Westhaven Gold reports infill and expansion drill results from its flagship Shovelnose gold-silver property. The readily accessible, 100%-owned, large, 17,623-ha property borders the Coquihalla Highway and is only 30km south of the City of Merritt in southern British Columbia. The company expects the ongoing exploration success to potentially add more open-pittable, bulk-tonnage resources.

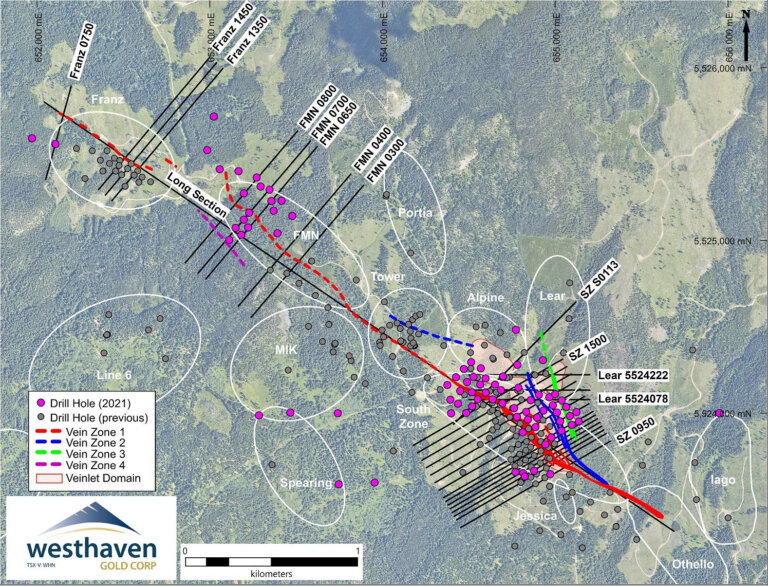

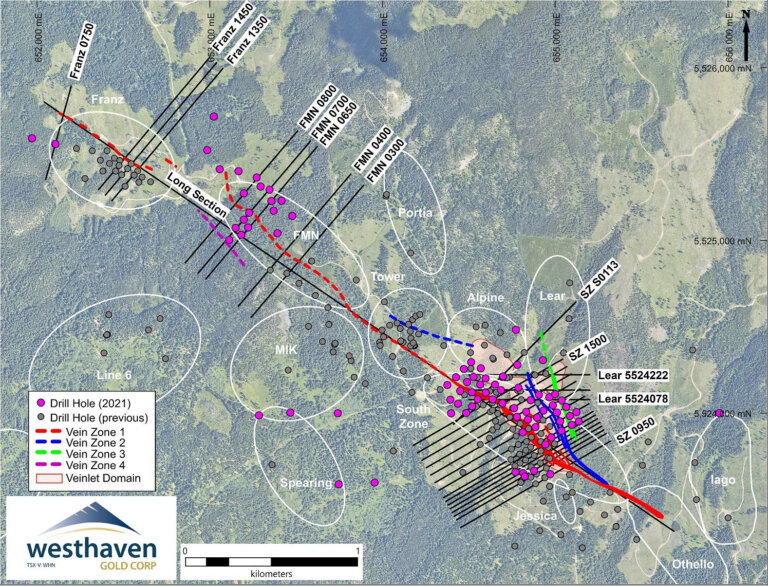

With a fully-funded exploration programme underway, Westhaven plans to test regional targets in the emerging Spences Bridge Gold District (see Exhibit 1).

Exhibit 1. Shovelnose Gold Property Plan View

Credit: Westhaven Gold

Earlier in the year, Westhaven reported the initial Mineral Resource Estimate (MRE) for the South Zone of the Shovelnose Property. The MRE was based on data from 145 surface holes totalling 56,491m.

The initial MRE for Shovelnose comprises 841,000 ounces (oz) of gold-equivalent grading 2.47 grams per tonne (g/t) including 791,000 oz gold at 2.32 g/t in the Indicated category. In addition, the project hosts an Inferred resource of 277,000 oz gold-equivalent at 0.94 g/t, with 263,000 oz of that gold at a grade of 0.89 g/t. The resource was based on an open-pit mining scenario.

