While Surge Copper is winding down activity following one of the busiest field seasons in the company’s history, the results trickling in from backed-up assay laboratories point to more market-leading intercepts from the Ootsa polymetallic property in west-central British Columbia.

Earlier in October, Surge Copper released the second batch of results from its now completed 26,556m definition drilling program at Ootsa, demonstrating the potential to expand the West Seel Deposit and to improve grade within existing volumes.

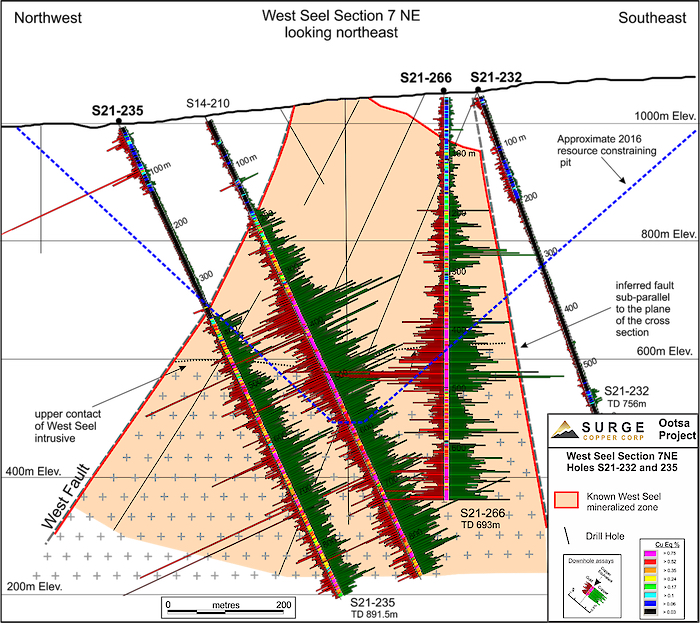

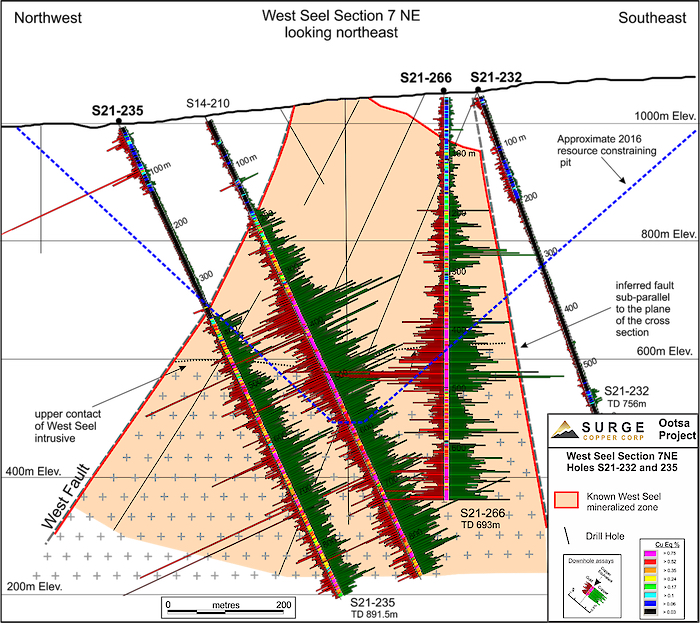

Among the highlight intercepts was 495m grading 0.54% copper-equivalent (CuEq) in hole S21-266, including 355m grading 0.62% CuEq and 126m grading 0.85% CuEq.

