Marathon continues to have success with Berry Zone infill drilling and exploration drilling at the Victory Deposit outside of the historical 2017 Victory pit shell. The recently-announced wide and high-grade intercepts from both the Berry Deposit and Victory Deposit (See below) are the latest from the first fifteen drill holes completed as part of the 2022 drilling campaign at Berry and an additional five holes from 2021 and 2022 drilling at Victory.

Highlighted fire assay results from Berry included:

- VL-22-1189: 6.17g/t gold over 1.80m true width (TW), including 10.78g/t gold over 0.90m TW, 0.75g/t gold over 13.50m TW and 8.68g/t gold (6.37g/t cut) over 14.40m TW, including 20.55g/t gold (14.39g/t cut) over 5.40m TW; at starting down-hole depths of 64m, 148m and 247m, respectively.

- VL-22-1193: 1.56g/t gold over 36.00m TW, including 12.67g/t gold over 0.90m TW and 6.44g/t gold over 1.80m TW, including 11.85g/t gold over 0.90m TW; at starting down-hole depths of 71m and 182m, respectively.

- VL-22-1191: 1.29g/t gold over 22.50m TW, including 12.76g/t gold over 0.90m TW and 3.86g/t gold over 11.70m TW, including 21.33g/t gold over 0.90m TW; at starting down-hole depths of 39m and 74m, respectively.

- VL-22-1198: 25.25g/t gold over 1.90m TW and 1.97g/t gold over 13.30m TW, including 13.06g/t gold over 0.95m TW; at starting down-hole depths of 9m and 175m, respectively.

- VL-22-1185: 1.38g/t gold over 8.55m TW, 13.55g/t gold over 0.95m TW, 2.58g/t gold over 12.35m TW, including 12.74g/t gold over 0.95m TW and 13.04g/t gold over 0.95m TW; at starting down-hole depths of 116m, 159m, 176m and 216m, respectively.

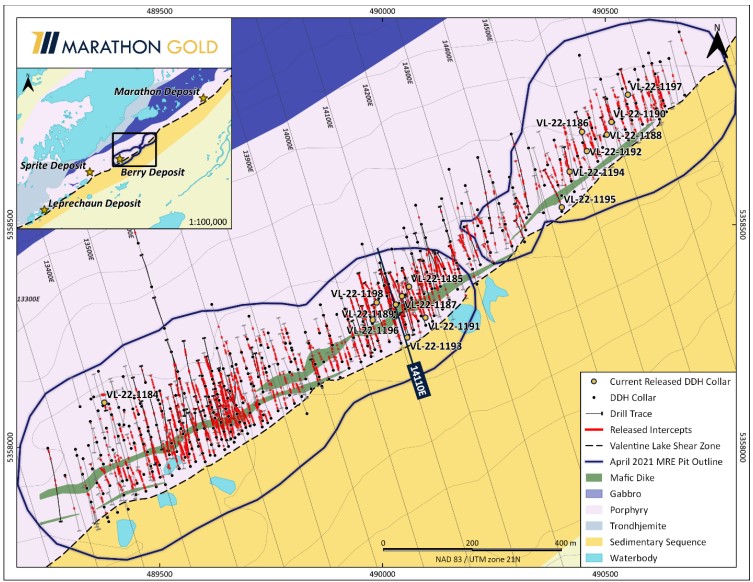

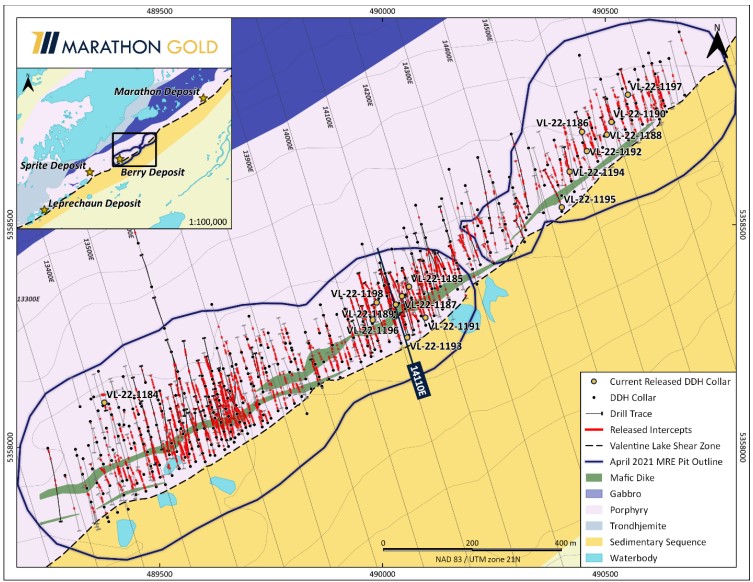

Exhibit 1. Plan View of Berry Deposit Showing the April 2021 MRE Pit Outline and Collar Locations for Holes VL-22-1184 to VL-22-1198

Source. Marathon Gold Corp.