The Significance

Westhaven believes it has barely started to unlock the exploration potential at Shovelnose. And with the average gold-equivalent grade of the Indicated resource about seven times higher than the cut-off grade, the company believes the resource model demonstrates excellent potential for future economic extraction.

Since the resource announcement, Westhaven has been releasing a steady flow of exploration results, increasingly demonstrating the bulk-tonnage potential near the South Zone.

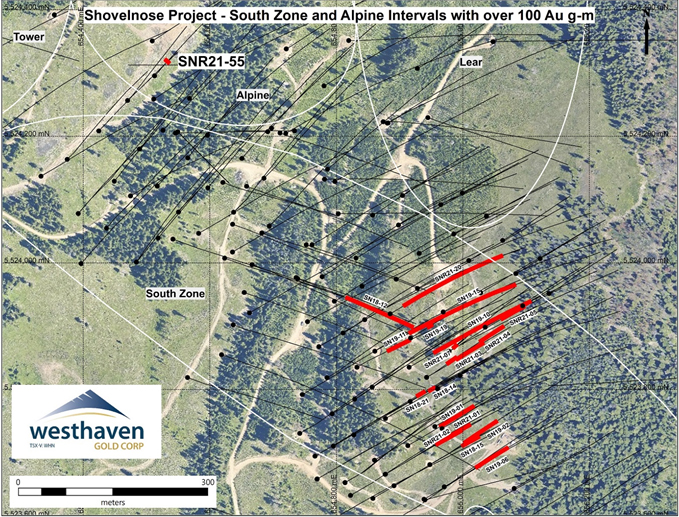

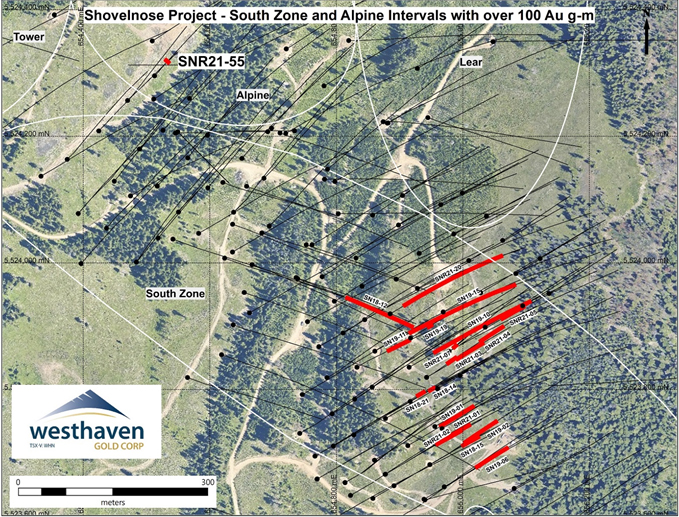

Most recently, Westhaven reported a new discovery within Vein Zone 2 at the Alpine Zone in hole SNR21-55, which returned 8.00 metres grading 20.22 g/t gold and 83.97 g/t silver. The discovery is 500m northwest of the main south zone mineralization (figure 2).

Figure 2. South Zone and New Alpine Zone High-Grade Intercept Locations

Source: Westhaven Gold

The company reports that the mineralized zone remains open to the northwest and gives an entirely new area to focus.

Drill hole SNR21-55 is reportedly amongst a group of 17 infill holes located in the northwestern part of the currently defined open pit resource that has not been incorporated into the current resource estimate. The company plans additional step-out drill holes to follow up on this high-grade intersection.

