British Columbia explorer NorthWest Copper outlined the first phase of the 2022 exploration plan for its north-centrally located Kwanika, Stardust and East Niv Projects (Exhibit 1) and also announced expectations to complete a Preliminary Economic Assessment (PEA) on the flagship Kwanika/Stardust Project in Q2.

With a strong balance sheet, NorthWest has a wealth of targets to test following the successful drill campaigns at Kwanika and East Niv in 2021.

Last year’s efforts paid off with discovering additional high-grade mineralization at Kwanika Central and a new porphyry centre at East Niv.

The company has also developed new targets at the Kwanika South Zone, Stardust and Lorraine.

NorthWest plans to explore the 150,000-hectare land package this year, with drilling starting at Kwanika, then moving to Stardust, then East Niv.

Exhibit 1. Orientation Map for Kwanika and Stardust Projects in British Columbia.

Source: NorthWest Copper Corp.

Resource Expansion

According to Northwest Copper, the Kwanika and Stardust Deposits will see additional exploration drilling in 2022. The assets benefit from an abundance of targets, low elevation and easy road access. Drilling is expected to start imminently at Kwanika. The company is looking for additional structurally-controlled, high-grade at Kwanika Central while following up on successful 2021 holes in the South Zone.

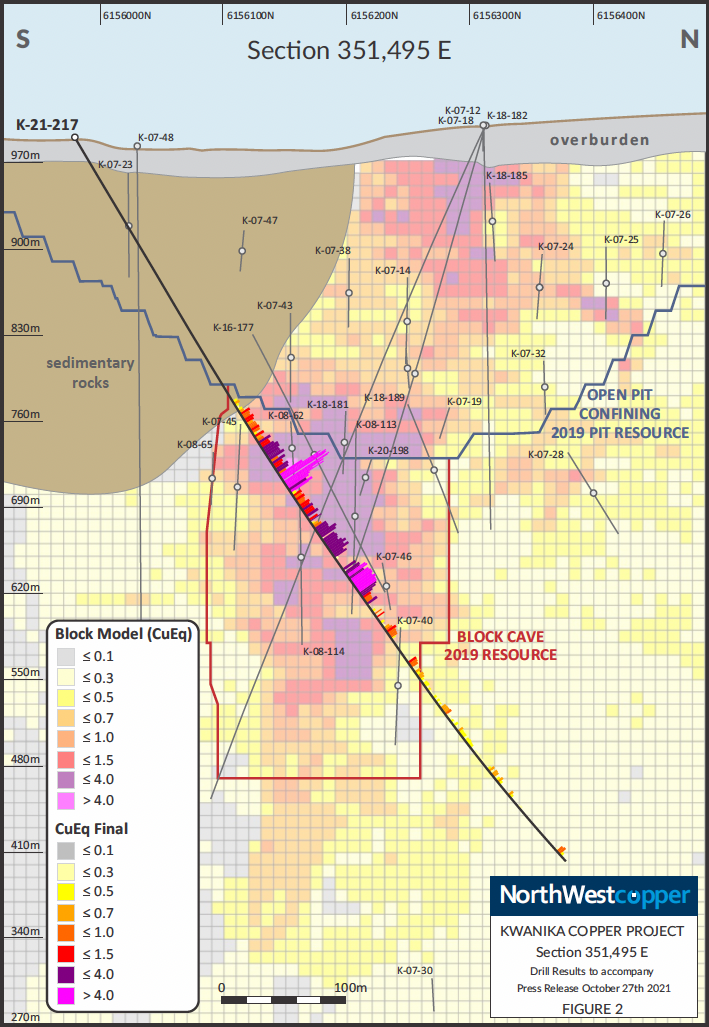

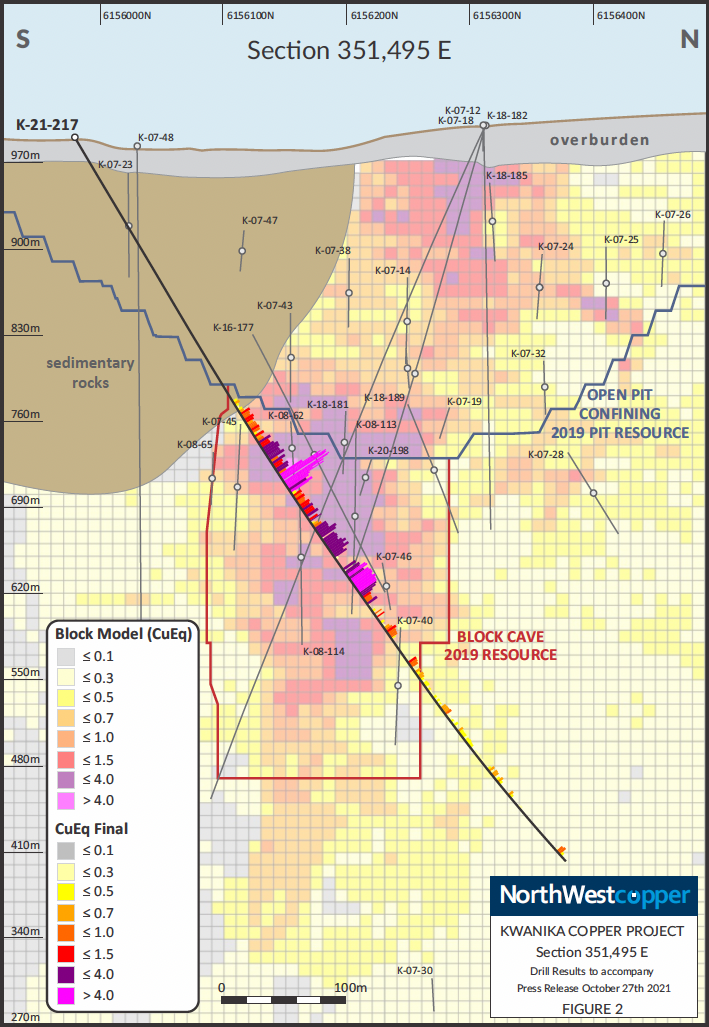

The company also plans to drill the first holes in two untested regional targets south of Kwanika (see Exhibit 2) and undertake a three-dimensional induced polarization (IP) survey for the main part of Kwanika to assist with drill targeting.

As a reminder, Kwanika contains unusually high-grade porphyry copper-gold mineralization and has excellent infrastructure. Kwanika consists of multiple targets, including Kwanika Central and South Zone, which are the most advanced.

The high-grade core includes structurally controlled mineralization of extremely high-grade intersected in hole K-21-217, which returned 33.6% copper-equivalent (CuEq) over 9.4m, within a broader 235.45m interval of 2.92% CuEq.

The South Zone is said to be a different, poorly tested porphyry system next to Kwanika Central with higher grades of molybdenum. Drilling here in 2021 returned an intercept of 34m of 1.3% CuEq, highlighting the potential to find additional high-grade.

Exhibit 2. Kwanika Section Showing Hole K-21-217, which returned 33.6% CuEq

Source: NorthWest Copper Corp.

Once the drills move on to the neighbouring Stardust Deposit, they will be directed to the east side of the deposit, the untested prospective limestone west of the deposit, and extensions to known mineralization (see Exhibit 3).

The company expects the additional drilling to aid in converting inferred material to indicated status, further de-risking the project and improving the geological understanding.

Drilling at Stardust will start later than Kwanika as it is at a slightly higher elevation, and tends to have more snow than Kwanika.

Stardust is a high-grade copper-gold carbonate replacement deposit about 7 km northwest of Kwanika. The mineralization occurs mainly at the intersection of mineralized faults and favourable limestone rocks, within the influence of an intrusive body known as the Glover Stock.