Highlighted fire assay results from the Victory Deposit area included:

- VGD-22-086: 3.85g/t gold (2.93g/t cut) over 15.30m TW, including 45.55g/t gold (30g/t cut) over 0.90m TW; starting at 48m down-hole.

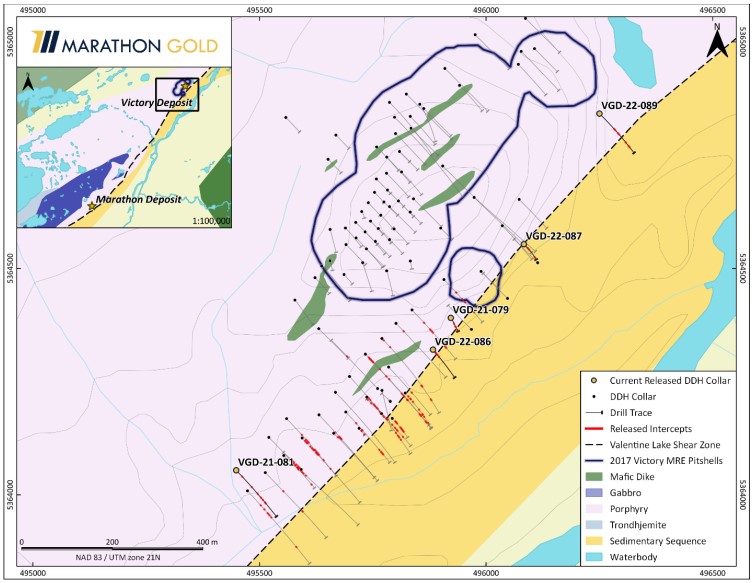

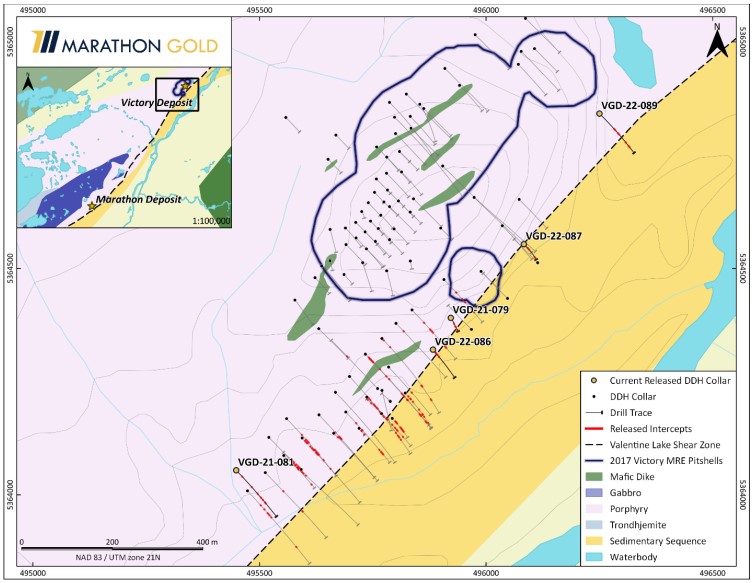

Exhibit 2. Plan View of Victory Deposit Showing the Historical 2017 Pit Shells and Collar Locations for the Five Press-Released Holes

Source. Marathon Gold Corp.

Concurrently, Marathon is advancing its 100%-owned and well-located Valentine Gold Project into development, in the central region of Newfoundland and Labrador. The Valentine Project hosts a 20km-long, mineralized shear-zone system hosting gold in extensional quartz-tourmaline-pyrite-gold (QTP-Au) veins within a quartz-eye porphyry and trondhjemite in the shear zone hanging wall. Five known Deposits (Marathon, Leprechaun, Sprite, Victory and the Berry Zone) have been identified at present. The two deposits, Marathon and Leprechaun, currently in the mine plan host estimated Proven Mineral Reserves of 1.40mln gold ounces (29.68Mt averaging 1.46g/t gold) and Probable Mineral Reserves of 0.65mln ounces gold (17.38Mt averaging 1.17g/t gold). For more details on the Valentine Gold Project’s Reserves and Resources, see the ‘Company Highlights’ section below.