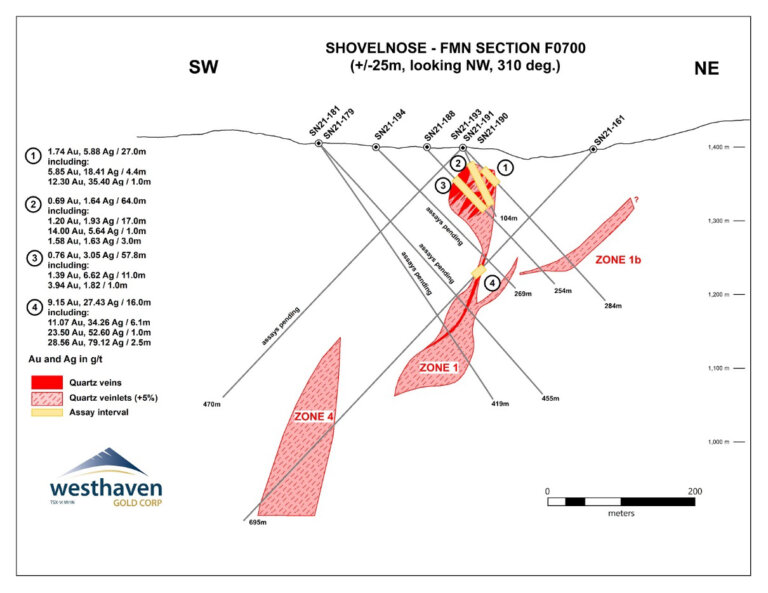

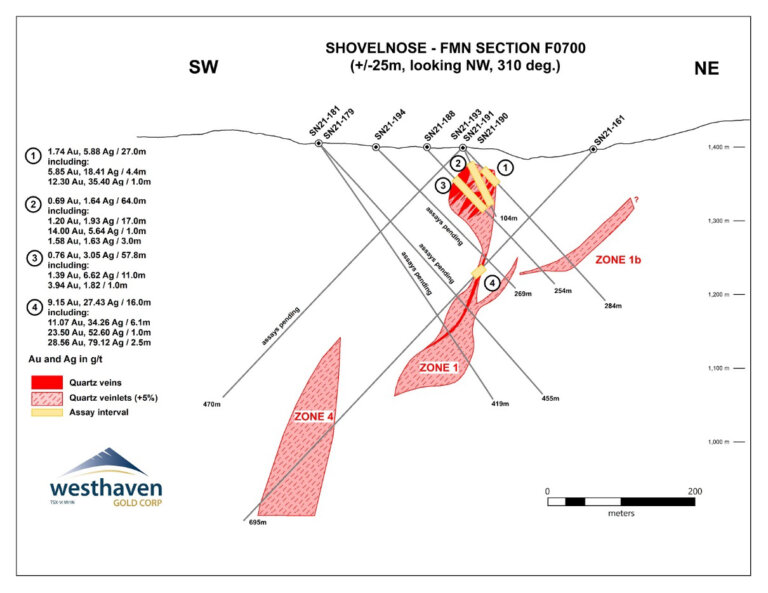

Westhaven also reported assay results from 20 holes from its ongoing drill campaign at the FMN target area, which is located 1.5 to 2.0 km northwest of the South Zone open-pit resource (see Exhibit 3).