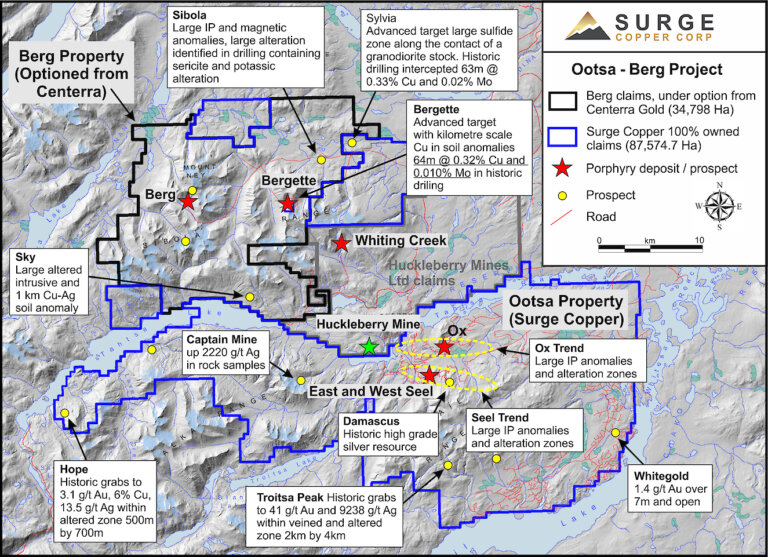

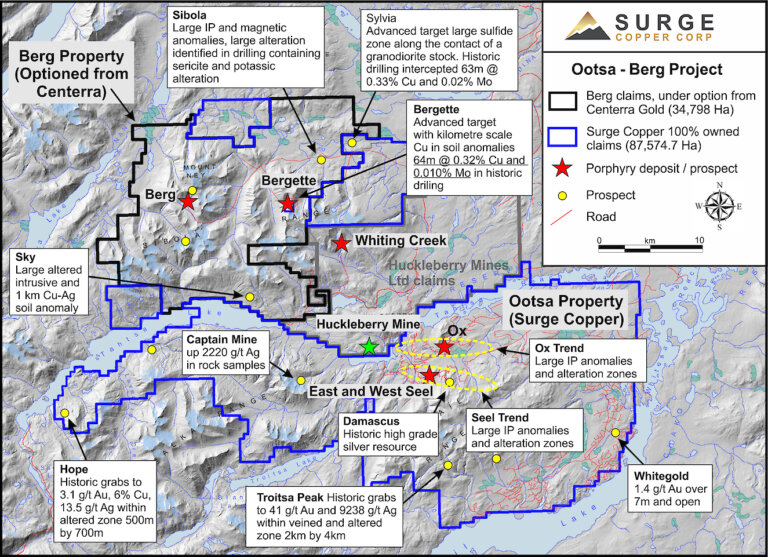

The company owns a 100% interest in the Ootsa property, an advanced stage exploration project containing the East Seel, West Seel and Ox porphyry deposits adjacent to the open-pit Huckleberry copper mine, owned by Imperial Metals (III.TSX).

The Ootsa property contains pit constrained NI 43-101-compliant copper, gold, molybdenum, and silver resources in the Measured and Indicated categories (see Exhibits 1 and 2).

Exhibit 1. Location of the Ootsa Property, British Columbia

Source: Surge Copper Corp.

Exhibit 2. Claim Map of the Ootsa Property Illustrating Location of Known Mineralized Zones

Source: Surge Copper Corp.

The company has released the results from 20 holes, with results from 52 additional holes pending. These include 1,934m in three holes from resource drilling within the Seel Deposit area; 9,054m in 45 holes from the Seel Breccia Zone located north of the Seel Deposits; and 2,319m in four holes from regional exploration targets within the Ox and Seel trends.

The Significance

According to Surge Copper, drill holes S21-256, 265, 266, and 268 are infill holes at West Seel. All encountered long intervals of continuous mineralization that will help define grade within those volumes (see Exhibit 3 and 4).

Exhibit 3. Plan Map of Drill Hole Locations for 2021 Ootsa Summer and Fall Drill Program

Source: Surge Copper Corp.

Hole S21-265 intersected 402m grading 0.50% CuEq. As mentioned, hole S21-266 intersected 495m grading 0.54% CuEq, including significant zones with higher grades.

Hole S21-268 intersected 270m grading 0.47% CuEq starting at 20m depth and will extend the zone of near-surface West Seel mineralization to the southeast. Assays are pending for the bottom portion of the hole.

Holes S21-259, 260, 261, and 263 were all drilled on the edges of the West Seel system and all encountered significant mineralization that will help expand the known extents of the West Seel Deposit.

Exhibit 4. West Seel Cross-Section 7 NE Illustrating Results for Holes S14-219, S21-232, 235, and S21-266 (see Exhibit 3 for section location)

Source: Surge Copper Corp.

Meanwhile, hole S21-258 tested a regional target located 600m southeast of the Seel Deposits and intersected a precious metal vein that returned 4.75 grams per tonne (g/t) gold and 69.7 g/t silver over 1m. Hole S21-257 tested the south edge of East Seel and did not encounter significant mineralization.

The remaining holes in this release are step-out or infill holes designed to expand or constrain West Seel mineralization.

Surge Copper has also recently completed 9,054m in 45 holes at the Seel Breccia Zone, located about 200m north of the East Seel Deposit. This drilling has focused on delineating a zone of breccia-style mineralization that outcrops at the surface, has been traced for over 200m along strike, is 20 to 60m wide, and extends to depths up to 150m below surface.