The core of the deposit is the Canyon Creek skarn, where the high-grade 421 Zone was discovered in 2018 with a drill hole of 100m of 5.30% CuEq.

Despite the geographic and metallurgical similarities with Kwanika, Stardust is hosted in a separate geological terrane and has different target characteristics than Kwanika. The upper zones of the Canyon Creek skarn are well drilled, but remains open at depth, and near-deposit and regional exploration is more limited.

Exhibit 3. NorthWest Copper’s Proposed Exploration Plan for Kwanika/Stardust in 2022.

Source: NorthWest Copper Corp.

Grassroots Opportunity

At the earlier-stage East Niv, a key discovery for NorthWest in 2021, plans are to follow-up on encouraging surface work and geophysics.

East Niv still entails an entirely new copper-gold porphyry system, with a known footprint of mineralization of about 1.5 by 1 km that remains open in all directions within a 43,000-hectare land position.

According to the company, this substantial property has seen minimal exploration.

NorthWest discovered a gold-only mineralized zone last year, including hole ENV-21-007, which intersected 41m of 1.24 grams per tonne (g/t) gold, including 2m of 10.5 g/t within the porphyry footprint. However, NorthWest is still trying to understand the relationship between the two mineralization styles (see Exhibit 4).

NorthWest’s primary aim at East Niv this year is to improve the geologic knowledge of this new area and focusing on better understanding the scale of the discovery.

The company plans to use helicopter support to increase flexibility and reduce disturbance from drilling, which will begin after Kwanika and Stardust have started.

The exploration program consists of extending the most substantial mineralization, which was intersected at the northwest part of the 2021 drill program, and testing numerous magnetic, induced polarization, and geochemical anomalies to look for additional porphyry copper-gold centres.

Exhibit 3. NorthWest Copper’s 2022 Exploration Focus Areas at East Niv.

Source: NorthWest Copper Corp.

For more information about NorthWest Copper, please read our previous note on the company by clicking here and see the corporate website at northwestcopper.ca.

Company Highlights

- A relatively new company focused on unlocking value through the combination of the Stardust underground and Kwanika open-pit and underground operations;

- Stardust has an existing Mineral Resource comprising:

- Indicated: 1.96 million tonnes grading 2.59% CuEq, for 112.1 million pounds of CuEq

- Inferred:5.84 million tonnes grading 1.88% CuEq for 242.2 million pounds CuEq

- Kwanika’s large scale complements Stardust’s high grades

- Measured: 42.9 million tonnes grading 0.54% CuEq

- Indicated: 180.6 million tonnes grading 0.38% CuEq

- Inferred: 90.4 million tonnes grading 0.26% Cu Eq

- Favourable metallurgy for Stardust-Kwanika Project

- A pipeline of earlier-stage projects:

- New discovery at East Niv

- Lorraine – large land package, existing high-grade trends, potential synergy with Kwanika-Stardust

- Part of the Oxygen Capital group of companies

- $25 million in cash on hand as of March 2022

- Substantial ownership by insiders and associates (over 14%)

- Strong institutional investment following (~10%)