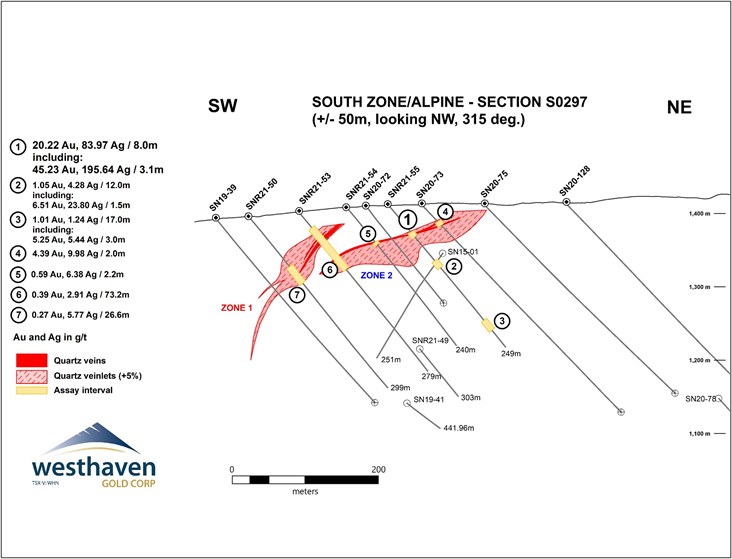

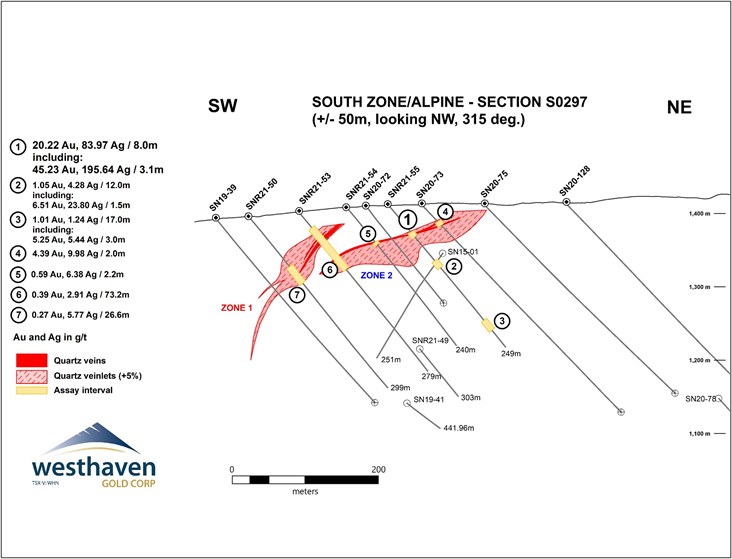

Exhibit 3. South Zone/Alpine Zone Cross-Section Looking Northwest.

Source: Westhaven Gold

At FMN, mineralization has been encountered over a strike length of 480 metres starting at the top of bedrock. Results suggest Vein Zone 1 broadens up-dip, toward surface, with true widths of up to 40 metres as seen in hole SN21-188, which returned 0.76 g/t gold over 57.8 metres.

These recent FMN and Alpine drill results define broad intervals of gold mineralization contained in Vein Zones 1 and 2 and associated.

Next Steps

Drilling continues along Vein Zone 1 with a single drill rig turning at the FMN target.

Drilling is following up on 2021’s high-grade intercept in hole SN21-161, which returned 9.15 g/t gold over 15.97 metres (see Exhibit 4). This drilling has now encountered mineralization over a strike length of 480 metres (from hole SN20-139 northwest to hole SN21-167), over a vertical range of 270 metres, starting at the top of bedrock.

Exhibit 4. Shovelnose Cross-Section of FMS Zone Looking Northwest

Source: Westhaven Gold

Additional results remain pending from both the FMN zone and South Zone expansion holes which should provide a steady flow of news.

Company Highlights

- High-grade gold discovery at Shovelnose (discovery hole intersected 17.7 metres of 24.50 g/t gold and 107.92 g/t silver at the South Zone in October 2018).

- Maiden Mineral Resource Estimate1 on Shovelnose South Zone in January 2022:

- 841,000 Indicated ounces at 2.47 g/t gold-equivalent.

- 277,000 Inferred ounces at 0.94 g/t gold equivalent.

- 95% gold and 96% silver recoveries in preliminary metallurgical test results

- Mineralization is reportedly non-refractory and amenable to recovery by a standard industry process flowsheet.

- The Shovelnose property is situated off a major highway, near power, rail, large producing mines, and within commuting distance from the City of Merritt, which translates into low-cost exploration.

- District-scale discovery potential in the emerging Spences Bridge Gold Belt where the company’s four projects, Shovelnose, Prospect Valley, Skoonka Creek and Skoonka North, cover 17,623 hectares.

- Shareholder alignment – insiders own 25% and have a track record of successful mine development.

Notes (from relevant technical reports):

1 – The Shovelnose MRE are estimated using metal price assumptions of US$1,675 per ounce for gold and $21.50per ounce for silver, with a USD:CD FX of 0.77. C$ operating costs used were $3 per tonne mineralized material mining, $2.50 per tonne waste mining, $2.00 per tonne overburden mining, $18 per tonne processing and $5 per tonne G&A.

The pit slopes used were 50º in rock and 30º in the overburden.

For more details and relevant drill cross-sections, click here, and click here for the latest Westhaven Gold news release.