Surge interprets the lower grade mineralization as haloes, locally surrounding the high-grade breccia cores.

The recent drill testing was designed to confirm the continuity and grade and to define the extent of the zone to allow this potential high-grade resource to be included in the upcoming resource estimate.

This breccia is known to contain high-grade mineralization highlighted by hole S06-42, which intercepted 138m grading 0.84% copper and 22.1 g/t silver from 22m depth (previously released).

Next Steps

Combined with approximately 20,000m drilled during the 2020-2021 winter program, a total of about 30,000m of new core drilling has been completed within the Seel Deposit area.

This compares to the approximately 100,000m comprising the drill hole database used for the most recent resource estimate. During the 2020-2021 drill programs, the company has consistently encountered broad, continuous mineralization zones within and outside the 2016 resource-constrained pit.

Surge Copper is also earning a 70% interest in the Berg property from Centerra Gold (CG-TSX).

Berg is a large, advanced stage exploration project located 28km northwest of the Ootsa Deposits. Berg contains pit constrained 43-101 compliant copper, molybdenum, and silver resources in the Measured and Indicated categories.

The 2021 core drilling program at the Berg Deposit area is expected to conclude shortly, with a total of 2,858m of drilling in nine holes completed to date. The drilling has confirmed the existing resource model and consistently intersected the chalcocite blanket.

Surge Copper is completing an updated resource estimate for the Ootsa property, and regional exploration target evaluation and data compilation is expected to continue over the winter with selective drill testing as warranted.

We expect robust news flow from Surge over the coming months into the New Year.

The company expects to release results from the remaining 52 drill holes from the 2021 Ootsa drill program; the drill results from nine drill holes from the 2021 Berg drill program; a resource update for the Ootsa project; and the results of inversion and targeting from regional airborne geophysics; as well as an update on the regional exploration pipeline.

For complete details, please reference the company’s website at surgecopper.com.

Company Profile

- Established mining district

- Located adjacent to the idled Huckleberry Mine in Central BC

- Excellent regional infrastructure including roads, grid power, water, and multiple deep-water ports

- Significant resource base

- Ootsa: 224Mt grading 0.44% CuEq1 containing 2.2 B lbs CuEq in M&I2

- Berg: 610Mt grading 0.41% CuEq containing 5.5 B lbs CuEq in M&I3

- Discovery potential

- Target-rich environment near existing resources

- 122,372 hectare largely unexplored land package

- New geophysical surveys and target drilling in 2021

- Experienced management

- Highly experienced team with technical and financial backgrounds

- Track record of success in discovery, capital raising, and M&A

- Combined, the adjacent Ootsa and Berg Properties give Surge a dominant land position in the Ootsa-Huckleberry-Berg District and control over four advanced porphyry deposits

Notes

Except where specified, all occurrences of copper equivalent (CuEq) are calculated on a gross in-situ basis, with no adjustments made for recovery, using the following pricing assumptions for copper equivalency: $3.00/lb Cu, $1,700/oz Au, $10/lb Mo, $22/oz Ag.

The Mineral Resource Estimate was conducted by P&E Mining Consultants Inc. and has an Effective date of January 1, 2016. Eugene Puritch and Brian Ray are the Qualified Persons responsible for the estimate. Open pit optimization was done using a Lerches Grossman algorithm to define the mineral resource using metal prices of $3.25/lb Cu, $1350/oz Au, $12/lb Mo, and $22/oz Ag. CuEq have been calculated using base case prices of $3/lb Cu, $1,250/oz Au, $10/lb Mo, $18/oz Ag and recovery assumptions of 90 to 92% for Cu, 65 to 70% for Au, 70% for Mo , 60 to 65% for Ag and take into account smelter payable rates and refining costs.

The Berg Resource statement has an effective date of March 9, 2021. The technical report is available under the company’s profile at www.sedar.com. A cut-off value of 0.2% CuEq was used as the base case for reporting mineral resources which have been constrained by a conceptual open pit shell. CuEq was calculated using metal prices of $3.10/lb Cu, $10/lb Mo, and $20/oz Ag with the following recoveries applied: supergene zone Cu = 73%, Mo = 61%, and Ag = 52%; hypogene zo ne Cu = 81%, Mo = 71%, and Ag = 67%; leachate zone Cu = 0%, Mo = 61%, and Ag = 52%. Smelter and refining costs were not applied.