Exhibit 3. Marathon’s Valentine Gold Project Showing Project Resources by Deposit

Source. Marathon Gold Corp.

The Significance

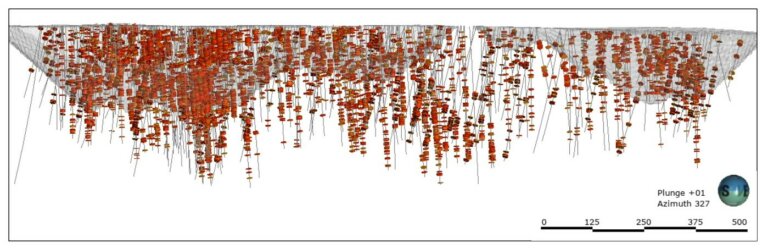

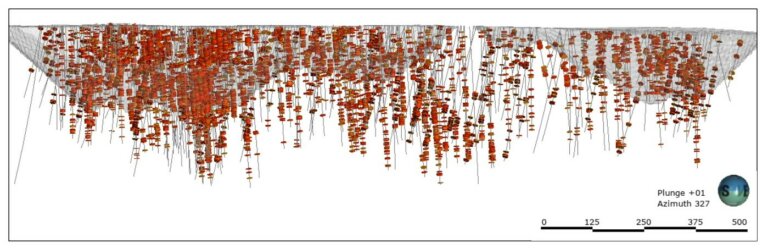

After drilling approximately 100,000m of infill at Berry in 2021 to obtain 25m-spacing between drill holes ahead of a planned Berry Mineral Resource Estimate (MRE) update, Marathon is now targeting specific areas of the Berry geological model for infill along the 1.5km of strike length delineated at present. Though the upcoming Berry MRE update only incorporates 2021 infill drilling until the end of November 2021, the latest results, including the impressive 8.68g/t gold (6.37g/t cut) over 14.40m TW intercept, demonstrate the remaining potential for significant mineralization to be discovered within pit shell boundaries. All reported intercepts were intersected at shallow depths above 247m down-hole. Additionally, all fifteen of the newly-reported drill holes returned intercepts above the 0.3g/t gold cut-off used in the maiden Berry MRE (April 2021).

Exhibit 4. Long Section of the Berry Deposit (Looking NW) – All Assays above 0.3g/t Gold are Shown

Source. Marathon Gold Corp.

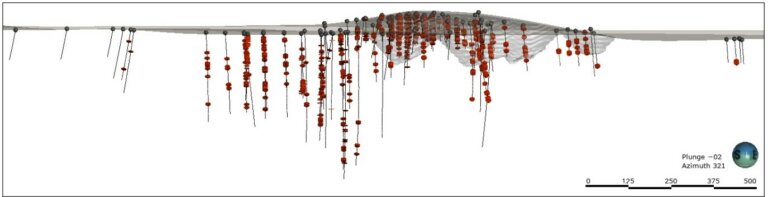

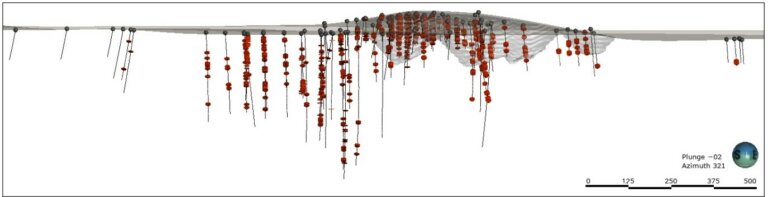

In addition to the Berry fire assays, Marathon reported fire assay results for five holes drilled in the Victory Deposit area. Two of the reported holes were the last holes of twenty-eight to be reported from 2021 drilling and the remaining three holes are from the 2022 programme. Last year and this year’s drilling are the first since 2014 at Victory and are focussed outside of the 2017 pit shell to the south and southwest of the historical drilling. The highlighted, shallow intercept of 3.85g/t gold (2.93g/t cut) over 15.30m TW is the most significant at Victory to-date according to Marathon. In addition, Marathon noted that all five reported Victory holes returned drill intercepts of greater than 0.7g/t gold and also the 0.3g/t gold used in as the pit shell cut-off.

