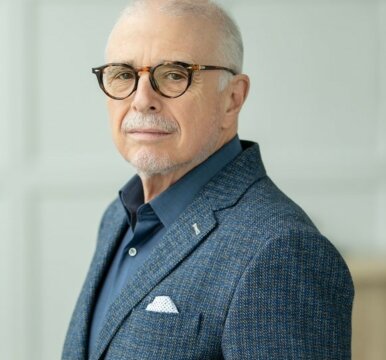

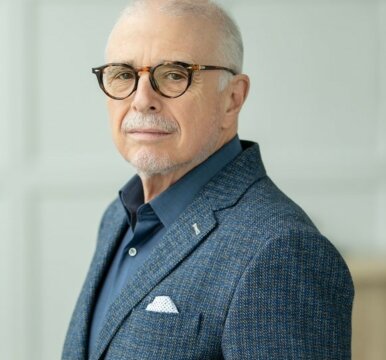

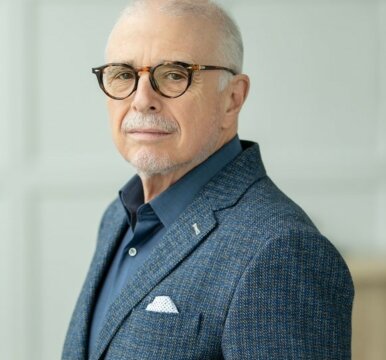

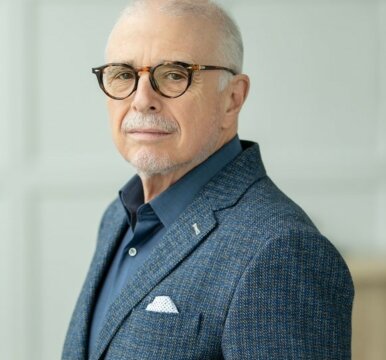

PearTree Canada Founder & CEO Ron Bernbaum featured on EarthLabs CrashLabs Podcast

Read More

AMT Changes: Impact on the Canadian Mineral Exploration Industry

Read More

Ontario Government Harmonizes the Ontario Focused Flow-Through Share Tax Credit with the Critical Mineral Exploration Tax Credit

Read More

Kodiak Copper Hits Broad Copper from Surface at MPD’s West Zone

Read More