With the path to mine development progressing smoothly, potentially accessible shallow mineralization at Victory could provide mill feed in addition to the Marathon and Leprechaun Deposits that are currently the only two deposits in the mining scenario.

Exhibit 5. Long Section of the Victory Deposit (looking NW) – Assays above 0.3g/t Gold are Shown

Source. Marathon Gold Corp.

Next Steps

Marathon is expected to keep advancing on the exploration front with a focus on potentially accretive discovery in addition to finding new grassroots discoveries. As previously mentioned, 50,000m of exploration drilling spread over the Berry and Victory Deposits and grassroots drilling of targets along the eastern arm of the Property is planned for 2022 and new discoveries could complement the already multi-million-ounce project.

An upcoming Berry MRE is expected shortly in “mid-year” 2022 but it is important to remember that only drilling up until the end of November 2021 is to be incorporated. This means additional 2022 intersections of gold mineralization would be over and above what the imminent MRE update estimates. We do, however, expect that new geological information uncovered in 2022 drilling could still be incorporated into the MRE model.

On the development front, Marathon has reported that site-specific permitting has commenced and on May 26, 2022 they noted the draft federal Environmental Assessment (EA) report had been submitted for 30 days of public review and comment. Upon completion of the public review, the Minister of Environment and Climate Change Canada could be in a position to make a Decision Statement (DS) on the acceptability of the Project. A positive DS would mark the completion of the federal EA. A parallel provincial EA was already concluded successfully as mentioned in our previous report.

Company Highlights

- Maiden Berry Zone MRE (April 2021)– the 1.5km-long Berry Zone is emerging as an important new area of concentrated gold mineralization

- Inferred Resource: 11.33Mt averaging 1.75g/t gold for 638,700 contained ounces gold

- Largest undeveloped gold resource in Canada* (effective Nov 20, 2020 and inclusive of Reserves)

- Measured Resources: 32.59Mt averaging 1.83g/t gold for 1.92mln contained ounces gold

- Indicated Resources: 24.07Mt averaging 1.57g/t gold for 1.22mln contained ounces gold

- Inferred Resources: 29.59Mt averaging 1.72g/t gold for 1.64mln contained ounces gold

- Reserve Estimate* – included in the above Measured and Indicated Resources (effective Nov 20, 2020)

- Proven Reserves: 29.68Mt averaging 1.46g/t gold for 1.4mln contained ounces of gold

- Probable Reserves: 17.38Mt averaging 1.17g/t gold for 0.65mln contained ounces of gold

- Positive Feasibility Study (FS) (March 2021) – Contemplates open-pit mining from the Marathon and Leprechaun Deposits only

- Base Case Highlights Include:

- After-tax IRR = 31.5%; After-tax NPV(5%) = C$600mln (using a US$1,500/oz gold price)

- After-tax Payback Period = 1.8 years

- Initial Capex = C$305mln

- 13 Year Mine Life; 173,000oz/yr in years 1 to 9 (from high-grade mill feed), 56,000oz/yr in years 10-13 (from low-grade stockpile)

- LOM Total AISC estimated at US$833/oz

- Mill Expansion Strategy

- In years 1-3, 6,800tpd (Gravity-Leach)

- In years 4-13, 11,000tpd (Gravity-Flotation-Leach)

- Controls 20km-long system hosting the four Valentine Gold Camp Deposits – room for expansion and discoveries in a top-tier jurisdiction

- Accessible by year-round roads and proximal to provincial electrical infrastructure – Hydro substation at Star Lake, only 30km from the property

- Metallurgical tests have demonstrated an average recovery of 94.2%

- Franco-Nevada Corp (FNV-TSX) holds a 2% NSR on the Valentine Gold Project

- Strong treasury

- Reported C$73mln in Cash and Cash Equivalents (March 31, 2022)

- US$185mln in secured project debt financing

- Community Cooperation Agreements with the six surrounding communities signed in December 2020

*Assumptions include US$1,500 per gold oz and CAD/USD= $1.33. For further assumptions, please refer to the relevant technical report found here (https://marathon-gold.com/valentine-gold-project/technical-reports/).

For more information on the latest press releases, click here.

For more information on Marathon Gold and the Valentine Gold Project, visit the company website here.